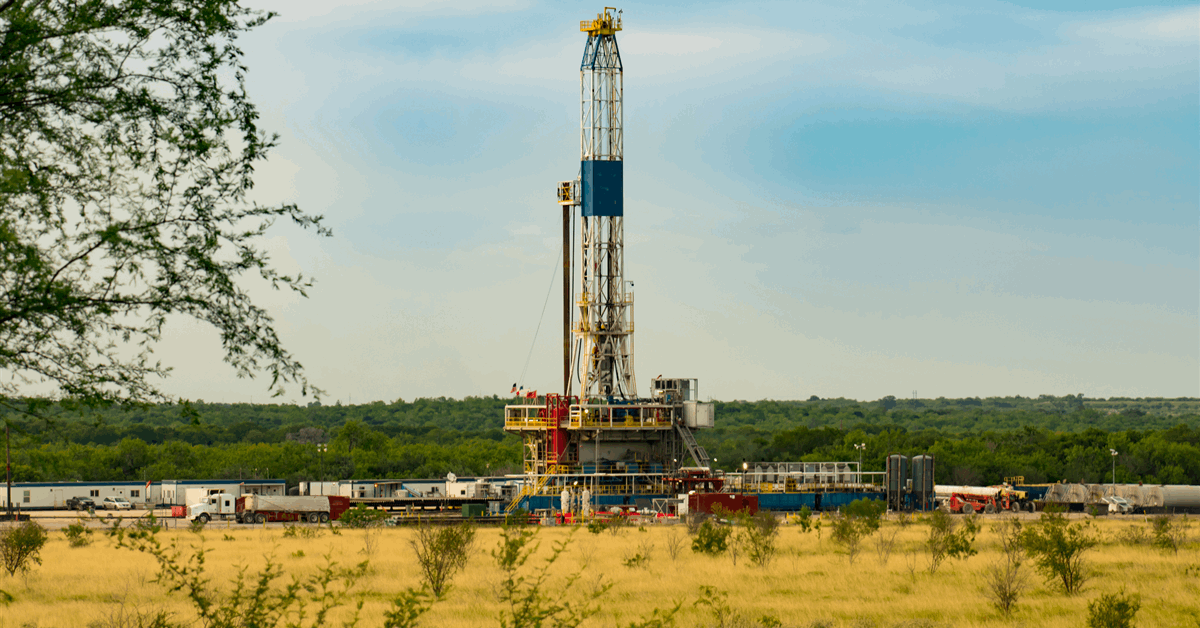

Matador Resources Co. has sold its remaining Eagle Ford shale assets in South Texas for over $30 million.

“Matador is excited to continue its primary focus on developing its high-quality acreage in the northern Delaware Basin, which Matador believes is recognized as the most prolific basin in the United States and where Matador owns approximately 200,000 net acres, approximately 80 percent of which is held by production”, Joseph Wm. Foran, Matador founder, chair and chief executive, said in a company statement.

The divested assets are in the counties of Atascosa, Karnes and La Salle. The sales took place in the last two quarters.

“The Eagle Ford shale has been a productive asset for Matador and was the stepping stone for Matador as it gained experience and built its acreage position in the Delaware Basin”, Foran said.

The Dallas, Taxas-based oil and gas exploration and production company said it had used the sale proceeds to reduce borrowings under its credit facility. Matador repaid $180 million of borrowings under its credit facility in the first quarter of 2025 ending the period with $405 million outstanding under the credit facility.

That position results in a leverage ratio of one times or less as of March, based on a preliminary review of first-quarter 2025 results, Matador said.

“Notably, Matador finished the first quarter of 2025 in the strongest financial position in its history with approximately $1.8 billion in liquidity”, it added.

The company also said it entered into additional oil hedges in the January-March 2025 quarter. It has hedged 45,000 barrels per day (bpd) for the first half of the year at weighted average prices of $60 a barrel floor and $86 a barrel ceiling. For the second half of 2025, Matador has hedged 70,000 bpd at weighted average prices of $52 a barrel floor and $77 a barrel ceiling.

“Matador has taken other precautionary actions in preparation for these turbulent times”, Foran said. “From experience, we believed it was prudent to fortify Matador’s balance sheet by entering into additional hedges and selling non-core assets”.

“Matador also structured its rig contracts with optionality to quickly decrease or increase its drilling program based upon market conditions”, Foran said. “Furthermore, Matador expects steel prices for goods such as casing, valves and surface equipment will increase in 2025 due to recent tariffs. To protect its financial position, Matador has already secured inventory for the majority of its 2025 drilling program. Matador does not expect any recent tariffs to impact its well costs until the second half of 2025”.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR