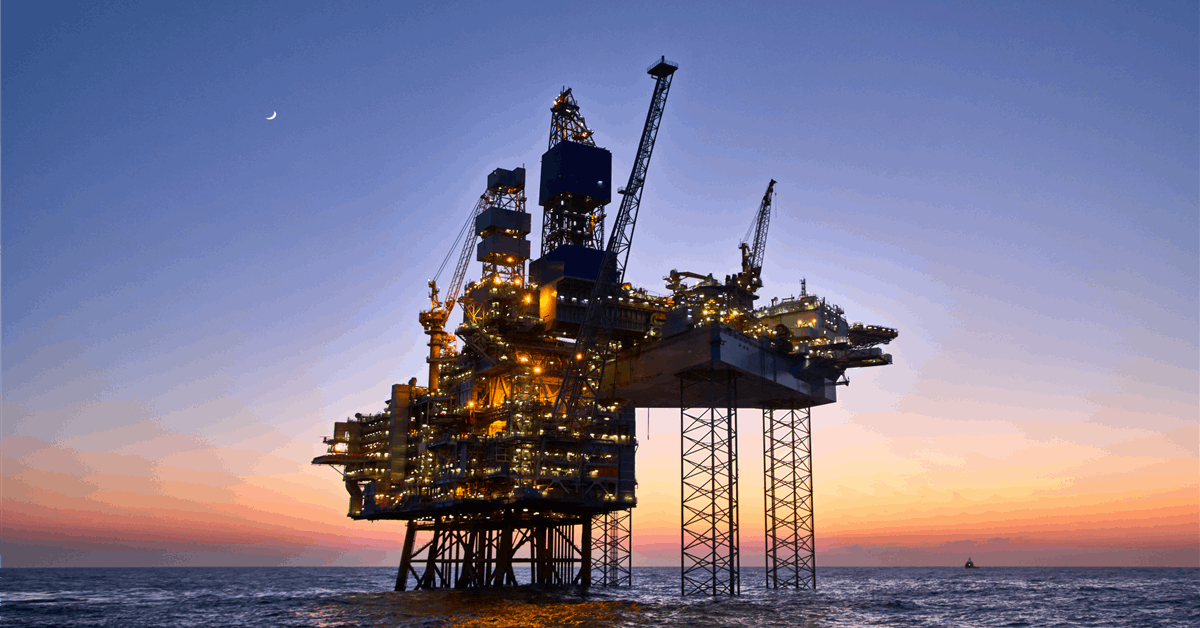

Israeli authorities have allowed the Chevron Corp.-operated Leviathan natural gas and condensate field to restart production, after ordering a pause about two weeks ago amid Israel’s exchange of attacks with Iran.

The Leviathan consortium had invoked a force majeure after the Energy and Infrastructures Ministry, acting on a “security recommendation”, asked that production at the field be temporarily halted, according to NewMed Energy LP, one of the consortium partners.

NewMed Energy has now said that order had been lifted. It said it intends to seek state compensation for losses.

“According to the Partnership’s [NewMed Energy] initial estimate, based, inter alia, on the forecasted production from the Leviathan reservoir and from the Karish lease, the halting of production for the said period resulted in a loss of income from the sale of natural gas and condensate (gross, before royalties) and income from overriding royalties from the Karish lease in the sum total of approx. $38.8 million”, NewMed Energy, a gas and condensate exploration and production company owned by Israel’s Delek Group, told the Tel Aviv Stock Exchange.

“The Partnership intends to explore the possibility of receiving compensation from the State in connection with the halting of the gas production, although at this stage there is no certainty as to receipt of such compensation and the amount thereof”, it added.

The Israel-Hamas war has also delayed the construction of a third pipeline for the field. A regulatory disclosure by NewMed Energy October 6, 2024, said the suspension of the project could last about six months.

The new conduit is expected to grow the maximum delivery to Israel Natural Gas Lines Ltd. from about 1.2 billion cubic feet a day (Bcfd) to around 1.4 Bcfd from mid-2025, according to a NewMed Energy filing July 2, 2023, that announced an investment of approximately $568 million for Leviathan’s third pipeline.

Leviathan’s two operating pipelines carry output from four wells to an offshore platform that processes the gas. The gas is then piped to shore into Israel’s national grid, through which it is distributed to users in Israel, Egypt and Jordan.

Earlier this year the consortium submitted to the Israeli government a revised development plan for Leviathan’s expansion project.

The new plan for Phase 1B would grow Leviathan’s production capacity to about 23 billion cubic meters (812.24 billion cubic feet) a year. That is up from the previous plan of around 21 Bcm per annum.

Leviathan, discovered 2010 off the coast of Haifa city, started production December 2019 under Phase 1A, which has a capacity of about 12 Bcm a year.

The consortium plans to implement the revised Phase 1B plan in either one go or two stages.

Stage 1 would drill three production wells, add new subsea systems and expand processing facilities on the existing platform to raise Leviathan’s production capacity to about 21 Bcm a year. The total cost is estimated to be $2.4 billion gross. So far the partners have approved $505 million, according to a NewMed Energy regulatory filing on February 23, 2025.

Stage 2 “mainly includes the drilling of additional production wells and related subsea systems, and in this context, insofar as required, the laying of a fourth pipeline between the field and the platform, in a manner that is expected to increase the maximum daily production capacity by another ~2 BCM per year, i.e. to a total quantity of ~23 BCM per year”, NewMed Energy said.

Chevron operates Leviathan with a 39.66 percent stake through Chevron Mediterranean Ltd. NewMed Energy is the majority stakeholder at 45.34 percent. Ratio Energies LP, a local player, owns 15 percent.

To contact the author, email [email protected]