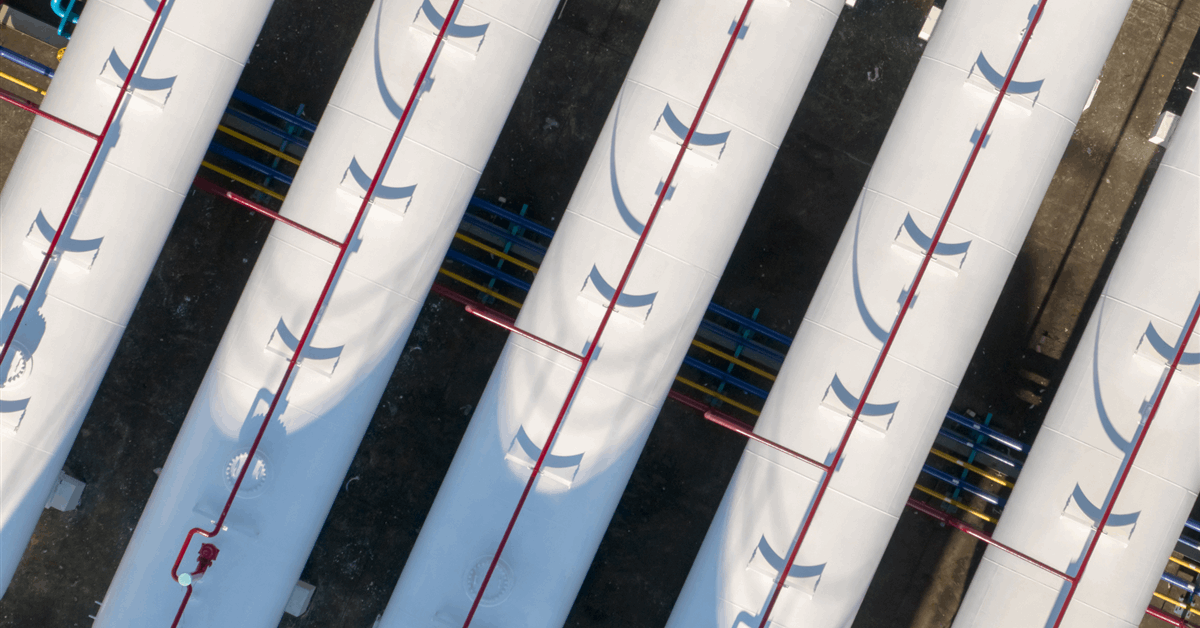

Europe can secure enough liquefied natural gas to refill storage for next winter at current prices, but the region faces competition for supply should prices fall further, according to Goldman Sachs Group Inc.

“We think that prices have to stay at current levels, or slightly above, in order to kill LNG demand outside of Europe,” Samantha Dart, the co-head of global commodities research, said on Bloomberg television. “If LNG gets too cheap this summer, you tend to see other buyers picking it up.”

Europe has drawn in more LNG cargoes so far this year thanks in part to weaker demand from Asia. China, last year’s top buyer, has sharply cut purchases due to high inventories, stronger pipeline imports, and elevated spot prices that have made shipments uneconomical. However, that trend could reverse if LNG becomes cheaper than alternative fuels in the region.

European gas storage ended winter below normal levels, but easing prices have provided some relief in recent months. The continent typically rebuilds its inventories during summer ahead of peak winter demand.

Looking further out, Dart expects that a flood of new LNG supply — driven by the US and Qatar — will create an oversupply, which will be visible from 2027 and become larger over the rest of the decade.

“We think having cheap natural gas for a few years can plant the seeds for additional demand growth,” she said.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg