Oil fell on signs that the conflict in the Middle East may avoid disrupting crude production, with Iran seeking to deescalate hostilities with Israel.

West Texas Intermediate slid 1.7% to settle below $72 a barrel after spiking to start the session and swinging in an $8 throughout the day. US President Donald Trump said Iran wants to talk about deescalating the conflict, helping quell fears that a protracted war would engulf a region that produces around a third of the world’s crude.

“The question is — will Israel really be on board with that?” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. “What this does suggest, though, is that the chatter about the Strait of Hormuz may have been overstating the threat.”

Still, oil markets remain on edge after Israel launched an attack on the South Pars gas field, forcing the halt of a production platform, following strikes on Iran’s nuclear sites and military leadership last week. However, critical crude oil-exporting infrastructure has so far been spared and there’s been no blockage of the vital Strait of Hormuz.

While an attack on Iran’s gas production is a concern, the biggest fear for the oil market centers on Hormuz. Middle East producers ship about a fifth of the world’s daily output through the narrow waterway, and prices could soar further if Tehran attempts to disrupt shipments through the route.

Oil prices remain significantly higher than where they were before the attacks began. Crude gained more than 7% in the session after air strikes began on Friday, leading to record volumes of producer hedging as well as futures and options changing hands. Wall Street analysts have been quick to highlight the risks the conflict could pose.

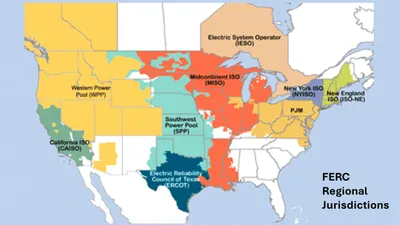

RBC Capital Markets said the fact both sides have targeted energy infrastructure shows a clear cause for concern, with the key export hub of Kharg Island and oilfields in Iraq potentially exposed. Morgan Stanley hiked its crude price forecasts by $10 a barrel, citing the increased risk from the conflict.

For now, the majority of the effects have been confined to the shipping market. Navigation signals in the Strait of Hormuz and the Persian Gulf are facing increasing interference at a level and intensity that is having a significant impact on positional reporting, the UK Navy said.

Some shipowners are reluctant to accept bookings in the region, citing safety concerns. Benchmark supertanker rates from the Middle East to China soared more than 20% on Friday.

Absent any supply disruptions, the potential market impact of the attacks so far has been on the demand side. Egypt is rushing to find alternative fuel supplies to avoid power blackouts after the conflict disrupted gas flow from Israel.

The price of fuels that could be used in power generation leaped Monday. High-sulfur fuel oil in Europe was close to a rare premium to crude, while diesel was the strongest since February.

Oil Prices:

- WTI slipped 1.7% to settle at $71.77 a barrel in New York.

- Brent fell 1.3% to settle at $73.23 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.