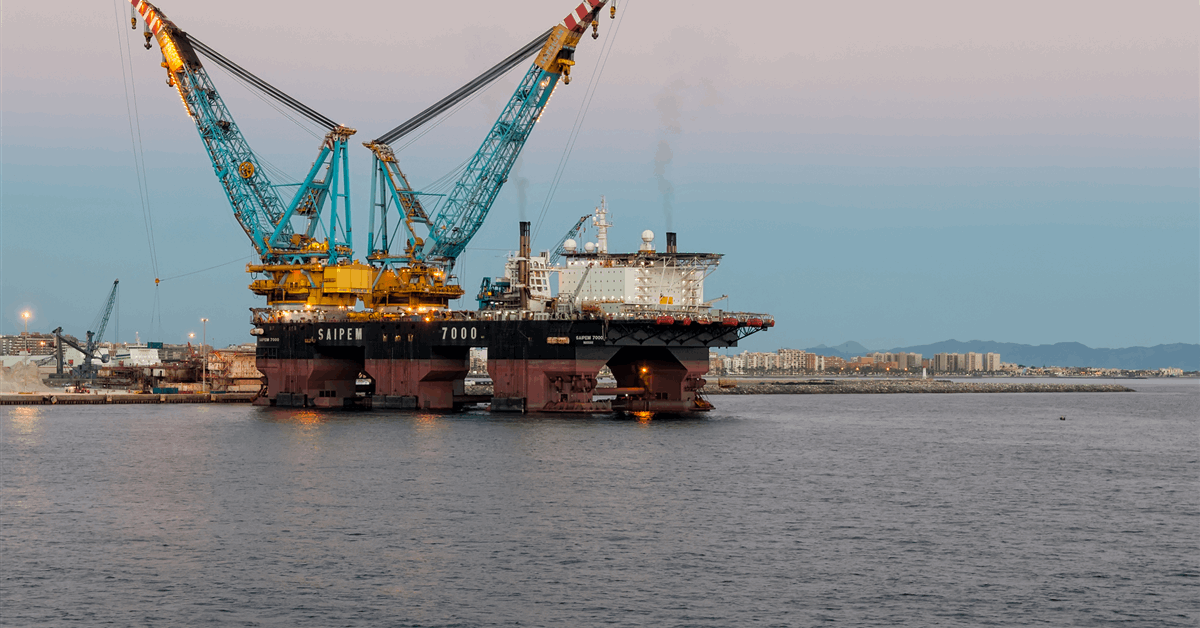

Saipem SpA has reported EUR 77 million ($87.45 million) in net income for the first quarter (Q1), up 35.1 percent from the same three-month period a year ago on the back of improvements in both its onshore and offshore engineering and construction segments.

Revenue rose 15.5 percent year-on-year to EUR 3.52 billion. Operating profit climbed 27.6 percent to EUR 157 million. Earnings before interest, taxes, depreciation and amortization increased 31 percent to EUR 351 million.

“In addition to the positive change in adjusted operating profit of EUR 34 million, there was also the effect of the improvement in the balance of equity investments of EUR 7 million, partly offset by the worsening of the balance of financial and tax operations of EUR 21 million”, the Italian energy engineering company said in an online statement.

Saipem did not have adjustments for extraordinary or nonrecurring items for the January-March 2025 period.

Operating cash flow landed at EUR 395 million, while free cash flow came at EUR 387 million.

Backlog, excluding contributions from nonconsolidated companies, stood at EUR32.67 billion, with EUR2.12 billion worth of contracts won in Q1 2025.

Earlier the board upgraded Saipem’s shareholder remuneration policy to at least 40 percent of free cash flow post-repayment of lease liabilities.

The board plans to propose a dividend of EUR 333 million for 2025 (on the 2024 results) and eyes a dividend of at least $300 million for 2026 (on the 2025 results), according to a company statement February 25.

Saipem recently unveiled a four-year plan targeting EUR 15 billion in revenue for 2028 and at least EUR 2.2 billion in free cash flow cumulative over the four-year period. Under the plan Saipem also committed to maintaining at least EUR 1 billion in available cash. The plan also aims to cut debt by about EUR 650 million by repaying maturities due 2025-27.

On February 23 it said it has struck an agreement in principle on the key terms of a potential merger with Luxembourg-registered Subsea7, which would result in a company called Saipem7.

Saipem and Subsea7 plan to enter into a merger agreement mid-2025. The transaction is expected to close in the second half of 2026.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR