It’s fair to say Aberdeen firm Wood has faced more than a few crises in recent years.

Seven years ago, Wood was valued at more than £5 billion and, as part of expansion plans, had just acquired one of its biggest rivals.

But numerous issues, including financial reports, inappropriate management pressure and contract problems, have caused a serious downfall.

With Wood failing to submit its latest accounts by April 30, shares are currently suspended at 18.2p each, valuing the firm at just £128 million.

But, could the tide be about to turn? The engineering giant is the subject of a potential takeover from Dubai-based group Dar Al-Handasah, known as Sidara.

What has made Aberdeen giant a takeover option?

A lot has happened at the engineering giant in the past decade. In 2017, Wood purchased Amec Foster Wheeler in a deal worth £2.2bn.

It was expected to provide new jobs for the north-east and accelerate its growth strategy by four years. However, that couldn’t have been further from the truth.

Amec Foster Wheeler brought issues with it, including court cases for contracts and bribery claims. Wood found itself paying out more than £230m in settlements.

© Supplied by –

© Supplied by –There was more trouble ahead. Its setbacks had made it a takeover target for rivals and in 2023 Wood faced several bids from Apollo Global Management, which rose as high as 240p per share.

But it wasn’t to be, and share prices fell by 34% on May 15 to 145p when Apollo pulled the plug.

The chaos continued into 2024, starting it by revealing plans to cut 22 jobs in the north-east as speculation mounted it would be exiting Aberdeen.

Wood confirmed it would be going nowhere, but neither were its issues.

Sidara and Wood deal background

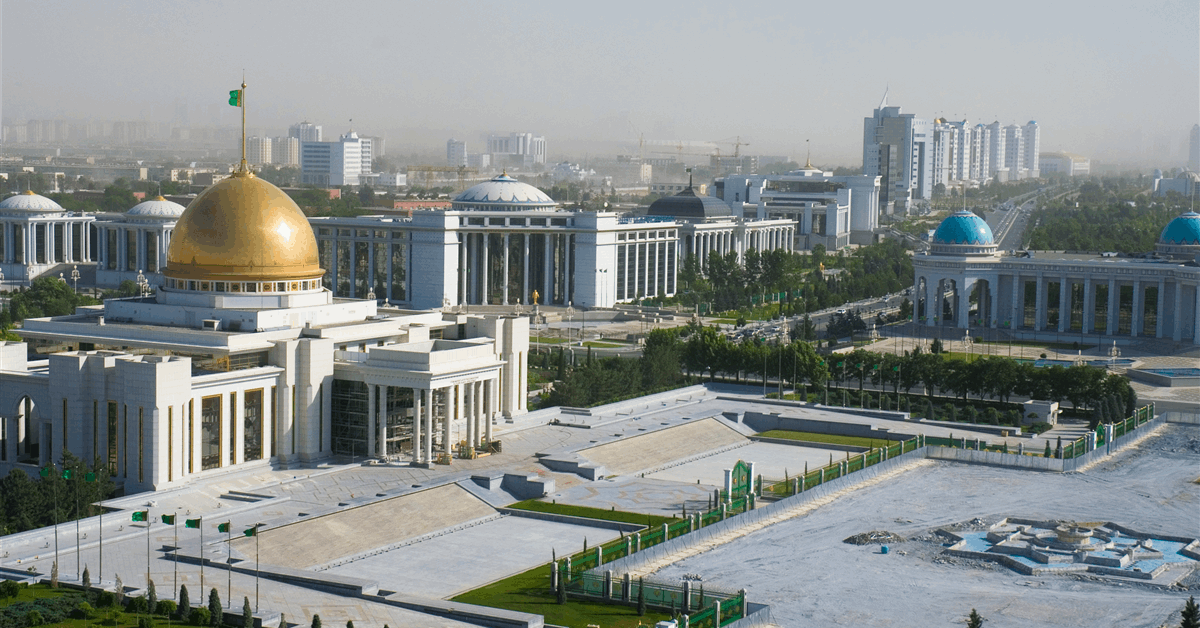

Sidara was founded in 1956 as Dar Al-Handasah, by Kamal Al-Shair and Dr Nazih Taleb, along with three fellow professors from the American University of Beirut.

The company has since grown into one of the world’s largest privately-owned architecture, engineering and consulting groups.

The family-owned business is now run by chief executive Talal Shair and employs around 21,500 people across more than 300 worldwide locations.

Sidara boasts a portfolio of 23 firms and its strategies include sustainable infrastructure and global expansion.

It has been known to use its strong financial position to pursue troubled but fundamentally sound firms, like Wood.

In its last accounts, the group reported a turnover above £2bn for the first half of its 2024 financial year.

The potential deal between Wood and Sidara has history, this isn’t the first time talks have taken place.

In August 2024, another £450m was wiped from Wood’s value after another takeover deal fell through.

After offering £1.6bn in June, the Dubai-based engineer confirmed to Wood it wouldn’t pursue the acquisition.

Sidara notified the Aberdeen firm of its decision “in light of rising geopolitical risks and financial market uncertainty”.

A couple of weeks later, the group revealed a £756m half year loss, with revenues of £2.1bn down 5% in the six months to June 30.

Now, the pair have returned to takeover talks in a deal worth around £242m.

And, a spokesman for Wood said: “The proposed combination of Wood and Sidara would create a leading global engineering consulting company, with enhanced scale, capability and diversification.”

Wood independent review

Since then, Wood’s fortunes haven’t changed. In November, its value fell by £500 million after announcing an “urgent” independent review of its books.

The firm agreed to commission an independent review by big-four auditor Deloitte.

Still ongoing, the review promised to look at positions on contracts in projects, accounting, governance and controls.

These relate to “exceptional contract write-offs” including the “exit from lump sum turnkey and large-scale EPC”.

And they are connected to Wood’s hefty near-£750-million loss reported in its half-year report.

© DC Thomson

© DC ThomsonSince then, Deloitte has identified “weaknesses and failures” in Wood’s financial culture, governance and controls.

Wood has also been facing challenges such as the resignation of its chief financial officer, Arvind Balan, over an “incorrect description of his professional qualifications”.

In March, an alarming update to investors said a number of adjustments are expected to be required on its income statements and balance sheets for the past three years.

The review also highlighted “inappropriate management pressure” as well as issues with project contracts.

Due to the issues in previous financial statements, its share price is suspended after missing the deadline of April 30 to post its annual accounts.

Will this time be different?

Sidara has backed out of a deal to buy Wood before, so you would pardon any sceptics of a future deal.

The Aberdeen firm presents a huge financial risk, with its share price dropping by more than 97% since 2017.

If Sidara was to pull out of another takeover deal, it could be catastrophic for Wood and its share price could crumble again.

And there is only so much it can crumble before Wood becomes worthless.

With the ongoing Deloitte review already finding several errors, Wood has not ruled out the possibility of more being uncovered.

So, why buy Wood?

First of all, Sidara is looking to expand its operations footprint in the west, and such a sizeable company would greatly aid its targets.

The firm will also be aware of previous companies, such as Apollo, which have shown interest in the past and, if serious, will want a deal done before it becomes a bidding war.

Despite all of the troubles, share price plummets and uncertainties, Wood says it is undergoing a “transformation”.

Chief executive Ken Gilmartin said the company is taking further actions to address the cost base of the business to the right size.

© Supplied by Wood plc

© Supplied by Wood plcAnd he believes there is light at the end of the tunnel, with a “very clear route” to a positive cash flow in 2026.

Wood can be confident the fundamentals of its company remain strong after increasing its order book to around £5 billion.

And it is confident Sidara’s long-term strategic commitment can enhance its “established market-leading position”

Wood also believes if the deal gets the go-ahead it could create opportunities for “sustainable, scalable growth”.

The Aberdeen firm will be eyeing a return to its glory days as one the world’s most valued engineering firms.