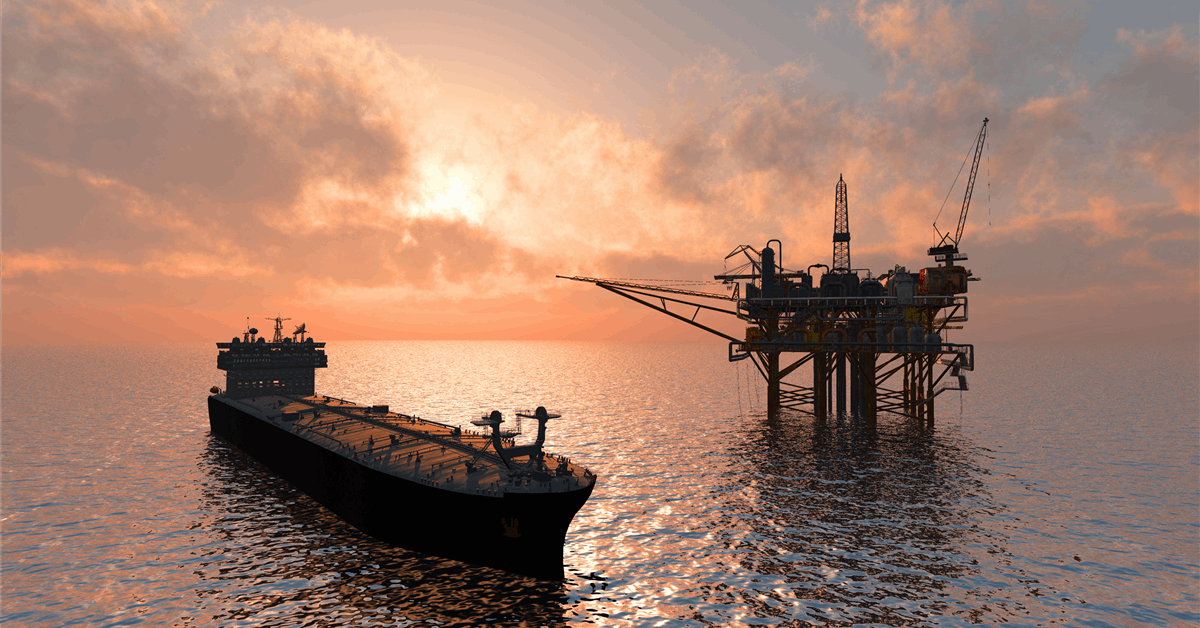

Oil edged higher, paring earlier gains, after the White House said President Donald Trump would decide within two weeks whether to strike Iran, reducing speculation that the US would plunge into the conflict imminently.

West Texas Intermediate’s more-active August futures were up 0.5% to around $74 a barrel after White House Press Secretary Karoline Leavitt made the comments on Trump’s timeline for the decision at a White House press briefing. The contract had approached $76 earlier in the session on reports that senior US officials had said the administration was preparing for a possible strike on Iran in the coming days.

The White House comments take “some of the immediate pressure off,” said Robert Yawger, director of the energy futures division at Mizuho Securities USA. “It looks like US involvement will not happen today or tomorrow.”

That delay in potential direct US participation in the conflict may prevent crude from reaching new highs, Yawger said.

Still, crude remains markedly higher than before Israel first struck Iran earlier this month, with volatility spiking, options getting more bullish and premiums for nearby crude prices soaring over later ones.

Trump concluded a meeting Wednesday with top advisers, but the White House offered few clues about the path forward. Asked if he was moving closer to bombing Iran, Trump said “I may do it. I may not do it.” The Wall Street Journal reported that the president approved a military attack plan earlier in the week, but withheld the final authorization as he weighed whether Tehran would meet his demands.

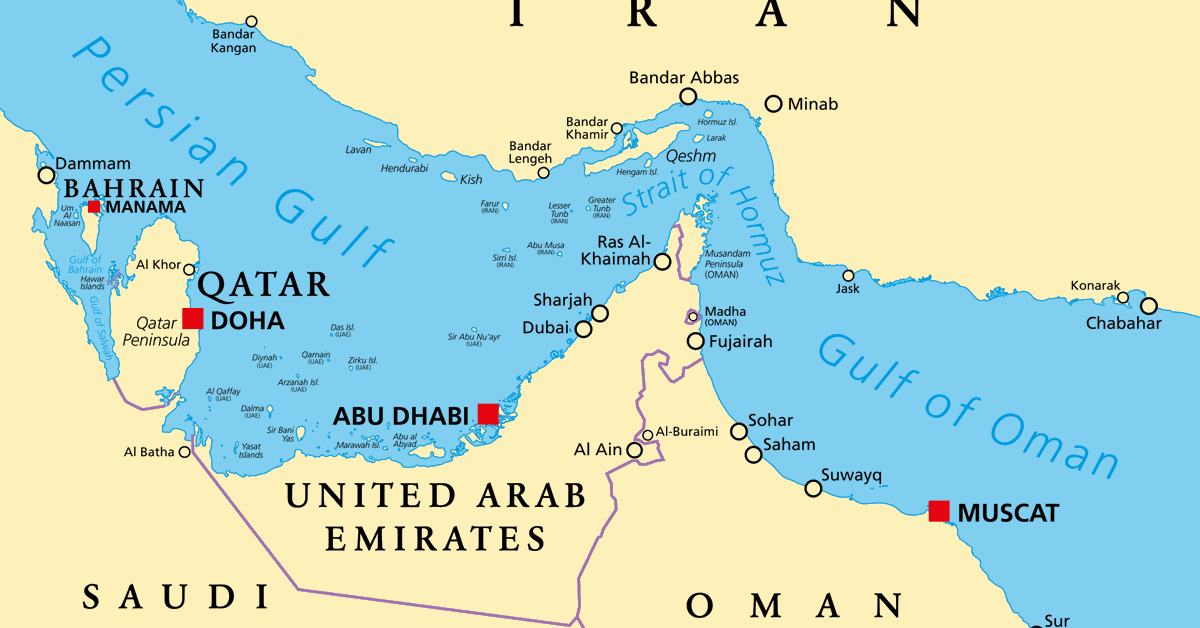

Shell Plc Chief Executive Officer Wael Sawan warned Thursday of a “huge impact” on global trade if the conflict were to result in a blockage of the Strait of Hormuz, a narrow waterway between Iran and Oman through which about a fifth of the world’s oil passes. Shell has contingency plans in place in the event that the situation deteriorates, Sawan said at the Japan Energy Summit & Exhibition in Tokyo.

So far there are no signs that Tehran is seeking to disrupt shipping Hormuz. Oil analysts and traders currently see about $8 of geopolitical risk premium priced into the market and are bracing for that to rise further if the US joins in on the attacks.

“We don’t see it as a likely scenario at this time, but given the precarious state that the Iran regime is in right now, I think everybody should be watching” the waterway, Mike Sommers, the president of the American Petroleum Institute, said in a Bloomberg television interview.

Oil Prices

- WTI for July delivery, which expires on Friday, was up 0.9% to $75.80 a barrel at 3:06 p.m. in New York.

- The more-active August contract rose 0.5% to $73.88 a barrel.

- Brent for August settlement rose to 2.8% to settle at $78.85, before the White House comments.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.