Canadian oil sands production will reach record annual production in 2025 despite lower prices, according to a forecast from S&P Global Commodity Insights.

Oil sands production in the country is projected to reach 3.5 million barrels per day (bpd) for the year, 5 percent higher than last year, the data analytics firm said in a news release.

Production could surpass 3.9 million bpd by 2030, an increase of about 500,000 bpd over 2024 figures, and 100,000 bpd higher than the previous outlook, according to the release. The outlook continues to expect oil sands production to enter a plateau later in the decade, at a higher level of production than previously estimated.

The potential for additional upside exists given the nature of optimization projects, which often result from learning by doing or emerge organically, according to the release.

The new forecast, produced by the S&P Global Commodity Insights Oil Sands Dialogue, is the fourth consecutive upward revision to the annual outlook.

Despite a lower oil price environment, the analysis attributes the increased projection to favorable economics, “as producers continue to focus on maximizing existing assets through investments in optimization and efficiency,” the release said.

“While large up-front, out-of-pocket expenditures over multiple years are required to bring online new oil sands projects, once completed, projects enjoy relatively low breakeven prices,” the firm said.

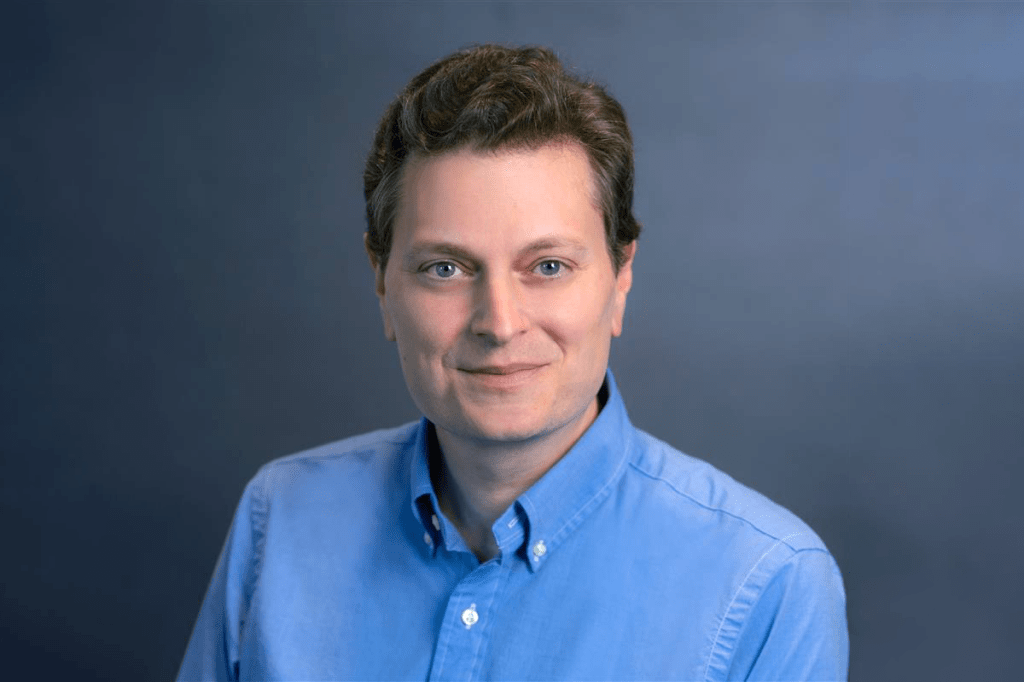

“The increased trajectory for Canadian oil sands production growth amidst a period of oil price volatility reflects producers’ continued emphasis on optimization—and the favorable economics that underpin such operations,” Kevin Birn, chief Canadian oil analyst for S&P Global Commodity Insights, said. “More than 3.8 million barrels per day of existing installed capacity was brought online from 2001 and 2017. This large resource base provides ample room for producers to find debottlenecking opportunities, decrease downtime and increase throughput”.

“Many companies are likely to proceed with optimizations even in more challenging price environments because they often contribute to efficiency gains,” Celina Hwang, director of crude oil markets for S&P Global Commodity Insights, said. “This dynamic adds to the resiliency of oil sands production and its ability to grow through periods of price volatility”.

Export capacity, which was already a concern in recent years, is a source of downside risk now that even more production growth is expected. Without further incremental pipeline capacity, export constraints have the potential to re-emerge as early as next year, the release said.

“While a lower price path in 2025 and the potential for pipeline export constraints are downside risks to this outlook, the oil sands have proven able to withstand extreme price volatility in the past,” Hwang said. “The low break-even costs for existing projects and producers’ ability to manage challenging situations in the past support the resilience of this outlook”.

“Other important risks remain, including the adequacy of pipeline export capacity. With even more production growth expected, without further incremental pipeline capacity, export constraints have the potential to reemerge as early as next year. Should this occur, western Canadian prices could be negatively impacted, leading to slower and lower growth than we currently anticipate,” according to the forecast.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR