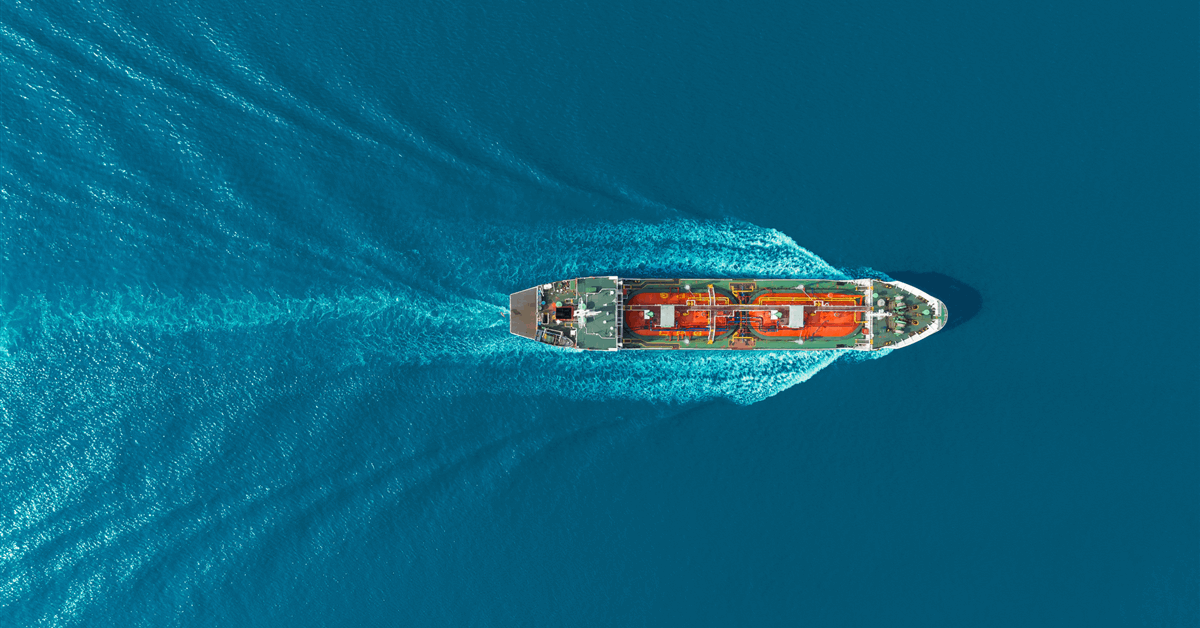

DNO ASA said its Norwegian operating subsidiaries have entered into an offtake agreement with France’s ENGIE SA for the company’s Norwegian gas production.

The offtake agreement covers the entirety of DNO’s Norwegian gas production following its acquisition of Sval Energi Group AS, the company said in a news release.

The four-year agreement is effective October 1 and “offers premium pricing,” DNO said.

Related to the agreement, DNO said it has entered into an offtake financing facility with an undisclosed U.S. bank for up to $500 million. Under the facility, the bank finances DNO the value of up to 270 days of scheduled gas production based on future gas sales receivables.

The all-in interest rate for drawn amounts under the facility is “significantly below” conventional reserve-based lending (RBL) terms available to DNO, with no charges for undrawn amounts, DNO said, adding that there are no financial covenants related to the facility.

Proceeds from the offtake financing facility will be used to replace Sval Energi’s existing similar facilities as well as for general corporate purposes, DNO stated.

“We have received strong interest by buyers to prepurchase our enlarged North Sea production of 80,000 barrels of oil equivalent per day split about equally between oil and gas,” DNO Executive Chairman Bijan Mossavar-Rahmani said.

“These three-way transactions are made possible because buyers are eager to lock in secure supplies of Norwegian oil and gas and U.S. banks, in particular, have significantly stepped up fossil fuel lending,” he added.

DNO said it has repaid and will not renew over $ 600 million in RBLs across its North Sea subsidiaries, “given [the] availability of attractive offtake financing terms”.

In addition, the company has borrowed $300 million under a one-year bank bridge loan “to add more arrows to our quiver,” Mossavar-Rahmani said.

Separately, DNO is also in talks to establish an offtake agreement and related financing facility on comparable terms for its North Sea oil production, according to the release.

Last month, DNO closed its acquisition of Sval Energi from HitecVision for cash consideration of $450 million based on an enterprise value of $1.6 billion.

The acquired portfolio consists of 16 producing fields in Norway, quadrupling DNO’s North Sea production to 80,000 barrels of oil equivalent per day (boepd), the company said in an earlier statement.

Sval Energi has non-operated interests in 16 producing fields offshore Norway, with net production of 64,100 boepd in 2024, and 141 million boe (MMboe) in net 2P reserves and 102 MMboe of net 2C resources. Its largest assets, measured by net 2P reserves, are Nova, Martin Linge, Kvitebjørn, Eldfisk, Maria, Symra and Ekofisk.

With a balanced portfolio split about equally between liquids and gas, there is additional upside and production potential from organic growth in producing assets, fields under development, such as Maria Revitalization, Symra, and Dvalin North; and discoveries such as Cerisa, Ringhorne North, and Beta; and redevelopment opportunities such as Albuskjell and West Ekofisk, DNO said.

As a result of the acquisition, the company said its North Sea proven and probable (2P) reserves increased to 189 MMboe, while its contingent resources (2C) reached 316 MMboe.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR