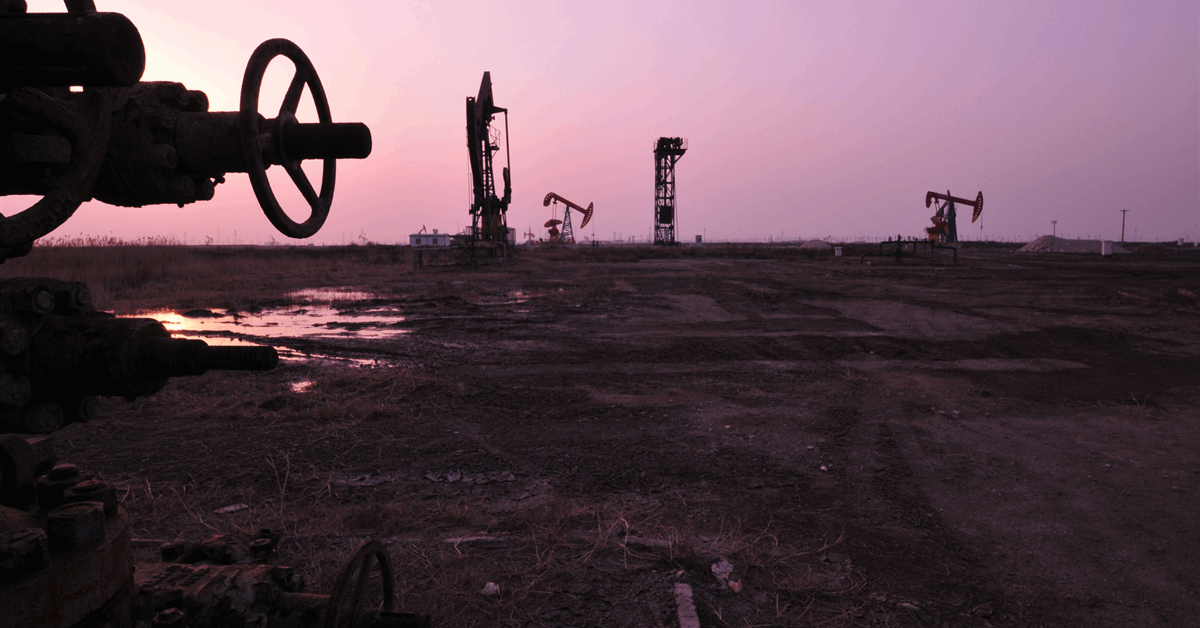

Fort Worth, Texas-based U.S. Energy Development Corporation (USEDC) said it has acquired approximately 20,000 net acres in Reeves and Ward Counties, Texas, expanding its total Permian Basin holdings.

The position includes a substantial proved-producing component and multiyear drilling inventory to supplement its existing footprint in the area, the company said in a news release. The transaction price was $390 million.

USEDC said it plans to run a dedicated drilling rig on the acquired acreage.

“This transaction greatly enhances the overall quality and resilience of our portfolio, supplementing our reserves with additional proved producing assets, adding years of multi-bench drilling inventory, and expanding our operated economies of scale,” USEDC Chairman and CEO Jordan Jayson said. “These factors position USEDC for sustained, efficient growth and reinforce our commitment to delivering long-term value for our partners”.

Concurrent with the acquisition, USEDC completed an increase in the borrowing base and commitments under its syndicated revolving credit facility led by Citibank, N.A. from $165 million to $300 million. The upsized revolving credit facility provides USEDC with significant financial flexibility to support its continued growth and has a maximum credit amount of $500 million, the company said.

“The upsize of our revolving credit facility in connection with our recently completed acquisition underscores our lenders’ confidence in USEDC’s disciplined strategy and positions us to capitalize on future growth opportunities,” USEDC CFO Brandon Standifird said. “We’re pleased to have strong support from our banking group as we continue our trajectory of strategic expansion”.

In February, USEDC said it planned to invest up to $1 billion in 2025, primarily in the Permian Basin.

In 2024, the company deployed about $850 million in operated and non-operated oil and gas projects in the basin, evaluating over 220 opportunities and completing 29 transactions.

The company said it expects the Permian Basin to remain the primary focus of its investment in 2025 due largely to the economics of drilling and operating wells in the basin.

The company stated that it has experienced consistent results and “is confident in its ability to continue to acquire high-potential Permian Basin properties and efficiently manage the costs of operated and non-operated ventures”.

“Our long-term acquisition and production strategies continue to generate solid performance across a portfolio of more than 2,000 wells. Despite global price volatility and market uncertainty, the energy market remained relatively stable, and our reputation for completing deals resulted in a record flow of successful transactions and capital deployment in 2024,” Jayson said in an earlier statement.

“We have built a strong track record of sourcing and transacting on high-quality opportunities, and our ability to deploy capital efficiently continues to drive strong results. Our approach remains the same – we will continue to evaluate opportunities that align with our disciplined investment strategy and deliver value to our partners. With a strong foundation and a targeted approach, we are well-positioned to build on our momentum entering 2025,” he added.

Founded in 1980, USEDC describes itself as a privately held exploration and production firm. The company said it has invested in, operated, and/or drilled approximately 4,000 wells in 13 states and Canada and invested more than $2 billion.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR