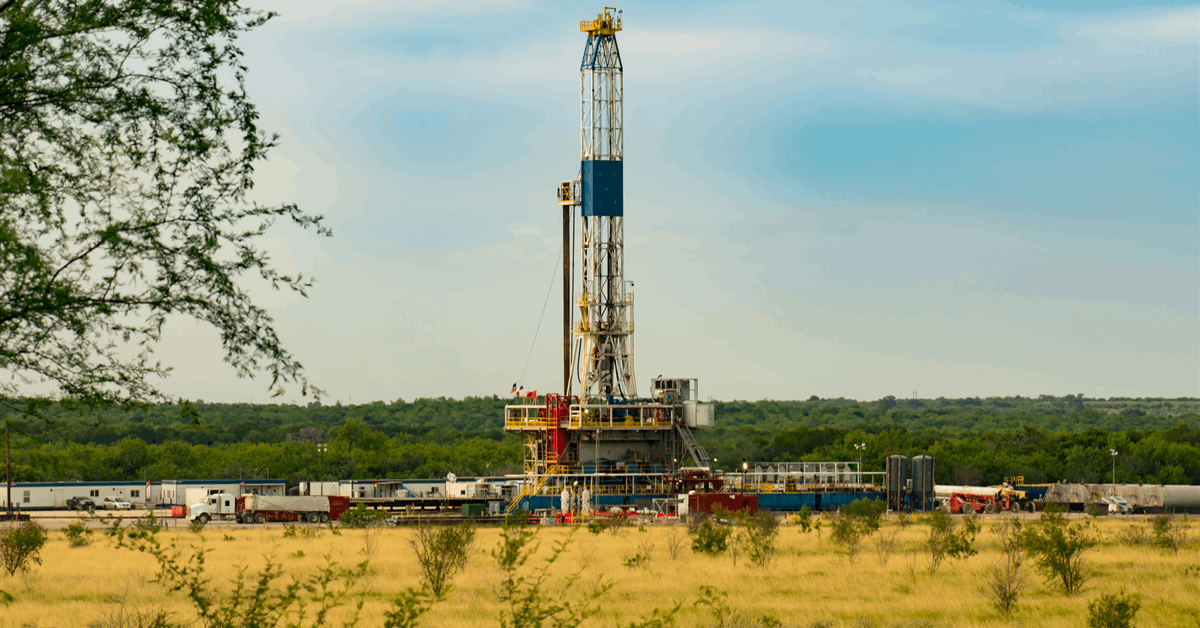

Diversified Energy Co. PLC and Carlyle have formed a partnership to invest up to $2 billion in proven developed producing (PDP) natural gas and oil assets across the United States.

“This exclusive partnership will combine Carlyle’s deep credit and structuring expertise, led by Carlyle’s asset-backed finance (ABF) team, with Diversified’s market-leading operating capabilities and differentiated business model of acquiring and optimizing portfolios of existing long-life oil and gas assets to generate reliable production and consistent cash flow”, a joint statement said.

“Under the terms of the agreement, Diversified will serve as the operator and servicer of the newly acquired assets”, the companies added. “As investments occur, Carlyle intends to pursue opportunities to securitize these assets, seeking to unlock long-term, resilient financing for this critical segment of the nation’s energy infrastructure”.

Diversified Energy chief executive Rusty Hutson Jr said, “This arrangement significantly enhances our ability to pursue and scale strategic acquisitions in what we believe is a highly compelling environment for PDP asset consolidation”.

“Diversified is a leading operator of long-life energy assets and a pioneer in bringing PDP securitizations to institutional markets”, commented Akhil Bansal, head of Carlyle ABF. “We are excited to bring institutional capital to high-quality, cash-yielding energy assets that are core to US domestic energy production and energy security.

“This partnership underscores Carlyle’s ability to originate differentiated investment opportunities through proprietary sourcing channels and seek access to stable, yield-oriented energy exposure”.

Carlyle ABF, part of Carlyle’s Global Credit platform, focuses on private fixed income and asset-backed investments. Carlyle ABF supports businesses, specialty finance companies, banks, asset managers and other originators and owners of diversified pools of assets. It has deployed around $8 billion since 2021 and has about$9 billion in assets under management as of the first quarter of 2025, according to Washington-based Carlyle.

Birmingham, Alabama-based Diversified Energy is involved in natural gas and liquids production, transport, marketing and well retirement.

In an earlier acquisition partnership, Diversified Energy announced March it has teamed up with FuelCell Energy Inc. and TESIAC eyeing a portfolio of 360 megawatts of power to cater to data centers across Kentucky, Virginia and West Virginia.

The three agreed to create an acquisition and development company “focused on delivering reliable, cost-efficient, net-zero power from natural gas and captured coal mine methane to meet the soaring demand of data centers for reliable power”, a joint press release said.

“The collaboration among the three companies would leverage in-basin natural gas production, advanced energy generation via fuel cell technology, and infrastructure financing to create a highly efficient, scalable, and sustainable energy solution tailored for the rapid expansion of data center power capacity requirements.

“Natural gas or CMM, extracted from coal mines by Diversified Energy and delivered via pipeline to fuel cells, would generate power through the electrochemical conversion of methane to hydrogen, and then to electricity.

“This combustion-free process is virtually free of air pollution emissions, speeding air permitting and enabling the system to be brought online faster than combustion-based systems.

“Heat that is co-generated by the fuel cells can be harnessed and converted to chilling for the data center, thus increasing overall system efficiency and further enhancing economic value.

“Importantly, this process qualifies for established environmental and tax credits that have the potential to provide meaningful cash flow in addition to the economic benefits of gas and power sales”.

To contact the author, email [email protected]