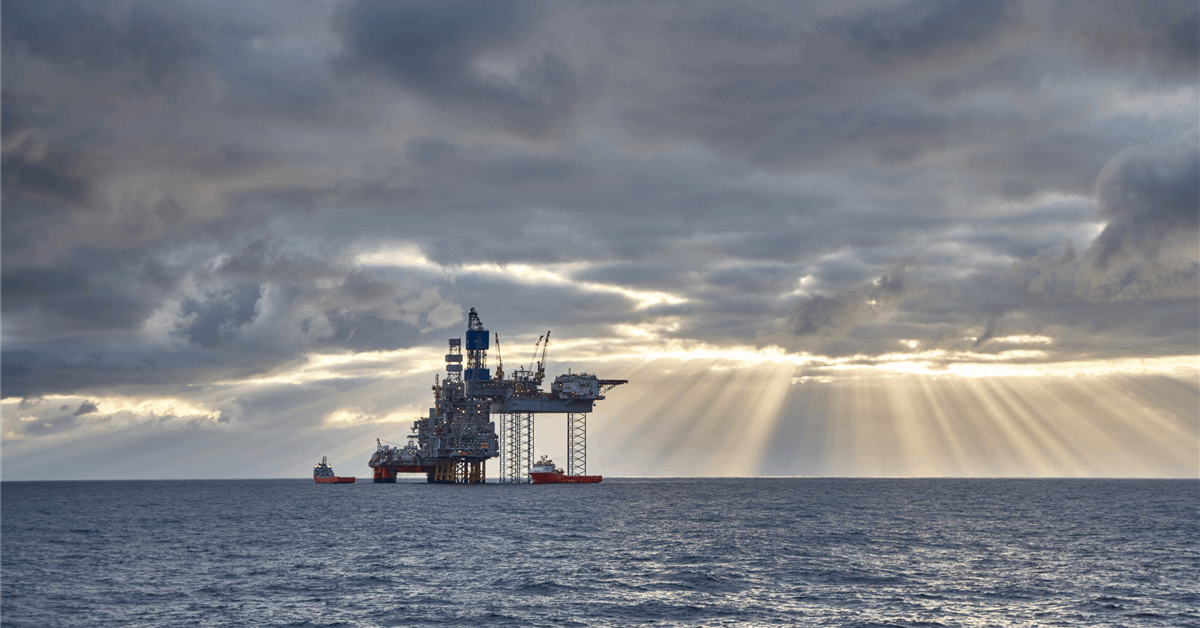

KNOT Offshore Partners LP has reported a net income of $7.6 million for the first quarter of 2025, slipping from the $23.3 million for Q4 2024. The company said in its quarterly report that revenues stood at $84 million, down from $91.3 million for the previous quarter, and earnings before interest, taxes, depreciation, and amortization (EBITDA) landed at $52.2 million, versus $63.1 million for Q4 2024.

Commenting on the Q1 results, Derek Lowe, Chief Executive Officer and Chief Financial Officer, noted that fleet utilization was above 99 percent during the quarter.

“As of the date of this release and including contractual updates since March 31, 2025, we have now secured approximately 96 percent of charter coverage for the final three quarters of 2025, and approximately 75 percent for 2026”, Lowe said.

He noted that the outlook for the Brazilian offshore oil market is improving with robust demand and increasing charter rates. “Driven by Petrobras’ continued high production levels and FPSO start-ups in the pre-salt fields that rely upon shuttle tankers, we believe the world’s biggest shuttle tanker market is tightening materially”, Lowe said.

“Our secondary geography, in the North Sea, has taken longer to rebalance, but we welcome the news of the new FPSO production starts for both the UK North Sea-based Penguins and Barents Sea-based Johan Castberg”.

KNOT Offshore believes that offshore oil production growth in shuttle tanker-serviced fields in Brazil and the North Sea will outpace shuttle tanker supply growth in the coming years, driven by the expansion of Brazilian deepwater production capacity as more shuttle tankers reach retirement age. The company has deployed 14 of its shuttle tankers in the Brazilian market.

KNOT Offshore also expressed optimism about the shuttle tanker market’s medium and long-term prospects due to clear supply and demand dynamics, along with dedicated investments from industry players.

In the near term, the partnership said it sees opportunities to use its cash flow for dropdown transactions as these could increase capital value and contractual backlog, leading to higher cash flow over time.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR