Johnson Matthey, the London-listed industrial group, has confirmed plans to sell a unit involved in the production of sustainable aviation fuel (SAF) as its board fends off pressure from an American activist investor.

The London-based company, founded in 1817, has been exploring the sale of all or part of its businesses over the past couple of years to compensate for its underperformance.

In its annual results the group confirmed it had agreed sale of Catalyst Technologies to Honeywell International at an “attractive” value of £1.8 billion on a cash and debt-free basis, with net proceeds expected to come in at £1.4bn.

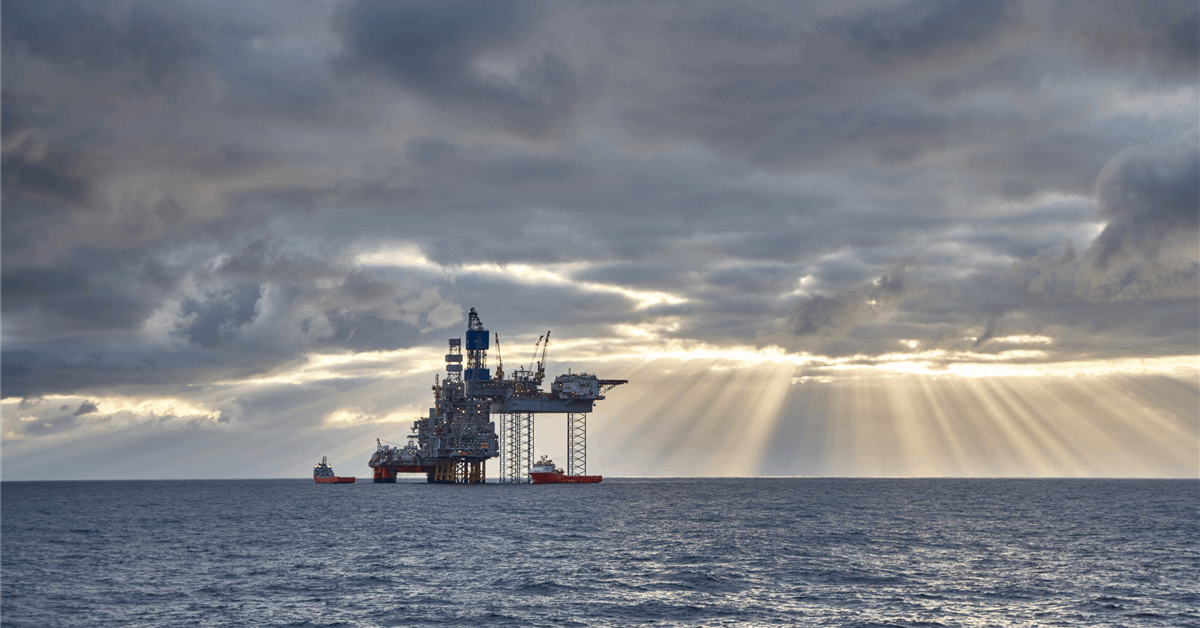

The deal includes its involvement in a sustainable aviation fuel project in Teesside.

The Willis Sustainable Fuels’ (WSF) sustainable aviation fuel project was listed amongst nine “new large scale projects in our sustainable technologies portfolio” in its catalysts business.

In March, WSF announced a partnership with Johnson Matthey to use its FT CANS feedstock technology, developed in partnership with BP, as well as its testing facilities located in Teesside as part of the project which is expected to be operational by 2028.

WSF, part of aviation giant Willis Lease Finance Corporation, had its plans for its Carbonshift SAF refinery on the Teesworks site approved by Redcar and Cleveland Borough Council.

Recently, the project was awarded a £4.7m grant from the UK Department for Transport Advanced Fuels Fund competition.

Johnson Matthew technology is also being deployed in Kellas Midstream’s H2NorthEast hydrogen scheme and BP’s H2Teesside plans.

Johnson Matthey said profits in the year to end of March were hit by a £329m impairment and restructuring charges with the biggest hit taken in its hydrogen business.

The firm said development of green hydrogen has “slowed considerably” due to “decelerating momentum around regulatory incentives, lack of hydrogen infrastructure, and high cost compared to incumbent technologies”.

Sales in the division, which is led out of Swindon, were down 15% to £60m, primarily driven by lower electrolyser sales.

It also slashed headcount 30% and said it will reduce investment in the division further, on the expectation the business will break even by end of 2025/26.

In its annual report it said: “Hydrogen is critical to the energy transition.

“With our decades of experience in fuel cells and our strong technical capabilities in PGM chemistry and catalysis, Hydrogen Technologies is well positioned for this long-term growth opportunity.

“Since late 2023, development of the green market has slowed significantly, driven by decelerating momentum around regulatory incentives, lack of hydrogen infrastructure, and high cost compared to incumbent technologies.

“Reflecting the market slowdown, we have adapted our strategy. We took action to reduce cost and are focused on reducing investment whilst maintaining long-term growth optionality.

“In the year, we recognised a £134m impairment of Hydrogen Technologies due to the further slowdown of the energy transition and the corresponding slower transition to hydrogen fuel cell and electrolyser technologies.

“We continue to expect Hydrogen Technologies to reach operating profit breakeven by the end of 2025/26 and be cash flow positive in 2026/27.”

Johnson Matthew has been facing pressure from Standard Industries, the US-based conglomerate which is its biggest shareholder with a stake of over 10%.