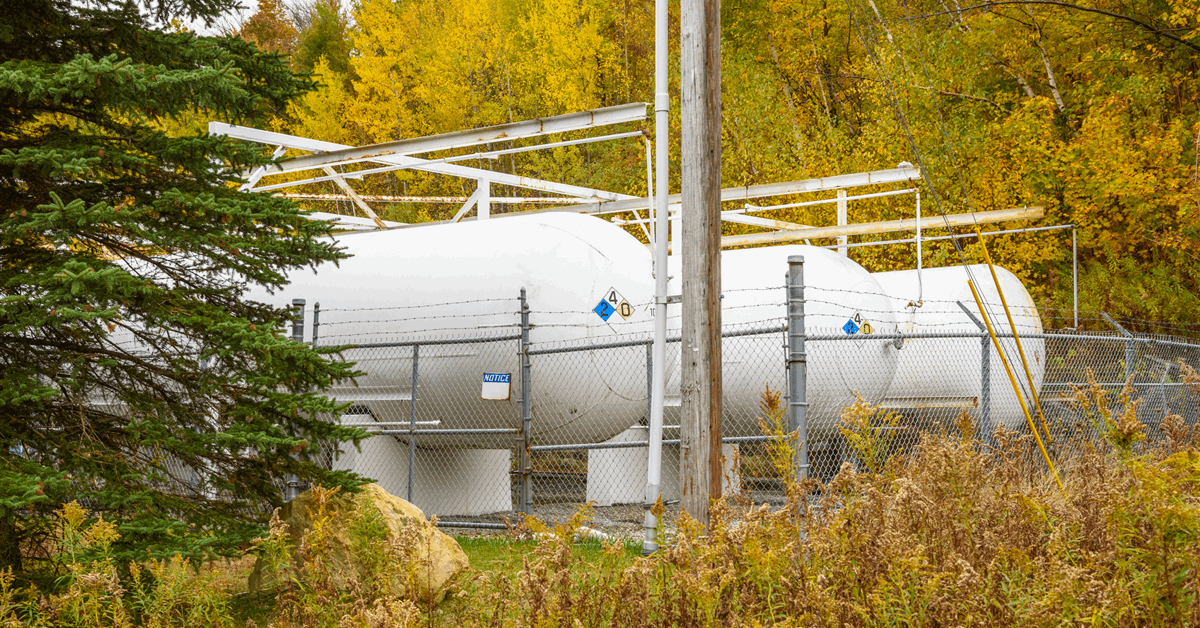

Propane marketing firm Alliance Energy Services said it has acquired 18 propane terminals from NGL Energy Partners LP.

The acquisition “significantly expands Alliance Energy Services’ infrastructure, strengthening its ability to serve customers across key markets nationwide,” the company said in a news release.

Financial terms of the transaction were not disclosed.

The propane terminals are strategically located across multiple regions and will enhance Alliance Energy Services’ capacity to meet the growing demand for reliable propane supply, the company said.

The company said it aims to integrate the facilities into its existing network and optimize distribution, as well as improve logistics efficiency.

“The acquisition of these 18 propane terminals represents a significant milestone for Alliance Energy Services. This investment underscores our commitment to enhancing supply security, expanding our market reach, and delivering best-in-class service to our customers. We also look forward to the new employees joining our team from NGL,” Alliance Energy Services CEO Jason Doyle said.

As part of the transaction, the company said it closed a sustainability-linked term loan financing led by Breakwall Capital LP, an energy-focused asset manager and employee-owned firm committed to supporting the growth and improvement of conventional, renewable, and next generation energy companies.

According to the release, Sustainable Fitch provided a second-party opinion on the sustainability-linked term loan and considers the transaction to be aligned with the ICMA Sustainability-Linked Bond Principles and the Loan Market Association, Loan Syndications and Trading Association and Asia Pacific Loan Market Association Sustainability-Linked Loan Principles.

Meanwhile NGL Energy Partners said it closed on the sale of its Rack Marketing refined products business, its Limestone Ranch ownership, and its remaining crude rail car fleet, as well as other miscellaneous proceeds.

The non-core asset sales will allow NGL Energy Partners to “focus on its core assets in the portfolio and redirect the capital to improving the capital structure,” the company said in a separate statement.

The recent asset sales and other cash proceeds of NGL Energy Partners total around $270 million, according to the statement.

“These asset sales reduce the volatility and seasonality of our adjusted EBITDA and working capital requirements. The proceeds will be used to pay off the remaining ABL balance and the excess cash will be used for additional deleveraging and addressing other parts of our capital structure,” NGL CEO Mike Krimbill said.

Alliance Energy Services, headquartered in North Kansas City, Missouri, describes itself as a leading wholesale propane marketing company that operates in the USA and Canada. It currently markets over 600 million gallons of propane per year out of approximately 75 terminals. Through strategic partnerships with gas liquids producers, the company said it is focused on adding value to its customers in the areas of product procurement, logistics, and price risk management planning.

NGL Energy Partners describes itself as a diversified midstream master limited partnership that provides multiple services to producers and end-users, including transportation, storage, blending and marketing of crude oil, natural gas liquids (NGLs), and water solutions.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR