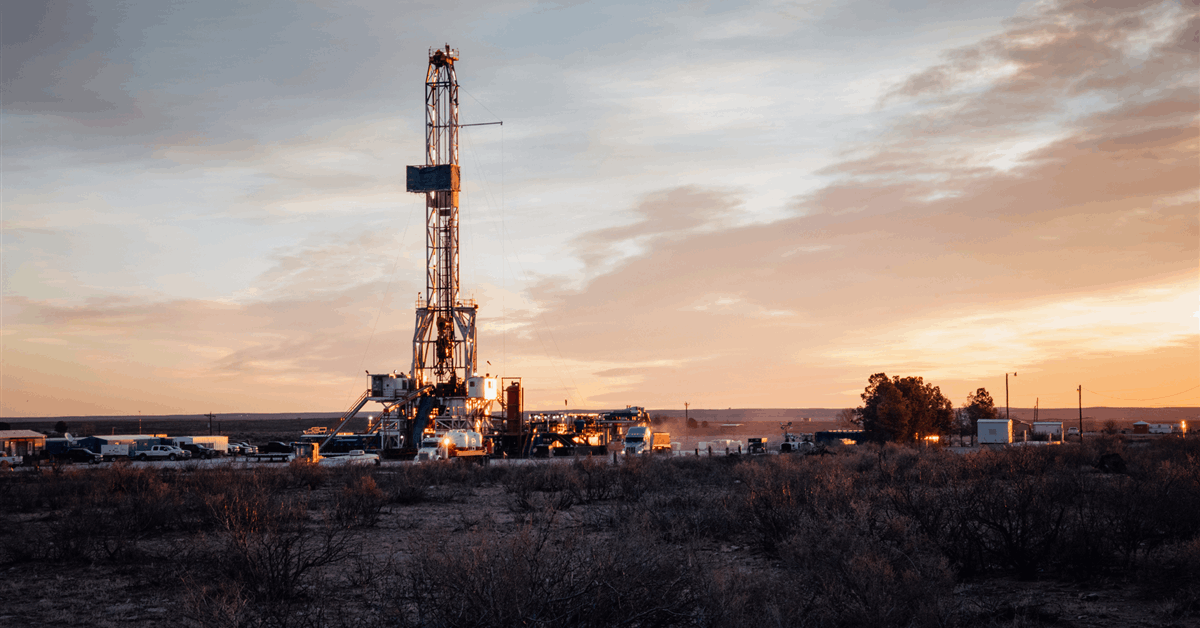

Lakes Blue Energy NL has secured AUD6.5 million to fund the proposed drilling of Wombat-5 in Petroleum Retention Lease 2 (PRL 2). The company said in a regulatory filing that it received firm commitments for a placement of 8,663,667 shares, which will also provide sufficient working capital to June 2025.

According to Lakes, the placement is subject to its reinstatement to trading on the Australian Securities Exchange Ltd. (ASX). The placement will raise a total of AUD 6,497,750.25 in two tranches. The first tranche will bring in around AUD 6 million, and the second tranche is set to bring in an additional $502,500.

The company added its directors intend to participate in the placement in consideration of outstanding amounts due to directors for a total of up to AUD636,024, subject to shareholder approval at its general meeting.

Shares in the placement will be issued at AUD 0.75 per unit, a 25 percent discount to the last traded share price of AUD 1.00 on September 30, 2023, before suspension from quotation on October 2, 2023.

Morgans Financial Ltd. acted as lead manager.

“Lakes is delighted with the market’s response to our placement, and we look forward to utilizing these funds to drill Wombat 5 and hopefully developing a substantial gas field to assist Victoria alleviate its forecast gas shortages”, Roland Sleeman, Chairman of Lakes, said.

The company earlier received approval from Lily D’Ambrosio MP, Victoria’s State Minister for Energy and Resources, to drill Wombat-5. Lakes said it had already secured an agreement with Condor Energy Services Ltd. for the supply of their Rig #1 for drilling the proposed lateral well, with spudding expected to start July.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR