Equinor ASA got no new signals that the Trump administration would reconsider the halt imposed on the Empire Wind project when its CEO met with a top White House official last week. Now the company must decide whether it will kill the project.

“If no progress is made within days, Equinor will be forced to terminate the project,” Molly Morris, president of Equinor Renewables Americas, said Monday. “We are still fighting every day to find a resolution.”

That came after there was no indication of a change in stance from US officials when the Norwegian oil and gas company’s Chief Executive Officer Anders Opedal and other top officials met with US National Economic Council Director Kevin Hassett on May 6, spokesperson Magnus Eidsvold said Monday.

A termination would cause the company to lose much of its $2.7 billion investment on the project. “It would be a direct impact to Equinor and our balance sheet,” Morris said.

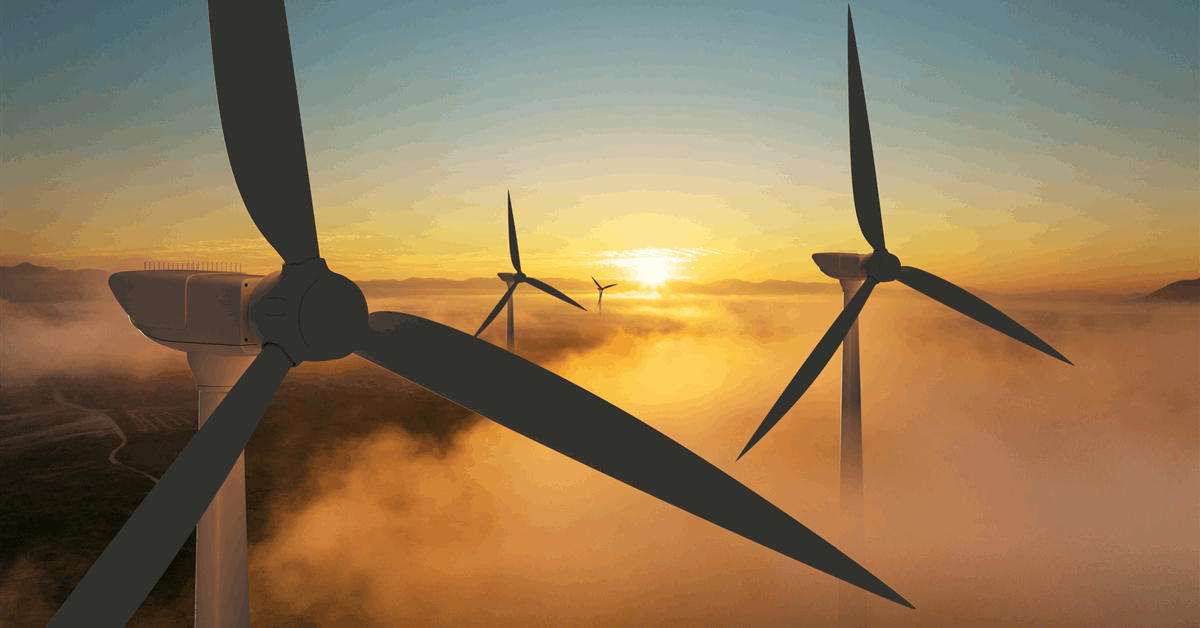

The $5 billion project was halted in April when Interior Secretary Doug Burgum said the Biden administration had rushed its approvals. Empire 1 was fully-permitted and slated to start commercial operation in 2027. Its 54 turbines were designed to power 500,000 homes.

‘Honoring Contracts’

Now, the paused project is costing the company $50 million a week, Morris said. While work at sea is completely stopped, operations at the South Brooklyn Marine Terminal in New York continue, and there are costs associated with keeping people and equipment on standby.

The halt on Empire is bigger than Equinor or even offshore wind, Morris said. “It’s about honoring contracts and financial investments made in the US,” she said. “They are setting a dangerous precedent by stopping a project in mid-execution.”

Morris said Equinor has operated in the US for almost 40 years and has invested more than $60 billion in the country. The company is also a major fossil-fuel firm with more than 100 oil and gas leases in the Gulf of Mexico.

President Donald Trump, a longtime critic of wind turbines, raised the specter of blocking even fully permitted offshore wind projects on his first day in office, when he directed the Interior Department to review the sector.

The stoppage is the latest — and perhaps biggest — blow to an industry seemed on the verge of major growth just four years ago.

The company has called the halt “unlawful” and said it is mulling legal options, including whether to appeal the decision.

If the project is terminated, “we expect the $4 billion to $4.5 billion sunk cost, invested thus far plus future commitments, to be worth zero,” Sparebank 1 Markets analyst Teodor Sveen-Nilsen said in a note to investors Monday.

The company secured billions in financing at the end of December, saying at the time that total capital investments would add up to about $5 billion, including the effect of future tax credits.

It owns 100% of the park, having swapped holdings with BP Plc in 2024. The Norwegian company has said it wanted to sell down its share in the park over time.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg