Energy firm BP has sold a stake worth $1 billion (£733m) in the Trans-Anatolian Natural Gas Pipeline (TANAP) to Apollo as part of the first tranche of a $20bn asset sale target.

The US asset manager will take a 25% non-operated stake in BP Pipelines (TANAP) (BP TANAP) which itself holds BP’s 12% interest in TANAP, owner and operator of the pipeline that carries natural gas from Azerbaijan across Turkey.

The sale comes after BP chief executive Murray Auchincloss unveiled plans to review assets for a potential sale including its core lubricants business, Castrol and its solar business, BP Lightsource.

The $20bn target was announced alongside a “fundamental reset” for the firm as it turns focus to its traditional oil and gas production business.

The deal marks the second such sale agreed with US fund manager, Apollo. Last year Apollo snapped up another $1bn BP-owned stake in Trans Adriatic Pipeline (TAP).

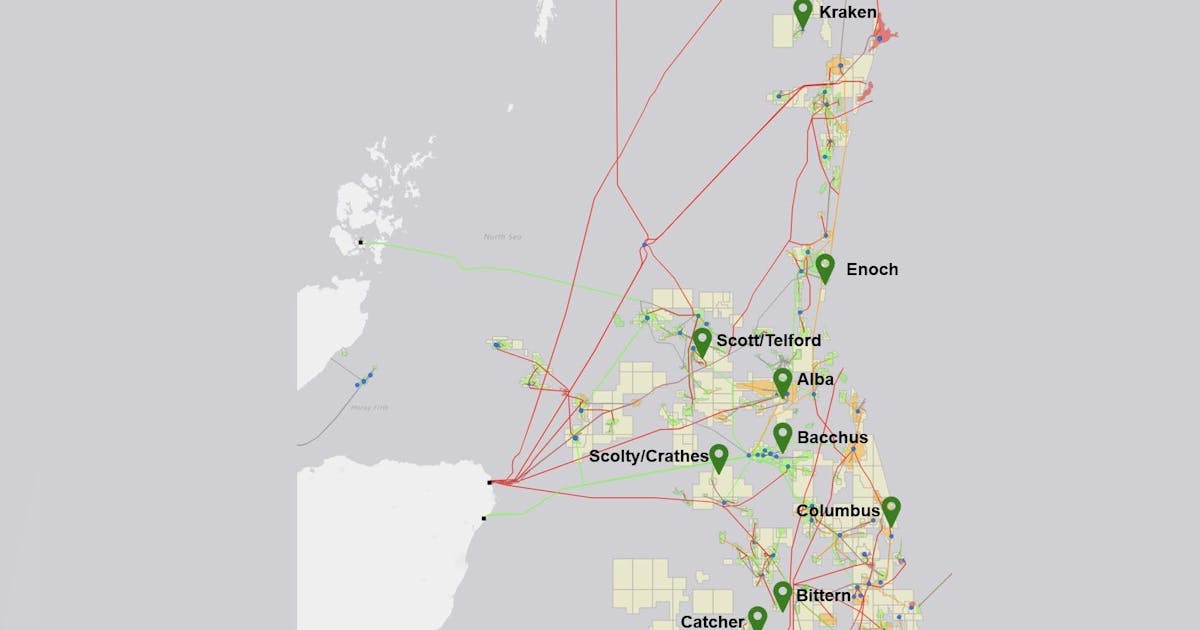

TANAP, running for approximately 1,120 miles (1,800km) across Turkey, is the central section of the Southern Gas Corridor project (SGC) pipeline system. The SGC transports gas from the BP-operated Shah Deniz gas field in the Azerbaijan sector of the Caspian Sea to markets in Europe, including Italy and Greece. It connects to TAP at the Greek-Turkish border, which crosses Northern Greece, Albania and the Adriatic Sea before coming ashore in Southern Italy to connect to the Italian natural gas network.

BP said the deal allows it to “monetise” its interest in TANAP while retaining control of the asset.

BP executive vice president for gas and low carbon energy William Lin said: “This unlocks capital from our global portfolio while retaining our role in this strategic asset for bringing Azerbaijan gas to Europe. BP and Apollo will continue to explore further strategic cooperation and mutually beneficial opportunities.”

Apollo partner Skardon Baker said: “We see significant potential with our scaled, long-term capital to partner with BP, in alignment with their strategic objectives. We are pleased by the highly successful partnership to date.”

The deal comes after Apollo sealed a deal to acquire a controlling stake Aberdeen-based OEG.