Norway’s Energy Ministry has offered Equinor ASA new acreage to explore potential carbon dioxide (CO2) injection sites in Norwegian waters.

License EXL014 covers blocks 8/5, 8/6, 8/8, 8/9, 8/12, 9/7 and 9/10 on Norway’s side of the North Sea, according to a work program published online by the Norwegian Offshore Directorate.

“The license is offered with a binding work program with built-in milestones to ensure fast and efficient progress or relinquishment of the acreage if the licensees do not complete the storage project”, the ministry said in a statement.

This is the eighth time Norway has awarded acreage for CO2 storage. EXL014, offered to Equinor Low Carbon Solutions AS, will be the fourteenth license to be awarded for CO2 storage on Norway’s continental shelf. So far 13 licenses have been awarded – one exploitation and 12 exploration, according to the ministry.

“This shows that there is interest in offering safe and secure storage of CO2 captured in Europe”, said Energy Minister Terje Aasland.

“The government is making it possible for Norway to receive large quantities of CO2 from Europe”, Aasland said. “The storage will take place on commercial terms, where those with emissions pay for the storage”.

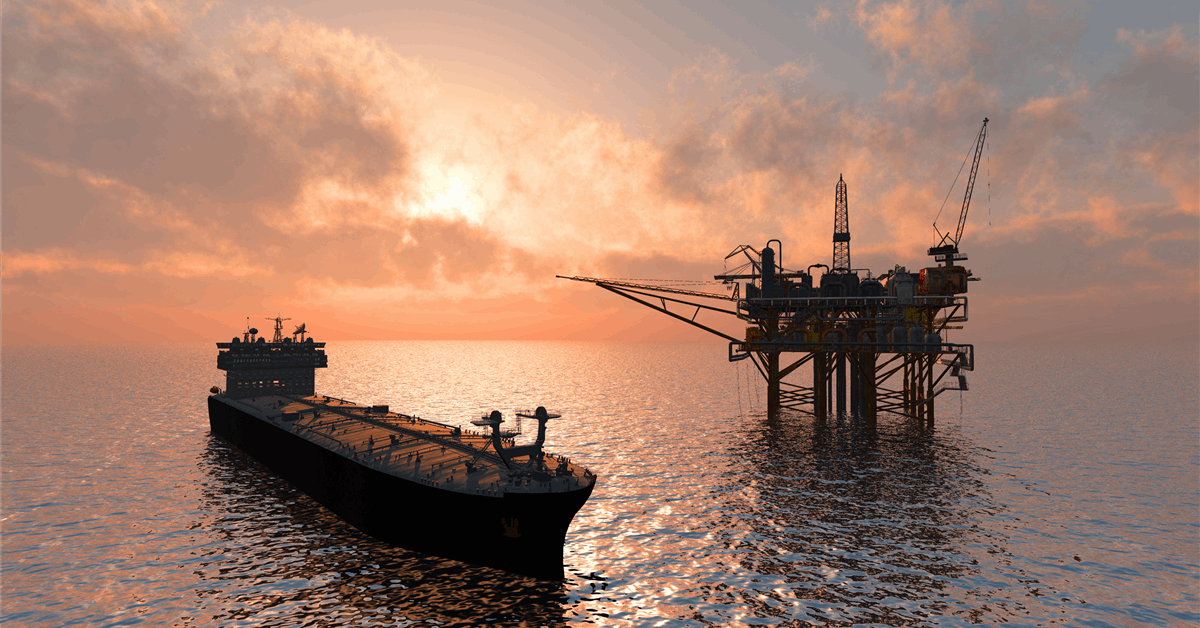

Earlier the Directorate said Harbour Energy PLC had found a suitable reservoir for CO2 injection in the North Sea about 30 kilometers (18.64 miles) southeast of the Yme platform.

Well 9/6-1 is the first well drilled in EXL006, awarded May 2023. “This is the fourth well drilled to investigate potential commercial storage of CO2 on the Norwegian continental shelf”, the Directorate said June 2.

The wildcat well aimed to assess the injection potential of Middle Jurassic and Middle and Upper Triassic reservoir rocks in the area of the planned Havstjerne storage project.

“Extensive volumes of data have been acquired from the reservoir and caprocks. An injection test has also been conducted. Preliminary results are positive”, the Directorate said.

“The data will now be subject to further analysis, and the results will become part of the basis for future decisions regarding investment in the Havstjerne storage project”.

Upstream oil and gas player Harbour owns 60 percent of EXL006 and is operator through Harbour Energy Norge AS. Stell Maris CCS AS holds 40 percent.

In May the Directorate said two wells drilled by Equinor in the North Sea about 20 kilometers east of the Troll A platform showed a suitable reservoir for CO2 storage.

Wells 32/4-4 and 32/7-1, drilled in the Alpha and Gamma areas respectively, make up a potential injection site for the Smeaheia project. They are the first to be drilled under EXL002, awarded June 2022, and the second and third wells drilled to investigate the possibility of commercial CO2 storage in Norwegian waters. The first, well 32/4-3 S, was also drilled by Equinor in 2019.

On March 5, the Energy Ministry designated a new area of the North Sea for application for licenses to explore the potential of CO2 storage. The acreage comprises defined blocks on the Norwegian side of the sea.

The Norwegian continental shelf holds a theoretical CO2 storage capacity of 80 billion metric tons, representing about 1,600 years of Norwegian CO2 emissions at current levels, according to a statement by the ministry April 30, 2024.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR