VARO Energy has agreed to buy the full share capital of Corral Petroleum Holdings AB and thereby acquire Preem Holding AB/Preem AB, a key Scandinavian oil refiner that is transitioning to renewable fuels.

“On completion, we will become Europe’s second largest renewable fuel producer with an extensive distribution and storage network across major European markets with conventional fuel production capacity of 530,000 barrels per day”, VARO chief executive Dev Sanyal said in a company statement. “Combined we will serve over 50,000 business customers across 33 countries, with our future growth underpinned by a robust portfolio of mature renewable fuel projects”.

Baar, Switzerland-based VARO is a joint venture of Carlyle (66.66 percent) and Vitol (33.33 percent) that produces and markets both conventional and renewable fuels. It operates in 26 countries.

Stockholm-based Preem provides over 40 percent of Sweden’s and a fourth of Scandinavia’s transport fuel needs, as well as serves 17 countries in Europe, VARO noted.

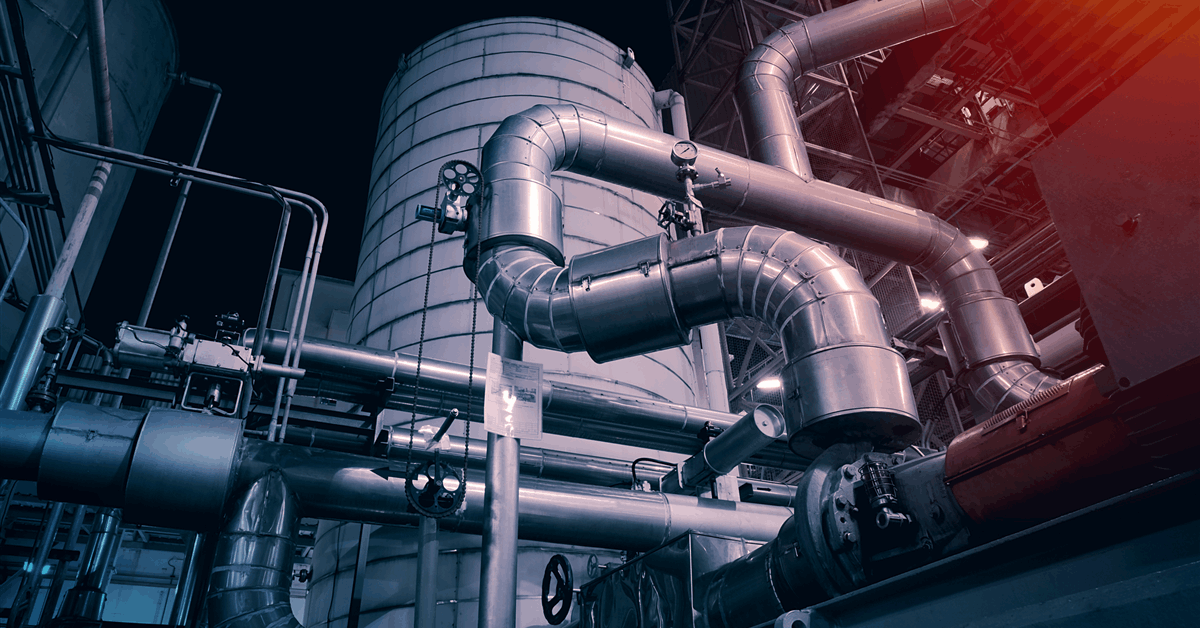

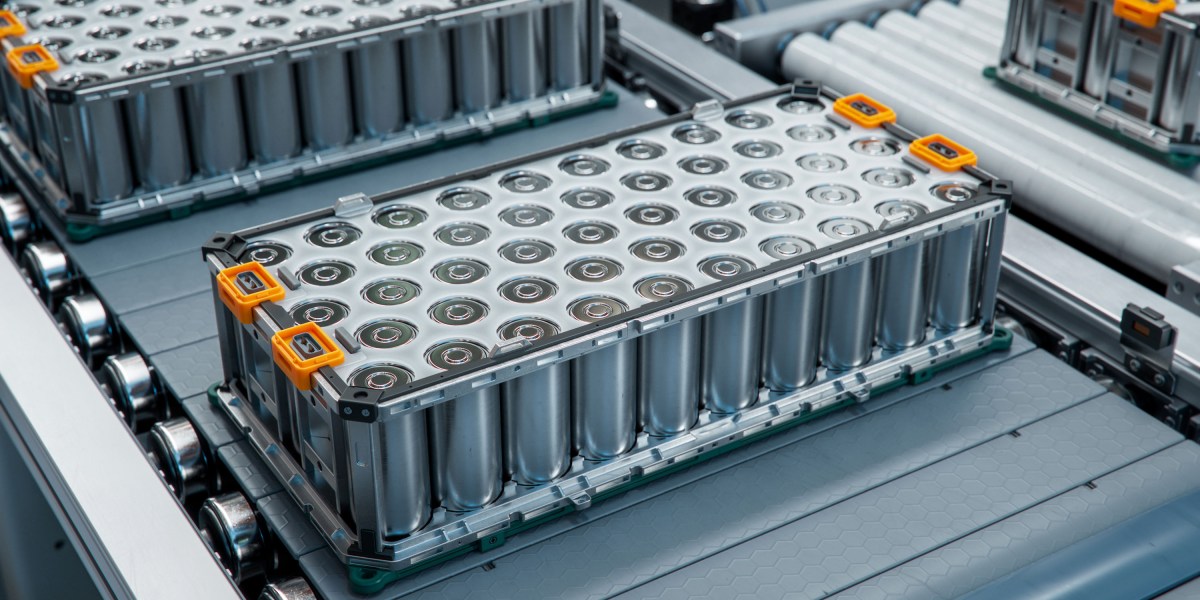

After investing nearly $1 billion since 2010 in renewable fuel production, as well as decarbonization initiatives, Preem now produces 300,000 metric tons a year of renewable fuels. This capacity is expected to rise to 1.3 million metric tons per annum after the completion of an upgrade at the Synsat diesel plant to enable up to 40 percent co-processing of renewable feedstocks.

In Sweden Preem owns 2 refineries with 352,000 barrels a day in combined production capacity, representing 80 percent of the country’s refining capacity, VARO said.

“Primarily located in Scandinavia, Preem’s assets are highly complementary to VARO’s existing operations across northwest Europe with limited overlap”, VARO said.

Marcel van Poecke, chair of VARO and chair of energy at Carlyle, said, “This acquisition provides material value creation opportunities through disciplined investment in future growth projects, while enhancing VARO’s ability to deliver the reliable and secure energy that Europe needs”.

“The combined entity will be well-positioned to continue to play an important role in meeting Europe’s growing demand for sustainable energy for the mobility and industrial sectors”, Van Poecke added.

The resulting company “will benefit from access to Vitol’s network and global expertise”, said Vitol chief executive Russell Hardy.

The enlarged VARO will operate one of Europe’s biggest fuel supply networks with access to over 120 terminals and account for nearly 10 percent of all road and marine fuels sold on the continent, VARO said.

“The company will be the largest co-processor of renewable feedstocks in Europe”, it added. “On completion, the combined group will rank in the top five largest producers of Hydrotreated Vegetable Oil and Sustainable Aviation Fuel globally. It will be Europe’s second largest renewable fuel producer and the top producer in Sweden.

“Material renewable fuel production will provide the company with a strong position in the fast-growing biofuels for transport sector. Biofuel demand in the EU transport sector is expected to increase by 50-80 percent by 2030 as Member States accelerate decarbonization efforts”.

The parties expect to complete the transaction this year.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR