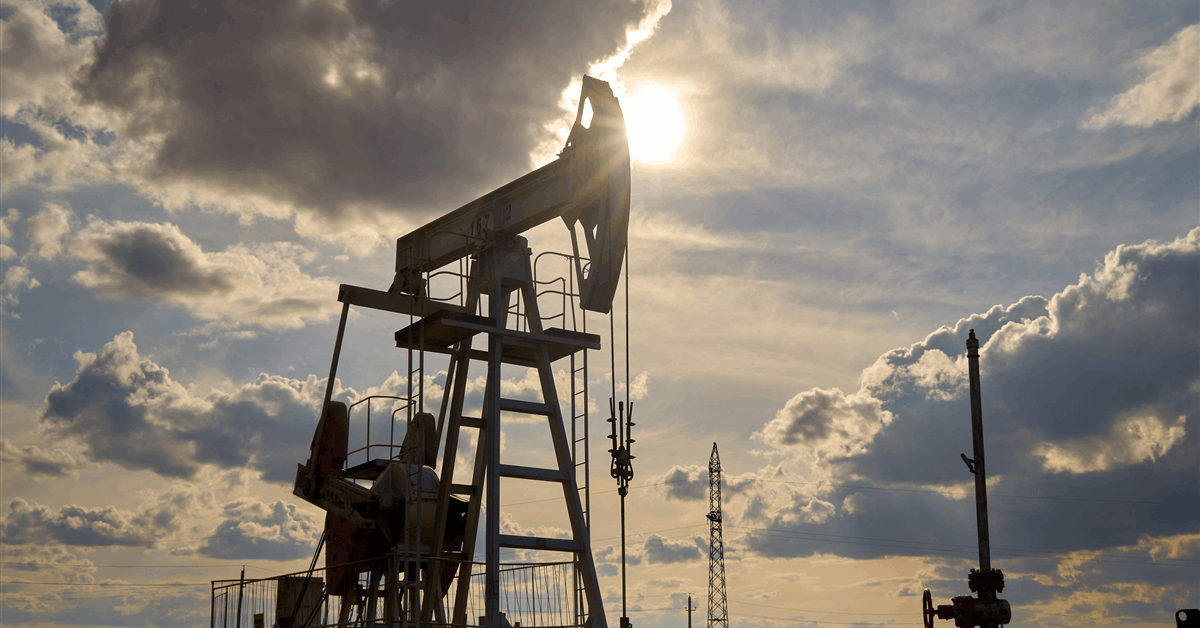

In a research note sent to Rigzone on Wednesday by Natasha Kaneva, Head of Global Commodities Strategy at J.P. Morgan, analysts at the company, including Kaneva, stated that, since 1967, except for the Yom Kippur War in 1973, none of the 11 major military conflicts involving Israel have had a lasting impact on oil prices.

“Examining Brent oil prices three months before and after the onset of each crisis, regional conflicts involving Israel often trigger a sharp increase in oil prices – even without immediate supply disruptions – likely due to apprehensions about potential future disruptions,” the analysts said in the note.

“Over time, however, oil prices tend to gradually stabilize and decline, leading to Brent trading at a discount to its fair value,” they added.

“Similarly, other military conflicts in the Middle East, such as the Syrian civil war in March 2011, the Yemeni civil war in September 2014, ISIS’s advance into Northern Iraq in June 2014, a U.S. drone strike on an Iranian Major General in January 2020, and an airstrike in Syria in April 2017, did not result in significant supply losses following the conflict, thereby having no lasting impact on oil prices,” they continued.

The analysts went on to state in the research note that, in contrast, events involving a major regional oil producer tend to have a material impact on oil prices.

“The First Gulf War in August 1990, the Second Gulf War and the conflict in the Niger Delta both in March 2003, the 2011 Libyan civil war in February 2011, the fall of Mosul in June 2014, and sanctions on Iran in 2018 all directly affected oil supply, leading to increased oil prices,” the analysts highlighted.

“During these episodes, we estimate that oil traded at a wide $7-14 per barrel premium to its fair value for an extended period,” they added.

The J.P. Morgan analysts also highlighted in the note that “the largest impact on prices … arises from regime changes”.

“Regime changes in oil-producing countries – whether through leadership transitions, coups, revolutions, or major political shifts – can have a profound impact on the country’s oil policy, production, and global oil prices, in both the short and long term,” the analysts pointed out in the note.

“Since 1979, there have been eight notable instances of regime change in medium-to-large scale oil-producing nations, each with significant implications for global oil prices and supply dynamics,” they added.

“While demand conditions and OPEC’s spare capacity significantly shape the overall market impact, these events typically lead to a substantial spike in oil prices, averaging a 76 percent increase from onset to peak,” they continued.

“Initially, oil prices rose by about five percent in the first month, but over a three-month period from the onset of the conflict, they averaged a 30 percent increase, eventually stabilizing at levels around 30 percent higher than pre-conflict levels,” they went on to state.

The J.P. Morgan analysts stated in the research note that “this pattern aligns with supply disruption trends, where in the initial month, only about two percent of supply on average is lost, but significant supply losses occur over a six-month period, averaging around 23 percent”.

They said these supply losses are challenging to recover quickly, further supporting elevated prices.

The analysts also pointed out in the note that, over the past six years, the global oil market “has endured a series of significant shocks”, singling out events such as the Covid pandemic and the start of the Russia-Ukraine war.

J.P. Morgan’s research note also showed that the company expected the Brent crude oil price to average $67 per barrel in the second quarter of this year, $63 per barrel in the third quarter, $61 in the fourth quarter, and $66 per barrel overall in 2025.

To contact the author, email [email protected]