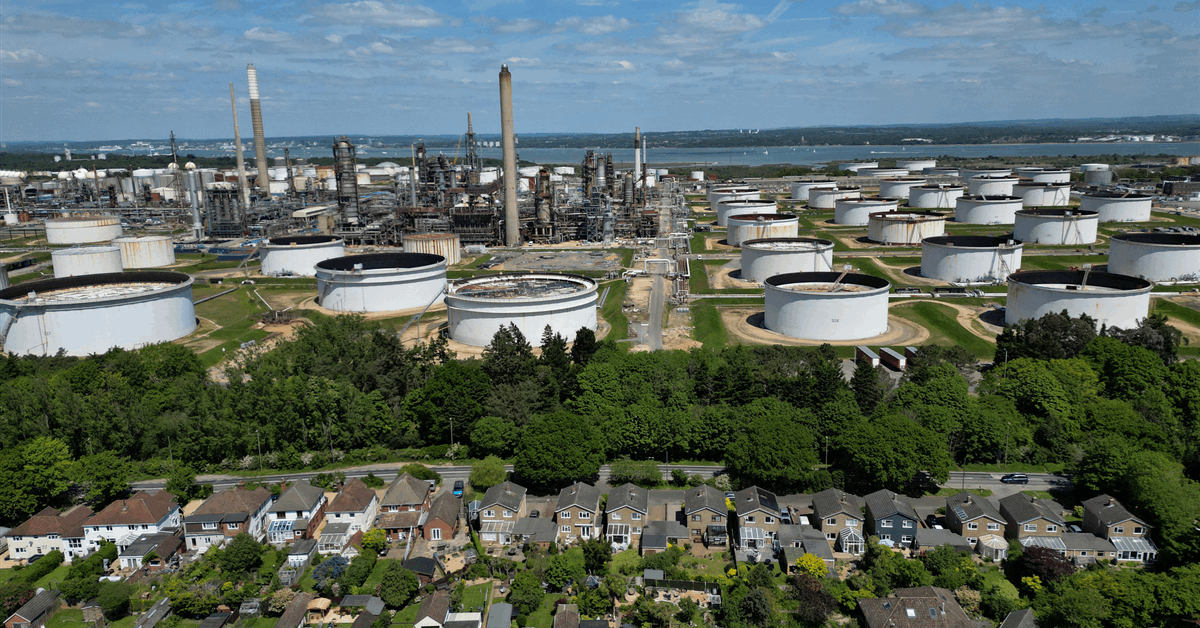

Hynamics UK, part of France’s EDF Group, is bringing Hy24 onboard a renewable hydrogen project meant to help decarbonize Exxon Mobil Corp.’s Fawley refining and petrochemical complex.

Hynamics UK and Hy24 signed Tuesday during the UK-France Summit a memorandum of understanding that would secure funding for the Fawley Green Hydrogen Project. Paris-based Hy24 is a private equity asset manager focused on the production of low-carbon hydrogen and its derivatives.

The project is planned to have a 120-megawatt electrolyzer. Hynamics UK expects to cut the Fawley complex’s carbon dioxide emissions by 100,000 metric tons a year “by replacing heavy fuel oil and gray hydrogen with low-carbon hydrogen”, a joint statement with Hy24 said.

“This Memorandum of Understanding marks the beginning of exclusive negotiations with Hy24, through its Clean Hydrogen Infrastructure Fund, to develop and finance a GBP 300 million hydrogen electrolytic production facility in Fawley, located in Hampshire, England”, the companies said.

“The project aims to supply green hydrogen to the ExxonMobil petrochemical complex as part of its decarbonization strategy”.

The UK’s biggest integrated petrochemical complex, Fawley refines 270,000 barrels of oil a day and fuels 1 in every 5 cars on United Kingdom roads, according to ExxonMobil. Meanwhile the site’s petrochemical production amounts to about 650,000 metric tons per year, according to the United States energy giant.

Additionally Hy24 and Hynamics UK “expressed their intention to collaborate on a broader range of projects developed by Hynamics UK, aligning with the UK government’s ambitions for clean energy development”, the companies said.

Hynamics UK chief executive Pierre de Raphelis-Soissan, said, “Our MoU is in line with the Clean Industrial Strategy presented by the British Government in June and is a testimony to the potential for cooperation between industrial and financial players across the Channel”.

Amir Sharifi, Hy24 head for the UK, Southern Europe, the Middle East and North Africa, commented, “The policy landscape in the UK is providing the certainty and clarity needed to enable decarbonization projects at the right scale and pace. We see this as a very positive signal and a strong opportunity for Hy24 to expand into the UK for the first time, alongside partners who are deeply committed to the energy transition”.

“The reality is that leadership positions across the hydrogen value chain are being shaped now – and the UK has shown remarkable consistency and determination in this regard. In this context, Hynamics UK stands out as one of the most advanced players”, Sharifi added.

The Fawley Green Hydrogen Project is among 27 electrolytic projects shortlisted under Hydrogen Allocation Round 2 for potential government funding, as announced by the Department of Energy Security and Net Zero on April 7, 2025.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR