The first round of partner selection for the planned Alaska LNG project attracted over 50 companies, lead developer Glenfarne Group LLC has said.

The potential partners are from the United States, the European Union, Japan, Korea, Taiwan, Thailand and India. The companies “expressed interest for over $115 billion of contract value for various partnerships with the Project, including equipment and material supply, services, investment, and customer agreements”, Glenfarne said in an online statement.

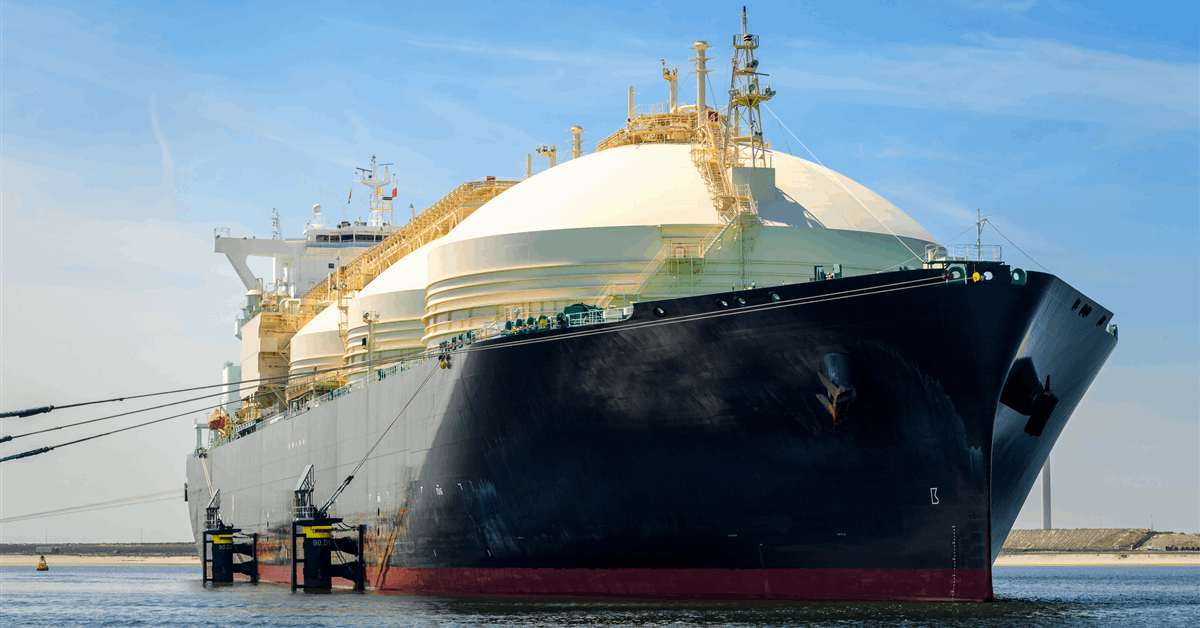

Alaska LNG, approved by the Federal Energy Regulatory Commission May 2020, will deliver natural gas from the state’s North Slope to both domestic and global markets. It is the only federally permitted liquefied natural gas (LNG) project on the United States Pacific Coast, according to co-developer Alaska Gasline Development Corp. (AGDC).

“Alaska LNG’s economic fundamentals allow it to deliver LNG into Asia at prices that are lower than Henry Hub pricing from the U.S. Gulf Coast”, the statement said.

Alaska LNG is planned to have an LNG export terminal with a capacity of 20 million metric tons per annum (MMtpa), an 807-mile 42-inch pipeline and a carbon capture plant with a storage capacity of seven MMtpa.

Phase 1 aims to deliver gas about 765 miles from the North Slope to the Anchorage region. Phase 2 would install compression equipment and around 42 miles of pipeline under Cook Inlet to the Alaska LNG Export Facility in Nikiski, which would be constructed at the same time.

“Glenfarne anticipates a final investment decision on the domestic portion of the Alaska LNG pipeline in late Q4 2025”, the statement said.

Brendan Duval, chief executive and founder of New York City-based energy investor Glenfarne, commented, “The many expressions of interest received reinforce that the market recognizes Alaska LNG’s advantaged economics, fully permitted status, and powerful federal, state, and local support”.

The project’s portion to deliver domestic natural gas, however, “is independently financially viable”, Duval said.

Earlier this month Glenfarne brought in Worley Ltd. to complete engineering works and update the cost estimate for Alaska LNG.

Worley’s work “has commenced and will utilize and supplement the extensive package of previously completed engineering work and update the cost of the pipeline”, said a joint press release May 27. “Worley has also been selected as the preferred engineering firm for the Cook Inlet Gateway LNG import terminal and project delivery advisor to Glenfarne across the Alaska LNG projects”.

On March 27 AGDC and Glenfarne said they entered into agreements for the latter to acquire 75 percent of 8 Star Alaska, a company formed by AGDC to manage Alaska LNG.

“Glenfarne assumes the role of Alaska LNG’s lead developer and will lead all remaining development work of Alaska LNG from front-end engineering and design through to a final investment decision”, AGDC said then.

“AGDC remains a 25 percent owner of 8 Star Alaska and a key partner to Glenfarne on the project”, AGDC added.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR