Oil fell after President Donald Trump signaled a decision on whether to strike Iran will be made within two weeks, easing concerns about an imminent attack from the US.

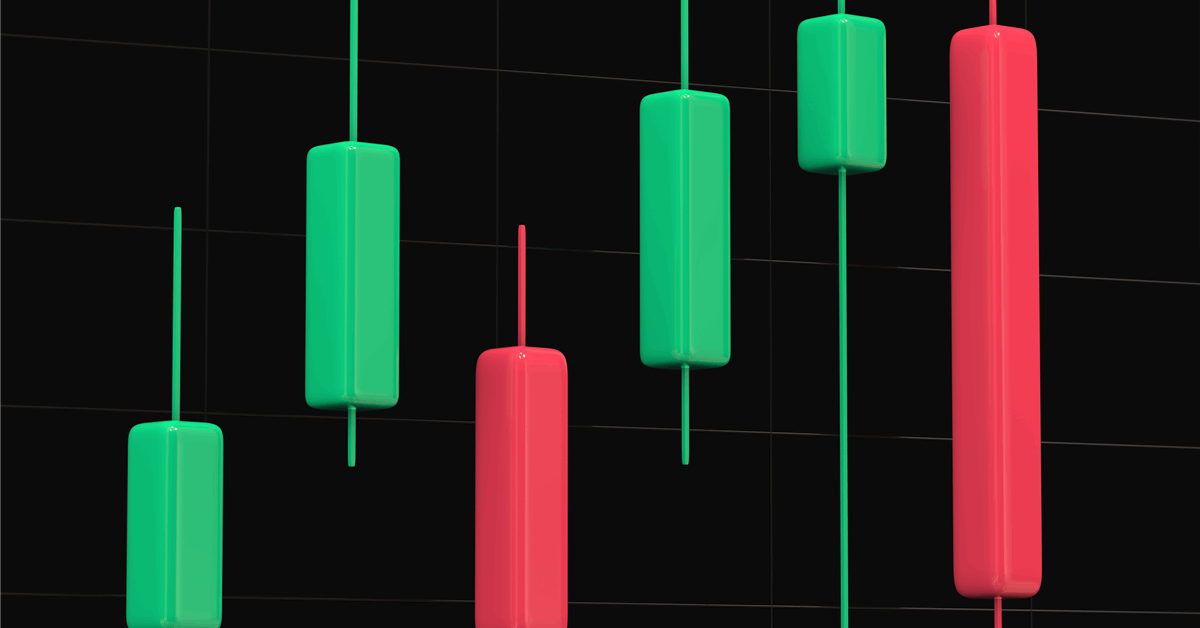

Global benchmark Brent slid about 2.3% to settle as just above $77 a barrel after the White House comments on Thursday and a Reuters report that Tehran is ready to discuss limitations on uranium enrichment. Trading volumes for West Texas Intermediate were muted because of the US holiday and a contract expiration on Friday. The US benchmark for August delivery settled just below $74 a barrel.

Iranian Foreign Minister Abbas Araghchi met with counterparts from the UK, France and Germany on Friday in Geneva. Araghchi said Iran is ready to hold another meeting with the Europeans in the near future, the state-run IRNA news agency reported. But, he warned, “As long as the attacks continue, we will not negotiate with any party.”

“We are keen to continue ongoing discussions and negotiations with Iran, and we urge Iran to continue their talks with the US,” UK Foreign Secretary David Lammy told reporters after the meeting. “This is a perilous moment, and it’s hugely important that we don’t see regional escalation of this conflict.”

Trump’s decision on Iran will take some time due to the “substantial chance of negotiations,” he said in a message through White House spokeswoman Karoline Leavitt. The UK, meanwhile, is withdrawing embassy staff from the Middle Eastern nation, AFP reported.

The oil market has had a turbulent week, with futures swinging in a range of around $8, volatility spiking to the highest since 2022, key premiums significantly widening and options at one stage more bullish than after Russia’s invasion of Ukraine. Still, both Brent and WTI notched their third straight weekly gains.

Brent crude closed almost 3% higher on Thursday in a trading session that was shortened due to a US holiday, on concerns over a potential strike from the US over the weekend. Senior American officials had been preparing for the possibility of an attack, although the situation was still evolving, people familiar with the matter said.

“We are highly skeptical that talks will materialize,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management. “All indications suggest that we are now entering a period of continued uncertainty over the next two weeks.”

Israel has continued to attack Iran’s nuclear sites, but the country’s crude-exporting infrastructure remains unscathed. There are signs, however, that the OPEC producer is racing to get its oil out into the world as storage tanks at the critical Kharg Island export terminal brim with crude.

The biggest concern for the oil market centers on the Strait of Hormuz, though there are no signs that Tehran is seeking to disrupt shipping through the narrow waterway at the entrance to the Persian Gulf. About a fifth of the world’s crude output passes through the strait.

Oil Prices

- WTI for August delivery advanced 0.5% to settle at $73.84 in New York, after there was no settlement Thursday due to the US holiday.

- The July contract, which expired Friday, settled at $74.93 a barrel.

- Brent for August settlement declined 2.3% to $77.01 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.