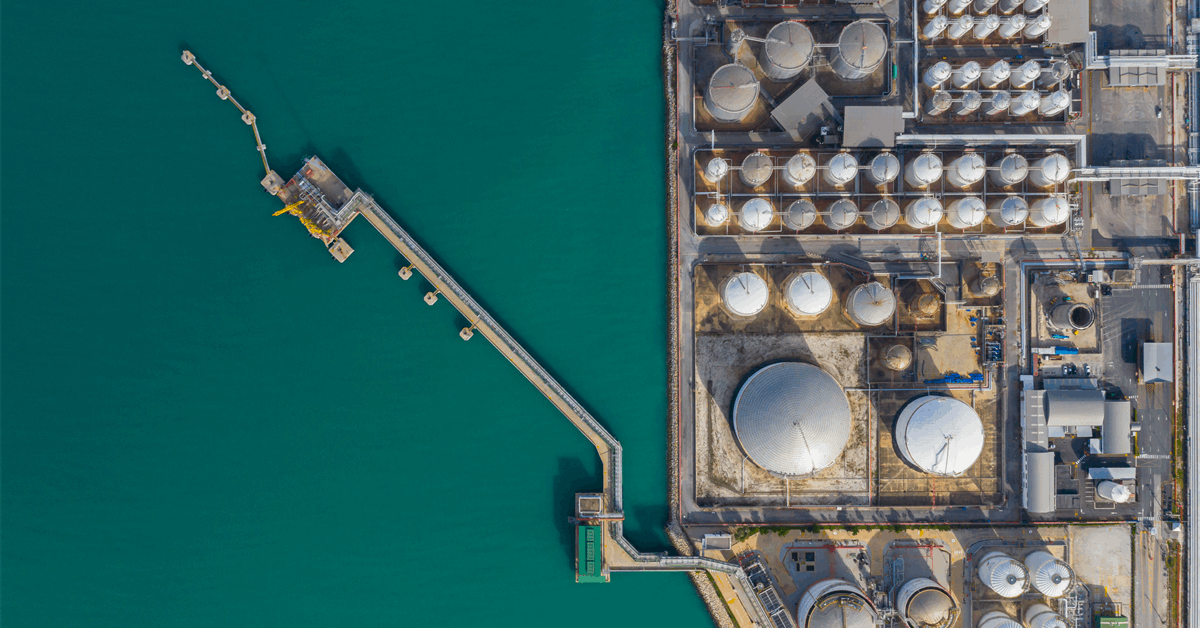

Executives from oil and gas firms have revealed where they expect the Henry Hub natural gas price to be at various points in the future in the fourth quarter Dallas Fed Energy Survey, which was released recently.

The average response executives from 128 oil and gas firms gave when asked what they expect the Henry Hub natural gas price to be at the end of 2025 was $3.19 per million British thermal units (MMBtu), the survey showed. The low forecast was $2.00 per MMBtu, the high forecast was $4.80 per MMBtu, and the spot price during the survey was $3.04 per MMBtu per, the survey outlined.

This question was not asked in the previous Dallas Fed Energy Survey, which was released back in the third quarter. The third quarter Dallas Fed Energy Survey asked participants what they expect the Henry Hub natural gas price to be at the end of 2024. Executives from 131 oil and gas firms answered this question, offering an average response of $2.62 per MMBtu, that survey showed. The low forecast was $1.50 per MMBtu, the high forecast was $4.25 per MMBtu, and the spot price during that survey was $2.23 per MMBtu, the third quarter Dallas Fed Energy Survey highlighted.

The fourth quarter Dallas Fed Energy Survey also asked participants where they expect Henry Hub natural gas prices to be in six months, one year, two years, and five years. Executives from 117 oil and gas firms answered this question and gave a mean response of $2.97 per MMBtu for the six month mark, $3.28 per MMBtu for the year mark, $3.63 per MMBtu for the two year mark, and $4.16 per MMBtu for the five year mark, the survey showed.

Executives from 112 oil and gas firms answered this question in the third quarter Dallas Fed Energy Survey and gave a mean response of $2.57 per MMBtu for the six month mark, $2.85 per MMBtu for the year mark, $3.24 per MMBtu for the two year mark, and $3.89 per MMBtu for the five year mark, that survey outlined.

In a ‘comments’ section of the fourth quarter Dallas Fed Energy Survey, which the survey outlined showed comments from respondents’ completed surveys that had been edited for publication, one exploration and production firm said, “the low price for natural gas is crushing current cash flow”.

“For smaller independents, cash flow is what feeds future investment. We need restrictions to be lifted for selling LNG (liquefied natural gas) to overseas buyers so that demand for natural gas will increase the prices we receive,” the exploration and production firm added.

Rigzone has contacted the Trump transition team, the White House, and the U.S. Department of Energy for comment on that statement. At the time of writing, none have responded to Rigzone’s request yet.

The U.S. Energy Information Administration (EIA) raised its Henry Hub natural gas spot price forecast for 2025 in its latest short term energy outlook (STEO), which was released last month.

According to its December STEO, the EIA sees the Henry Hub spot price averaging $2.95 per MMBtu in 2025. The EIA’s previous November STEO projected that the Henry Hub spot price would average $2.90 per MMBtu in 2025.

In its December STEO, the EIA forecast that the Henry Hub natural gas spot price would average $3.40 per MMBtu in the fourth quarter of 2025. The EIA’s previous STEO projected that the fourth quarter 2025 Henry Hub natural gas spot price would come in at $3.29 per MMBtu.

The EIA’s next short term energy outlook is scheduled to be released on January 14.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR