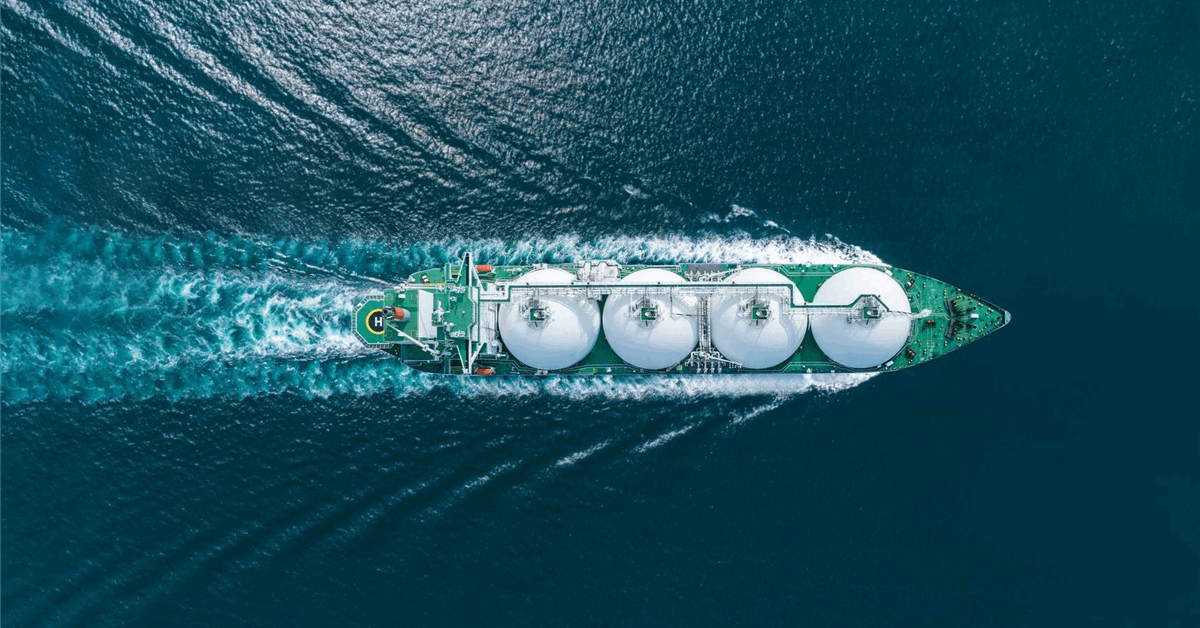

Shell said Tuesday it is targeting a yearly increase in liquefied natural gas (LNG) sales of 4-5 percent through 2030.

‘‘We want to become the world’s leading integrated gas and LNG business and the most customer-focused energy marketer and trader, while sustaining a material level of liquids production”, chief executive Wael Sawan said in an online statement.

The British energy giant said it aims to grow top-line production in its upstream and integrated gas segments by 1 percent a year during the rest of the decade. Shell aims to sustain 1.4 million barrels per day of liquid production through 2030 at increasingly lower carbon intensity.

Last year it sold 65.8 million metric tons of LNG, while it recorded 29.1 million metric tons of liquefaction volumes. Australia accounted for the bulk of Shell’s liquefaction volumes in 2024 with 14.4 million metric tons, followed by Trinidad and Tobago with 4 million metric tons and Nigeria with 3.5 million metric tons, according to the company’s annual report, also published Tuesday.

Its “integrated gas” segment, which encompasses gas liquefaction and gas conversion to liquid fuels, logged $11.39 billion in adjusted earnings for 2024. Segment adjusted earnings before interest, taxes, depreciation and amortization landed at $20.98 billion.

Shell holds stakes in 15 liquefaction plants in operation across Africa, Asia, Oceania and South America. Four more LNG projects in which Shell invested are under construction in Canada, Nigeria and Qatar, according to the annual report.

In June 2024 Shell entered into a deal to buy Singapore-based Pavilion Energy Pte. Ltd., whose LNG trading business has about 6.5 million metric tons per annum (MMtpa) of contracted supply.

In July 2024 Shell approved the development of the Manatee gas field in Trinidad and Tobago.

Also that month it signed an agreement to acquire a 10 percent stake in Abu Dhabi National Oil Co.’s Ruwais LNG, which will have 2 LNG liquefaction trains with a total capacity of 9.6 MMtpa. Deliveries are expected to start 2028.

In August 2024, Arrow Energy, Shell’s incorporated 50-50 venture with PetroChina, sanctioned phase 2 of the Surat gas development in Australia, which will supply the Shell-operated Queensland Curtis LNG facility.

Asia-Driven Demand

In an earlier report Shell projected that LNG demand could reach 630-718 MMtpa by 2040.

“More than 170 million tonnes of new LNG supply is set to be available by 2030, helping to meet stronger gas demand, especially in Asia, but start-up timings of new LNG projects are uncertain”, it said in its latest annual LNG outlook report published February 2025.

China’s campaign to connect more people to piped gas and India’s gas infrastructure build-out support demand in Asia, Shell noted.

Besides economic growth in Asia, other drivers are emission reduction efforts in the heavy industry and transport, as well as demand in the artificial intelligence sector, according to Shell.

In the maritime sector, increasing orders for LNG-fueled ships would raise sectoral demand to over 16 million metric tons a year by 2030, higher by 60 percent than previously expected, Shell said.

In Europe LNG would continue to be relevant into the 2030s as a balancer for the growing share of intermittent renewables in the power sector and as a cushion against energy shortages, Shell said.

“Upgraded forecasts show that the world will need more gas for power generation, heating and cooling, industry and transport to meet development and decarbonization goals”, commented Tom Summers, senior vice president for LNG marketing and trading at Shell.

Increased Distribution

Also on Tuesday Shell said it plans to raise shareholder distributions from 30-40 percent to 40-50 percent of cash flow from operations (CFFO) through the cycle. The new dividend policy will continue to “prioritize share buybacks, while maintaining a 4 percent per annum progressive dividend policy”.

Shell said it aims to grow free cash flow per share by over 10 percent per year through 2030.

It also revised its structural cost reduction target from $2-3 billion by the end of 2025 to $5-7 billion by the end of 2028 compared to 2022.

To contact the author, email [email protected]