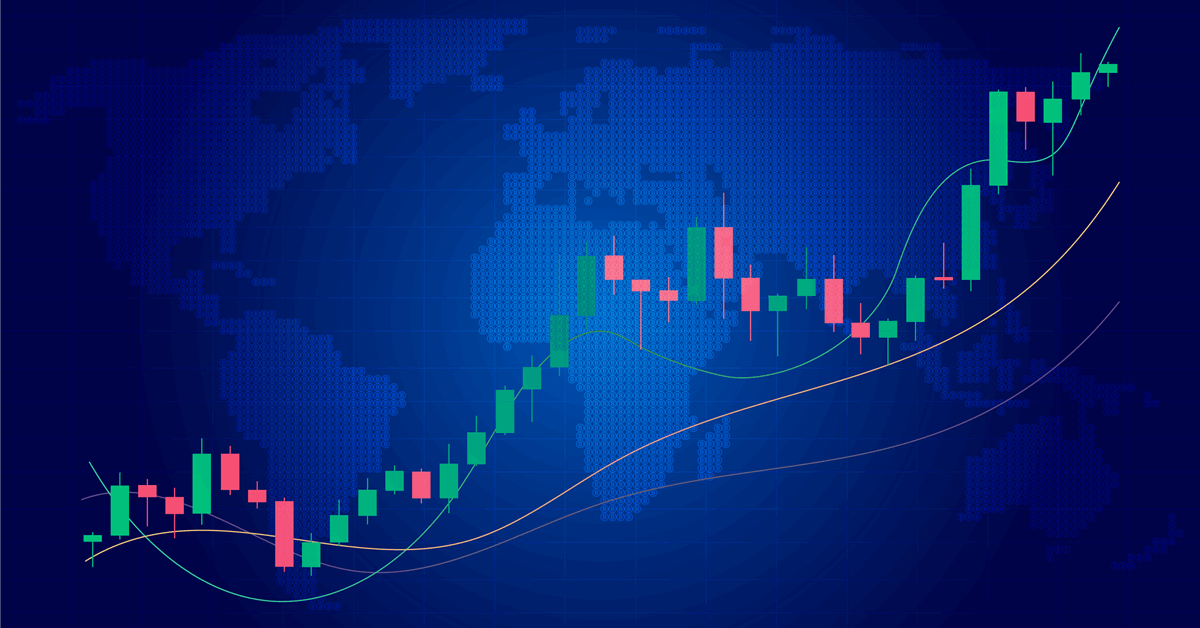

Oil edged up from near the lowest levels in a month as tensions once again flared in the Middle East, returning the spotlight to the fragility of a truce between Israel and Iran.

West Texas Intermediate rose 0.5% to settle near $65.50 a barrel, while Brent closed above $67. Volumes were trending lower ahead of Friday’s July 4 holiday in the US.

Investors are watching closely to see whether Iran’s inventories of near-bomb-grade uranium have been depleted and whether its moves to cut off communication with key United Nations watchdog officials will trigger another wave of US strikes. President Donald Trump has said the US will “be there” unless Iran backs away from its nuclear program.

So far, the conflict has not disrupted flows in the region but the mere possibility of supply interruptions now has some traders taking a wait-and-see approach. During the heat of tensions, a quarterly record of combined options contracts for WTI and Brent changed hands as traders bet on the outcome of these fast-evolving conflicts, based on data from the exchanges.

Aside from geopolitics, macro factors also lent conflicting signals to oil. The demand outlook for the US darkened slightly after factory activity contracted in June for a fourth consecutive month, although the labor market showed signs of strength.

The Middle East developments took away the focus from a meeting between the Organization of the Petroleum Exporting Countries and its allies. The group is expected to agree to a fourth monthly major supply increase during discussions Sunday, according to a Bloomberg survey, as de facto leader Saudi Arabia continues its bid to reclaim market share.

Oil lost almost 10% last quarter in a volatile three months that saw prices drop sharply in April on Trump’s tariff plans, and surge in June after Israel attacked Iran, before erasing gains as hostilities eased. One gauge of implied volatility on Tuesday fell to the lowest since June 10, just before Israel launched its aerial campaign against Iran.

“There is no doubt traders are still suffering from the recent whiplash, which may lower liquidity in the short term,” said Ole Hansen, head of commodities strategy at Saxo Bank.

The market’s attention now is returning to the interplay between the peak summer demand season and OPEC and its allies adding barrels to the market. For now, refined products markets remain strong, bolstering the incentives for refiners to turn crude oil into fuels.

Trump also reiterated plans to fill up the Strategic Petroleum Reserve when “the market is right,” but didn’t specify a timeline.

Oil Prices:

- WTI for August delivery climbed 0.5% to settle at $65.45 a barrel in New York.

- Brent for September settlement rose 0.6% to settle at $67.11 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.