Frank Wolak is president and CEO of the Fuel Cell and Hydrogen Energy Association, and Mark Menezes is president and CEO of the United States Energy Association.

At first glance, the Regional Clean Hydrogen Hub program may seem like a relic of the Biden administration — an initiative that prioritizes decarbonization at the expense of affordable and reliable energy choices that benefit our economy, consumers and workers. A closer look, however, demonstrates how closely hydrogen aligns with President Trump’s energy strategy and the extent to which the hydrogen hubs can advance our nation’s energy security and prosperity through innovation and new investment.

As the Trump administration reviews programs spanning the enterprise, they should consider that the seven hubs authorized by Congress and initially approved for funding are in fact a pro-business effort leveraging public-private partnerships to stimulate local economies and boost industrial corridors across the country.

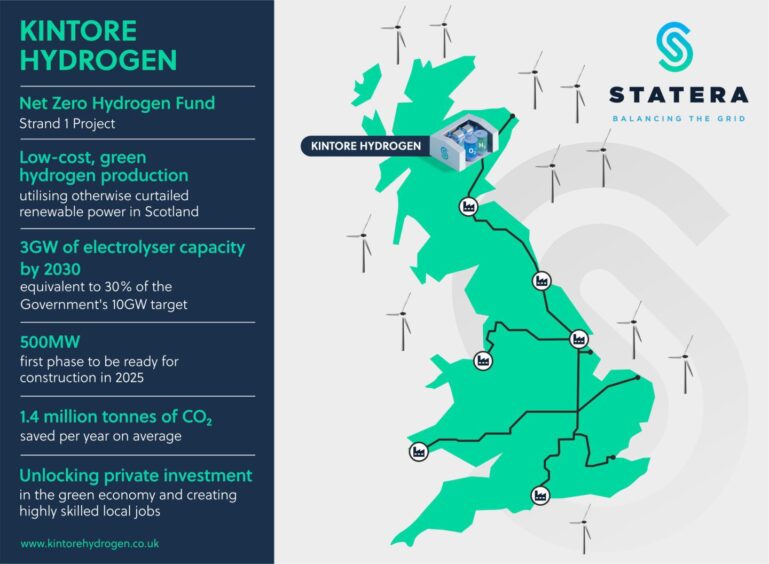

The structure of the program reflects one of hydrogen’s unique benefits — its versatility. That versatility is critical in a country like the United States, whose natural resources vary by region, posing both a blessing and a challenge. Hydrogen enables us to leverage that variety, bringing together in each place the right combination of investment, production pathways, and end-uses to meet our nation’s needs.

Nowhere is this better illustrated than in the breadth and depth of the seven proposed hydrogen hubs. The Appalachian ARCH2 will take advantage of its local abundance of natural gas, while HyVelocity on the Gulf Coast will tap into its access to a sophisticated network of energy infrastructure, technology and know-how to produce traditional, low-carbon and green hydrogen. In the Pacific Northwest, their project will leverage hydropower to produce hydrogen through electrolysis, whereas the Midwest will use its access to reliable nuclear power. California’s ARCHES will focus on the production of renewable hydrogen in support of its state’s low-carbon efforts, while the Mid-Atlantic and the Heartland hubs will produce other forms of hydrogen tailored to benefit their respective local industries, including transportation, manufacturing and fertilizer production for American farmers.

The hydrogen hub program is uniquely positioned to revitalize key industrial regions across the country, especially in communities with heavy manufacturing and energy production that cannot rely on electricity alone. By integrating hydrogen infrastructure into these areas, the program ensures that industrial hubs benefit from increased energy diversity and open up a new avenue for remaining competitive in a constantly evolving global energy landscape.

Critically, these projects are leveraging existing energy resources to maximize efficiency and cost-effectiveness, supporting efforts to increase U.S. energy production and enhance our energy independence. And as we have seen time and time again throughout history, investing in energy is an economic boon for all of us. One recent industry report estimates that a strong domestic hydrogen market could generate 700,000 new American jobs and $140 billion in new business revenue by the end of this decade.

We should also consider that if we don’t make significant investments into hydrogen today, our competitors will — and many already are. The number of hydrogen projects reaching final investment decisions have increased sevenfold in the last few years, representing $75 billion as of 2024. China, in particular, has prioritized hydrogen development, now controlling over 60% of the global manufacturing capacity for hydrogen production technology — up from less than 10% just five years ago. Likewise, the European Union, Japan, South Korea and Australia have outlined ambitious hydrogen strategies with substantial funding and infrastructure investments.

On the other hand, if we follow through with the intention of the Hydrogen Hub program, we are well-positioned to maintain our competitive advantage and solidify another avenue for American energy trade. In fact, a robust hydrogen industry complements our well-established leadership in liquefied natural gas, with many parallels for new technology innovation and export potential to existing and new global markets. And as we have learned through the success of LNG exports, our presence in global energy markets is a force for good thanks to our reliability, transparency and adherence to the rule of law.

Through hydrogen produced from all sources, we have an opportunity to strengthen existing energy partnerships and build new relationships that reinforce diplomatic ties, stabilize allied economies and ensure our friends and like-minded nations are never dependent on unfriendly sources to keep the lights on. Today, the United States is the world’s largest hydrogen exporter, generating an estimated $2.15 billion in revenue in 2023. Our hydrogen exports are already an important component of our trade relationships with Japan, Vietnam and South Korea, and that is only the beginning if we take the right steps now.

Cutting potential hydrogen hubs is a step backwards for our energy security. Unlike heavy-handed regulatory mandates, the hubs program is designed to foster market-driven innovation through competition. This ensures that American businesses — not bureaucrats — drive the development of our energy economy.

Allowing this program to develop organically means ensuring that American innovation remains at the forefront of global energy markets, increasing our energy independence and strengthening our domestic energy and manufacturing sectors. These hubs are not just an environmental initiative — they are a strategic investment in America’s future.