Oil rose as algorithmic traders fled short positions amid renewed optimism about trade talks between the US and China this weekend.

West Texas Intermediate climbed 1.9% to settle near $61 a barrel, the highest in over a week, as the Trump administration weighs reducing levies on China to de-escalate tensions and temper the economic pain in both countries. The rally was limited by President Donald Trump’s comments that an 80% tariff on China “seems right.”

Meanwhile, commodity trading advisers, which tend to exacerbate price swings, liquidated short positions to sit at 91% short in both WTI and Brent on Friday, compared with 100% short on May 8, according to data from Bridgeton Research Group.

Crude has tumbled from a mid-January peak on concerns the trade war will dent economic growth, while OPEC+ is reviving idled production. Measured optimism on trade negotiations has helped prices recover some ground after starting the week near the lowest since 2021. Fuel markets have also provided positive signs, with one gauge of strength in gasoline reaching the strongest in about six months.

“WTI breaking back above $60 has likely triggered short-covering from newly established positions,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. “Optimism around potential progress with China is also providing support.”

Still, while Trump hailed the pact with the UK as historic, specifics of the deal indicated it fell short of the “full and comprehensive” agreement he had promised. And even though Trump said negotiations with China would result in tangible progress, Beijing reiterated on Thursday its call for the US to cancel tariffs ahead of talks.

The US, meanwhile, sanctioned a third so-called teapot refinery in China — along with port terminal operators, vessels and individuals — for allegedly facilitating the trade of Iranian crude. Hebei Xinhai Chemical Group was the main target of the action.

The UK also sanctioned senior executives in an oil trading network that it says has been helping key Russian oil exports flowing. The country also plans to target more than 100 oil tankers.

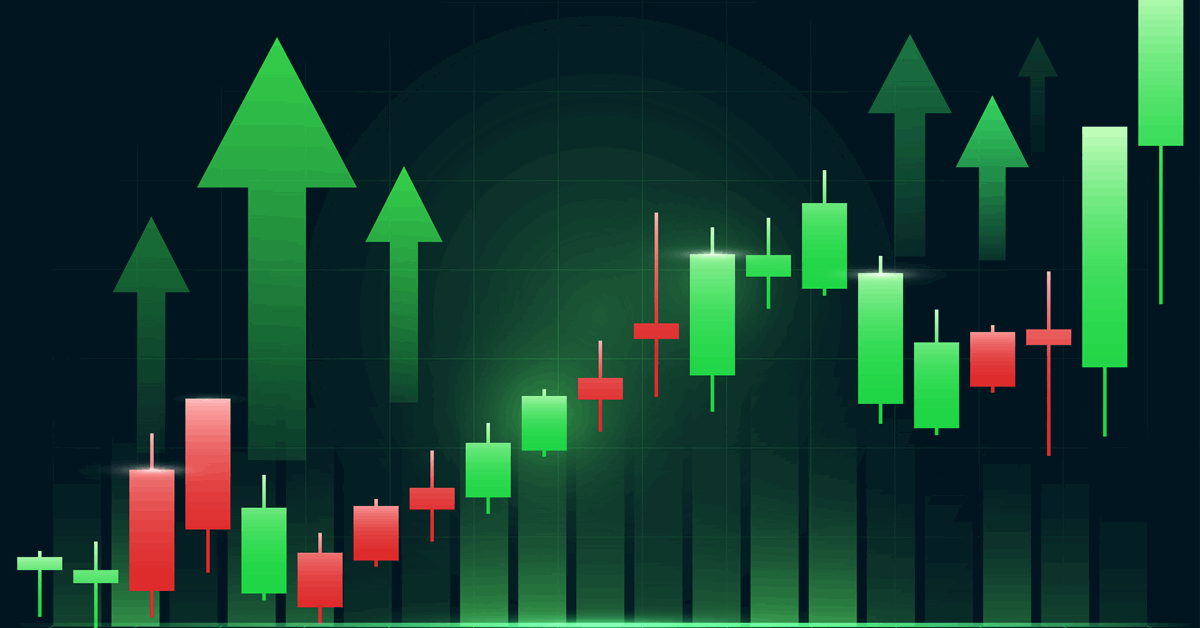

Oil Prices

- WTI for June delivery rose 1.9% to settle at $61.02 a barrel in New York.

- Brent for July settlement advanced 1.7% to settle at $63.91 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR

Bloomberg