A man working in the North Sea left the oil and gas industry due to a lack of career certainty, Anasuria Operating Company (AOC) boss Richard Beatie told Energy Voice.

Speaking of the man whose picture is still framed in AOC’s Aberdeen office, Beatie said: “This was one of our great guys, there he is in his mid-thirties, he’d been on the asset since he left school, basically, and went to college and came on.

“He loved the asset, loved the job, but was at that point where he started to think ‘I’m in my thirties now, I don’t know if there is a future for me in the oil and gas industry’ and he actually left the oil and gas industry to move into another industry.”

According to the Anasuria boss, the man left the North Sea with the mindset that “he’s young enough now that maybe he can reset his career and he still has long enough to progress in that.”

Beatie said that the story was “heartbreaking” despite the young man’s departure from AOC and life in the North Sea being “amicable”.

“He feels that there’s no longevity for him, not in the asset because he feels like he could stay with us for another 10 years, or whatever, but then what?

“He didn’t want in 10 or 15 years time, so okay, he’s 35, but he didn’t want to say at 50, where’s the industry going to be? So, he wanted to get ahead of it.”

This was the first example of someone leaving oil and gas for this reason that Beatie saw; however, “we are starting to see people looking to that,” he warned.

‘I’m worrying that I might not have a job for the duration of my working life’

© Supplied by –

© Supplied by –To highlight this issue and the potentially negative impact on jobs that the UK government’s current oil and gas policy will have, Anasuria has produced a video in collaboration with trade body Offshore Energies UK (OEUK) and GMB Union to share the voice of its workers.

One worker featured in the short film, operations technician George Balfour, explained that the uncertainty around where the industry will be in the next decade is stopping workers from making big decisions in their personal lives.

He said: “If someone said to you, your job might only be there for 10 years, you start thinking, well, what if I have a mortgage and then suddenly someone takes away that income and I can’t afford my mortgage and you have to sell your house and make these massive life changes just because there’s no stability.”

Bryan Irvine, a Marine Technician, added: “I’m worrying that I might not have a job for the duration of my working life.

“So, I’m worrying not only for my job, but I’m not telling my kid to go into the industry because I don’t see a long-term future the way it’s headed.”

‘I feel a massive weight of obligation to the guys’

© Supplied by Image: Darrell Benns

© Supplied by Image: Darrell BennsThe main thrust of Anasuria’s argument throughout the video centres around the impact the Energy Profits Levy (EPL), or windfall tax, is having on investment into oil and gas operations in the UK.

Previously, Beatie has spoken out about the windfall tax. In a recent conversation with Energy Voice, the AOC boss called for the controversial policy to be removed “now”, rather than waiting until its 2030 end date.

The EPL brought the headline rate of tax paid by North Sea players to 78% under the Labour Party’s first budget of its premiership.

In the first year of the windfall tax, 90% of North Sea operators slashed spending, OEUK reported.

Beatie added: “I feel a massive weight of obligation to the guys’ future. The Anasuria is, and I know this sounds cliche, like a community.

“There’s many people that have been on that installation since the mid 90s – I call them ‘lifers’ jokingly – those guys care about the asset and… they’ve come from backgrounds where the industry has given them a leg up and it’s changed their lives, and it’s changed their family’s lives.”

‘The younger generation are not necessarily going to have the benefits’

The biggest demographic in the offshore workforce is those older than 40 years old, and as the oldest workers retire, there is a fear that young people will not enter the industry to replace them.

Speaking about a conversation he recently had with a worker on the vessel, the AOC CEO said: “One of the guys, I won’t name him obviously, but he was choked up, and he was upset because he was so grateful for what the industry had done for him and his family and how we look after him and he’s so angry that he feels that the younger generation are not necessarily going to have the benefits that he’s had of good jobs.

“This was a scaffolder by background, just to give a give his trade, he was saying that in terms of what he’s had in his life, in terms of the impact that it has had on his family, it’s been such a positive experience and changed all of their lives.”

© Supplied by AOC

© Supplied by AOCIt has been widely reported that the UK oil and gas sector is struggling to recruit the next generation of workers, and the crew of the Anasuria FPSO have raised concerns that young people will not reap the benefits that they had from life in the North Sea.

“The fact that we still need this industry, and I’m really proud of the industry and I’m proud of these guys, it is a good industry.

“We genuinely care about the people, we look out for them, try to keep them safe, we try to invest in them, we try and improve their welfare all the time,” Beatie continued.

“He was choked up because of the frustration that he feels that nobody’s listening, nobody’s hearing, that the industry is being looked at as a negative.

“We shouldn’t look at the oil and gas industry as a negative… it’s completely changed the standard of living for all of us over the last 50 years.”

‘Maybe my future is outside of the North Sea’

The oil boss explained that, although offshore workers predominantly come from the UK’s energy hubs, those working in the North Sea can come from anywhere across the country and benefit their local communities with the money they earn in the industry.

Speaking about the conversations he has had with some of his employees, Beatie explained: “They’ve talked about deindustrialisation and how they’ve lost the main industry in their cities and in their homes, but because they’re able to work in the oil and gas industry and go offshore for two weeks and then come home for three weeks, they can still continue to live at home and have a standard of living.

“That benefits the whole community, if you have a stable job and you’re earning reasonable money then maybe you get a new car, you extend your house, you get it repainted, and those benefits go in.”

© DCT

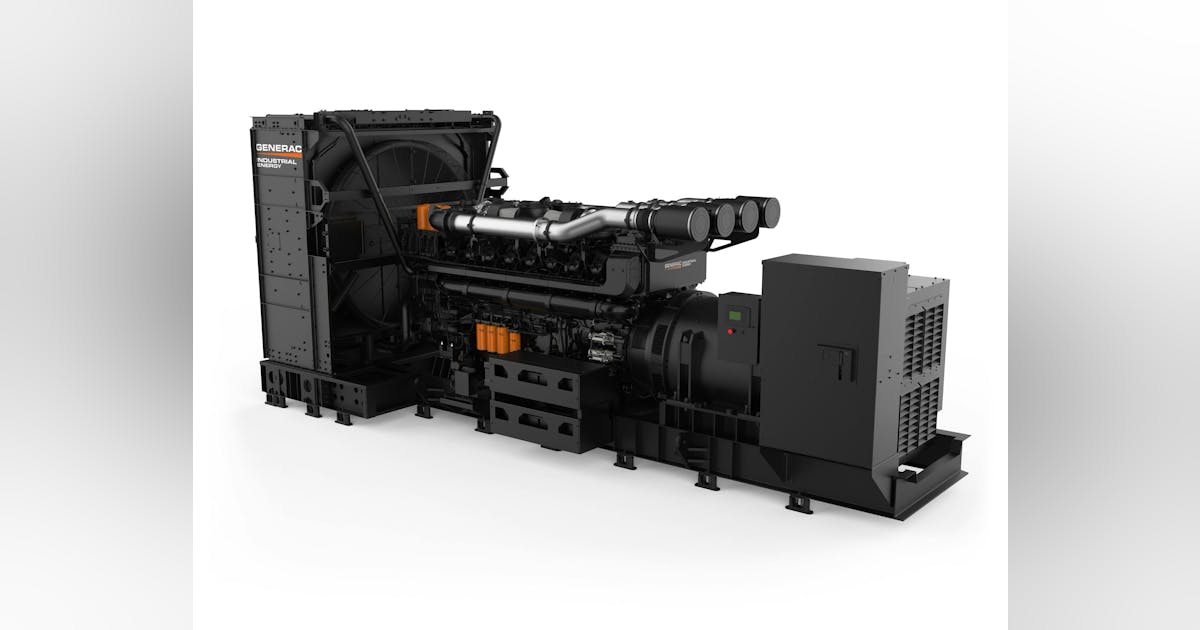

© DCTIn addition to the potential issue of seeing workers leave the sector, others are considering overseas employment.

This will see the skills they have built up in the North Sea leave the UK, meaning that talent and experience built up in the North Sea will not be carried on throughout the country’s energy transition.

“We’ve been through these cycles, but I think everyone feels now that this is different because there’s a there’s a feel it’s not the global oil price or that that’s impacting the industry, of all the downturns previously most have been worldwide, but I think the frustration is other oil and gas sectors and industries and countries are continuing to invest across Africa, Middle East, America, Norway, etc.,” said Beatie.

“Our guys are looking at, some of them, are looking now and saying ‘well, maybe my future is outside of the North Sea’.”