Woodside Energy Group Ltd. has inked a non-binding collaboration deal with Saudi Arabian Oil Co. (Aramco) including for the Saudi oil giant’s potential offtake from and ownership in Louisiana LNG.

The planned cooperation also eyes lower-carbon ammonia, among other global opportunities, the Australian oil and gas explorer and producer said in an online statement Wednesday.

“This collaboration aligns with Woodside’s strategic vision to build a diverse and resilient global portfolio”, Woodside chief executive Meg O’Neill said. “It leverages our growing relationship with one of the world’s leading integrated energy and chemicals companies, to explore new opportunities which deliver value for both parties.

“It is also another demonstration of the ongoing interest Louisiana LNG is generating among high-quality potential investors, following our recent agreement with Stonepeak to acquire a 40 percent interest in the project’s infrastructure holding company”.

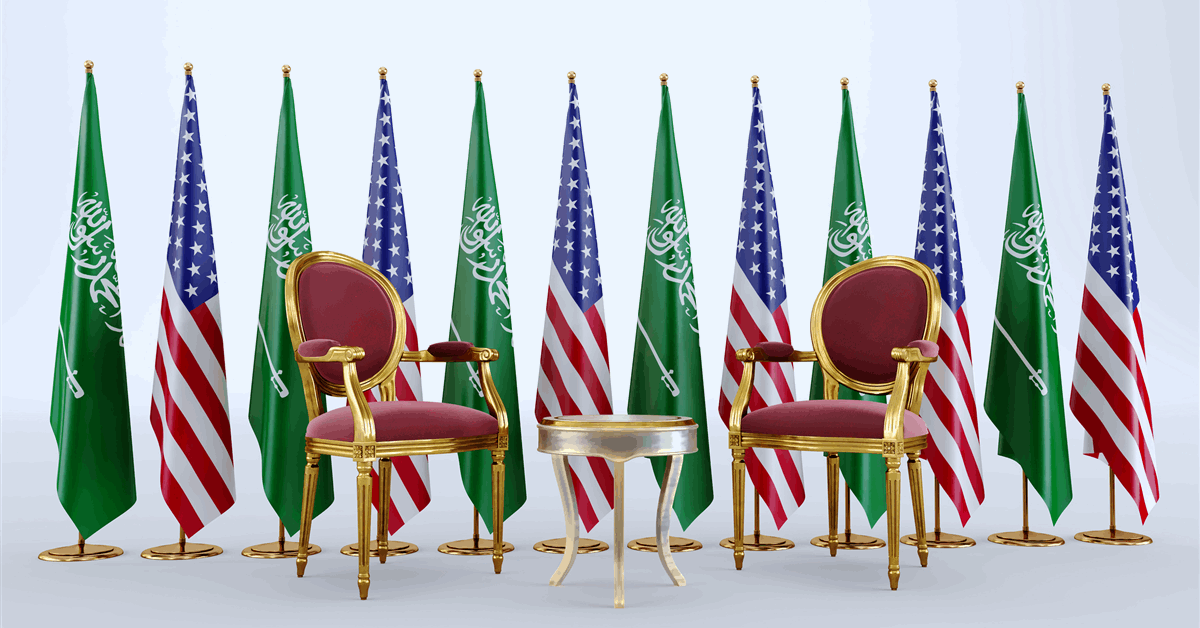

The deal was signed in Riyadh at the Saudi-United States Investment Forum, attended by Crown Prince and Prime Minister Mohammed bin Salman and President Donald Trump.

On April 29 Woodside announced a positive final investment decision (FID) on the project, which it acquired as Driftwood LNG when it took over Tellurian Inc. for $1.2 billion last year.

“The forecast total capital expenditure for the LNG project, pipeline and management reserve is $17.5 billion (100 percent)”, Woodside said. New York City-based Stonepeak Partners LP will gradually contribute $5.7 billion in exchange for a 40 percent interest, under an agreement announced earlier in April.

Louisiana LNG has an Energy Department permit to export a cumulative 1.42 trillion cubic feet a year of natural gas equivalent, or 27.6 million metric tons per annum (MMtpa) of liquefied natural gas (LNG) according to Woodside, to FTA and non-FTA countries.

The FID is for phase 1, which will build three liquefaction trains with a collective capacity of 16.5 MMtpa. Louisiana LNG has already started construction with Reston, Virginia-based Bechtel Corp. as the lead contractor.

“Development of Louisiana LNG will position Woodside as a global LNG powerhouse, enabling the company to deliver approximately 24 Mtpa [million metric tons per annum] from its global LNG portfolio in the 2030s, and operating over 5 percent of global LNG supply”, Woodside said. “The development has expansion capacity for two additional LNG trains and is fully permitted for a total capacity of 27.6 Mtpa”.

On April 17 Woodside said it had signed a deal with Uniper SE to supply the German power and natural gas utility up to 1 MMtpa from Louisiana LNG for 13 years. The deal commits an additional supply of up to 1 MMtpa from Woodside’s global portfolio from the start of Louisiana LNG’s operation to 2039.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR