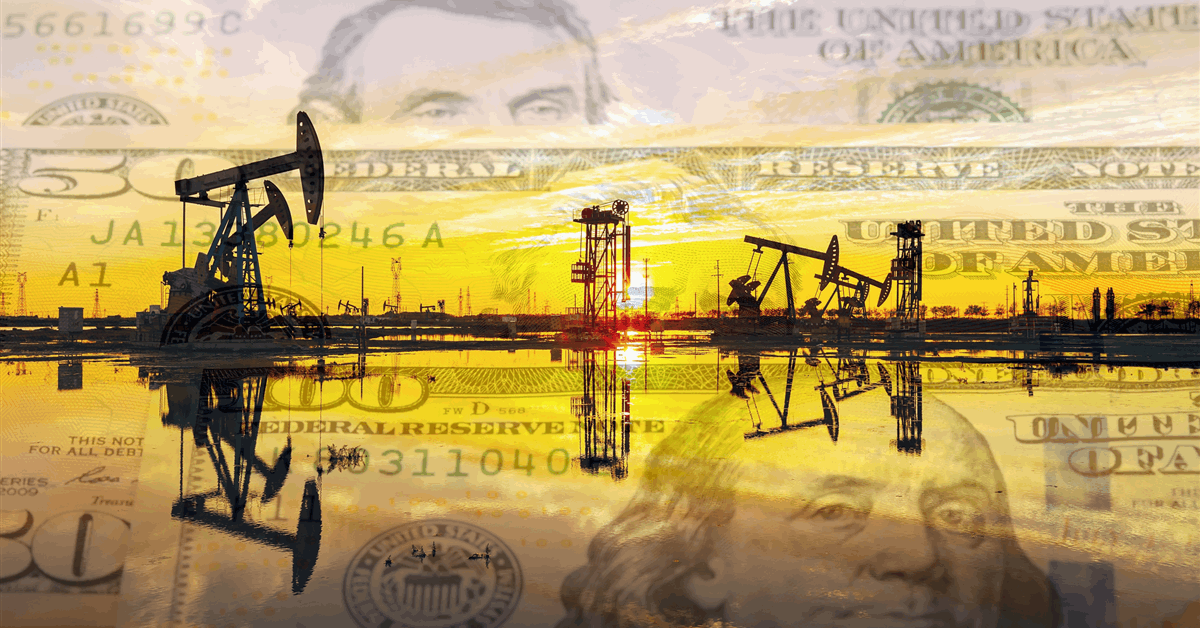

Crude oil futures slightly retreated but continue to hold at their highest levels since October, supported by colder weather in the Northern Hemisphere and China’s economic stimulus measures.

That’s what George Pavel, General Manager at Naga.com Middle East, said in a market analysis sent to Rigzone this morning, adding that Brent and WTI crude “both saw modest declines, yet the outlook remains bullish as colder temperatures are expected to increase demand for heating oil”.

“Beijing’s fiscal stimulus aims to rejuvenate economic activity and consumer demand, further contributing to fuel consumption expectations,” Pavel said in the analysis.

“This economic support from China could help sustain global demand for crude, providing upward pressure on prices,” he added.

Looking at supply, Pavel noted in the analysis that “concerns are mounting over potential declines in Iranian oil production due to anticipated sanctions and policy changes under the incoming U.S. administration”.

“Forecasts point to a reduction of 300,000 barrels per day in Iranian output by the second quarter of 2025, which would weigh on global supply and further support prices,” he said.

“Moreover, the U.S. oil rig count has decreased, indicating a potential slowdown in future output,” he added.

“With supply-side constraints contributing to tightening global inventories, this situation is likely to reinforce the current market optimism, supporting crude prices at elevated levels,” Pavel continued.

“Combined with the growing demand driven by weather and economic factors, these supply dynamics point to a favorable environment for oil prices in the near term,” Pavel went on to state.

Rigzone has contacted the Trump transition team and the Iranian ministry of foreign affairs for comment on Pavel’s analysis. At the time of writing, neither have responded to Rigzone’s request yet.

In a separate market analysis sent to Rigzone earlier this morning, Antonio Di Giacomo, Senior Market Analyst at XS.com, stated that, “at the market’s opening, the price of WTI crude oil began the week on a positive note, solidifying an optimistic outlook for investors and analysts in the energy sector”.

“Last Friday, WTI crude oil recorded a gain of over one percent, closing near the $74 per barrel mark. This advance marks the second consecutive week of gains, highlighting strengthening demand and positive expectations in international markets,” he added.

“The recent rally in WTI has been primarily attributed to signs of economic growth from China, the world’s largest oil importer,” he continued.

“Another key catalyst has been the Chinese government’s announcement of potential economic stimulus measures,” he went on to state.

In a report sent to Rigzone today by the Skandinaviska Enskilda Banken AB (SEB) team, Bjarne Schieldrop, the chief commodities analyst at the company, highlighted that Brent crude “got off to a good start in 2025 with a gain of $2.3 per barrel from Friday 27 December to Friday January 3”.

“The close on Friday at $76.51 per barrel was the highest close since October. Brent also rallied through the 100-day moving average last week with that measure now sitting at $74.35 per barrel,” he added.

In the report, Schieldrop said Brent crude “probably got some help from lower U.S. crude stocks, colder than normal weather in North-West Europe and the U.S., a rally in EU natgas prices (cold weather and end of Russian piped gas to EU), and higher oil refining margins because of all that”.

Schieldrop also noted in the report that OPEC+ “proved strong resolve on supply restraint in 2024” and said, “we have solid resolve by OPEC+ to keep oil prices steady”.

“They have confirmed and reconfirmed this solid resolve again and again over the past half year by postponing heralded production hikes time and time again,” he added.

Schieldrop also stated in the report that curbs to Iranian oil exports are necessary for U.S. oil production to rise strongly.

“The only possible way for a significant production increase in U.S. crude oil production without crashing the price is if someone else in the global oil supply leaves the party,” he added.

“In the eyes of Donald Trump, that someone is probably Iran. Donald Trump has forced Iranian oil exports out of the market once before in 2018 when they went from around two million barrels per day to close to zero,” he continued.

“A repeat of this would probably require cooperation from China,” Schieldrop went on to state.

Rigzone has contacted the Trump transition team, the Iranian ministry of foreign affairs, and the Chinese government for comment on Schieldrop’s statement. At the time of writing, none have responded to Rigzone’s request yet.

To contact the author, email [email protected]