Deep Dive

Load growth and aging infrastructure require investment, but customer electricity prices are up 4.5% nationally, almost twice the 2.4% national inflation rate.

Published July 15, 2025

High voltage power lines run along the electrical power grid on May 16, 2024, in Pembroke Pines, Florida. Utilities need to invest in grid modernization to meet rising electricity demand. At the same time, customer electricity prices are up 4.5% nationally — almost twice the 2.4% national inflation rate, according to the June Bureau of Labor Statistics Consumer Price Index.

Joe Raedle via Getty Images

Utility regulators across the U.S. face a paradox that demands resolution, panelists at the American Clean Power Association’s CleanPower 2025 conference said.

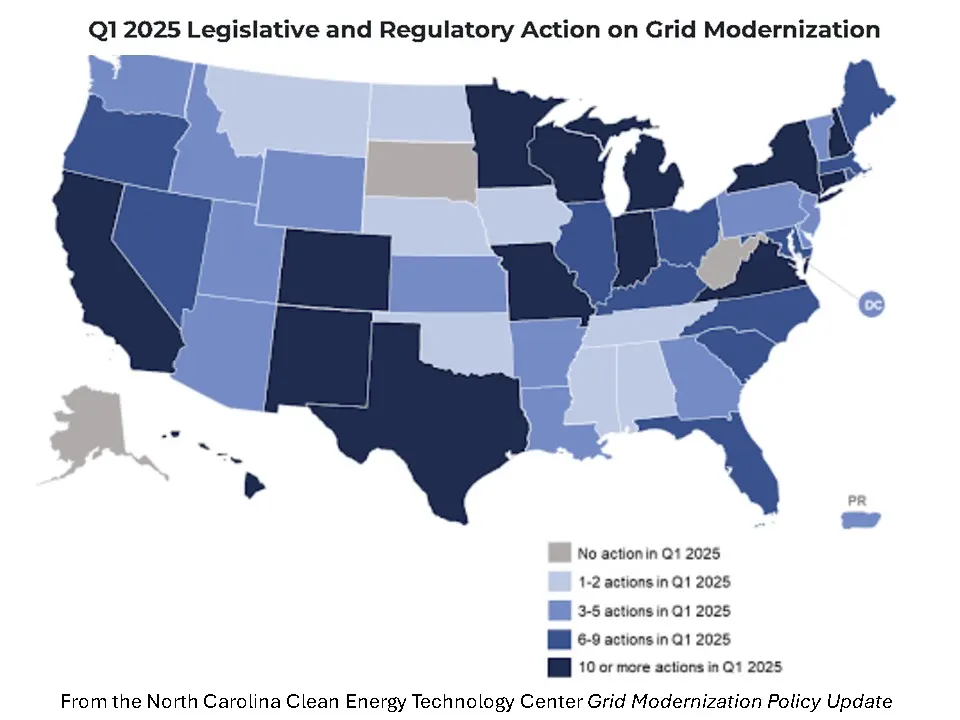

There were 726 policy actions on grid modernization in the U.S. in the first quarter of this year, many requiring significant new investments, per the Clean Energy Technology Center’s most recent Grid Modernization policy update. But customer electricity prices are up 4.5% nationally, almost twice the 2.4% national inflation rate, according to the June Bureau of Labor Statistics Consumer Price Index.

“Utility regulation has always been a complex balancing act and the lesson learned is the need to ensure investment value and utility accountability,” said Regulatory Assistance Project, or RAP, Principal, Research and Strategy, Mark LeBel. Regulators must choose “the most cost-effective investments from a realistic set of alternatives,” he added.

Almost 80% of $186.4 billion spent by U.S. investor-owned utilities in 2024 went to infrastructure, according to September 2024 data from the Edison Electric Institute. And more spending must follow: April’s 120 GW five-year load growth forecast was over five times higher than 2023’s five-year forecast of 23 GW, according to the recent GridStrategies update.

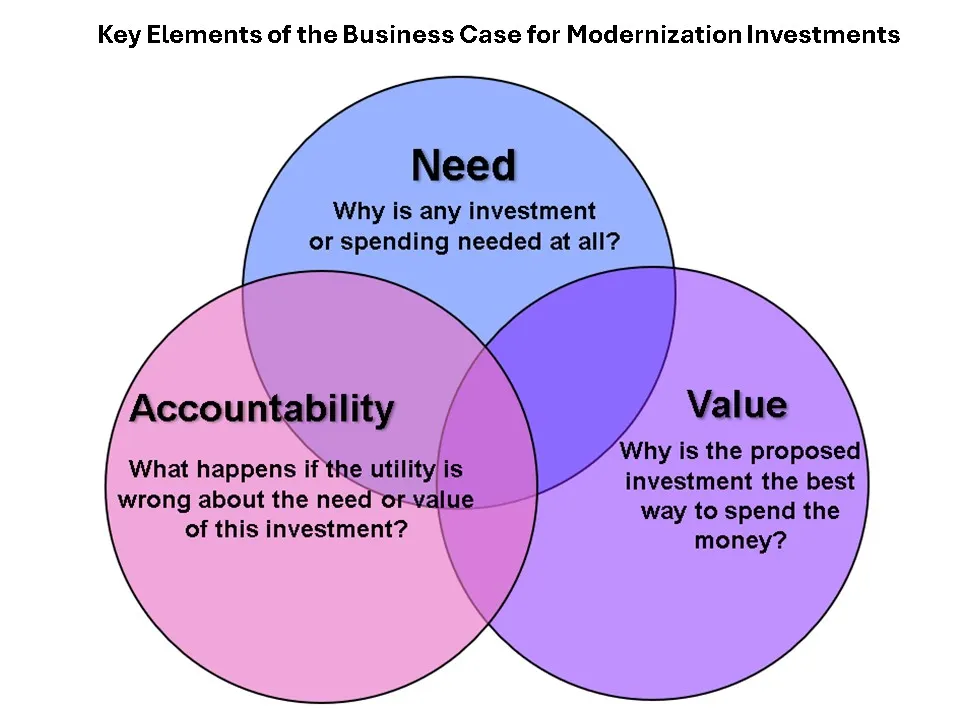

“Regulators can approach modernization investments like they are investors in a business,” said Commissioner Abigail Anthony of the Rhode Island Public Utility Commission. Utilities should present investment information “like a business owner seeking a loan” to eliminate regulators’ concern that approval “is a gamble with customer money,” she added.

Balancing the apparent opposites of spending to modernize and not spending to avoid rate increases is what utility oversight is about, many commissioners agreed. Emerging tools for business case regulation are new metrics, effective planning and well-paced spending that can identify needed investments that add value and make the utility accountable, some regulators added.

Can opposites balance?

Conscientious regulators need new approaches for the hard choice between legitimate modernization investments and the upward rate pressure they cause, state commissioners and analysts said.

Pressures on an out-of-date system are rising and significant investments, mostly paid by utility ratepayers, are needed, said Bryce Yonker, executive director of modernization advocate Grid Forward. As a result, though, if “affordability is the paramount target, it will be difficult to achieve.”

The Georgia Public Service Commission recently initiated a solution to balance costs for new large load customers that many state regulators are adopting, said Georgia Commissioner Tricia Pridemore.

“New rules require Georgia Power to contract for 15 years with new large load customers at a rate that covers 100% of utility costs,” she added.

Georgia Power procures the generation needed by the new large load, and the commission approves the contract in “a collaborative planning process,” Pridemore said. Costs not recovered through the contract go into the utility’s rate case, but recovery of those costs is not likely to be allowed “because negotiating the contract was the utility’s responsibility and not a ratepayer problem,” she added.

With Georgia Power and its regulators facing questions about the utility’s nation-leading profitability, Pridemore stressed the estimated $2.64 per month downward pressure on each residential customer’s rates attributed to the new rule.“Like every state commission,” Georgia regulators are “working to find the right amount of spending to ensure reliability without unnecessary costs,” she added.

New elements for broader balancing of affordability and modernization are emerging in many other states.

Permission granted by NCCETC

The theory of balancing

One emerging tool for effectively balancing spending and rate increases is new metrics.

“Ultimately, potential investments need to be prioritized,” said Newport Consulting Group Managing Partner Paul De Martini, who co-authored a January Lawrence Berkeley National Laboratory report on optimizing distribution system modernization investments.

The report describes metrics for “multi-objective prioritization” developed by DTE Electric in Michigan and Portland General Electric in Oregon. Planning “must address multiple objectives” and “they need to be prioritized,” even though “most distribution grid investments solve more than one objective,” it added.

The Michigan utility commission uses DTE’s global prioritization model, but it recognizes the model’s usefulness has practical limits, said Michigan Public Service Commission Chair Dan Scripps. “If it is clear the model has good inputs, we can have confidence the outputs are good.”

A regulator’s priority should be “modernizations that can create the most value,” LBNL’s report said. And the most valuable modernization investments are “an outcome of Integrated Distribution System Planning” with comprehensive analyses that often include two metrics, it added.

A “best fit, least cost” analysis can be applied to individual expenditures that only achieve their full value “when the interdependent components are all deployed,” LBNL said.

Benefit-cost analysis is best if benefits “are discrete and assignable, quantitatively measurable, and do not materially change” with usage, the report added.

Best practices in planning align investments “to achieve specific outcomes … that clearly support established planning objectives,” LBNL concluded. The best metrics reflect both “the priority ranking of the objective” and “the contribution of the proposed solution to addressing each objective,” it added.

Commissioner Ann Rendahl of the Washington Utilities and Transportation Commission agreed the planning process is critical to effective decisions. “Significant requests for rate increases have become more common,” but with effective planning, regulators can resolve “the trade-off” between cost savings and “the most efficient reliable service,” she said.

Other recent research has also developed new metrics, De Martini noted. The Pacific Northwest National Laboratory has worked on planning strategies for aging infrastructure replacement, and the Clean Air Task Force has looked at risks of relying too much on levelized cost of energy data, he said.

“It also is important to begin the planning process by defining affordability,” De Martini cautioned. “Utilities assume a certain percentage increase in revenue requirement in relation to the inflation rate is affordable, but stakeholders, regulators and legislators will likely differ,” he added.

Despite the best metrics, regulators ultimately face hard judgment calls, many acknowledged.

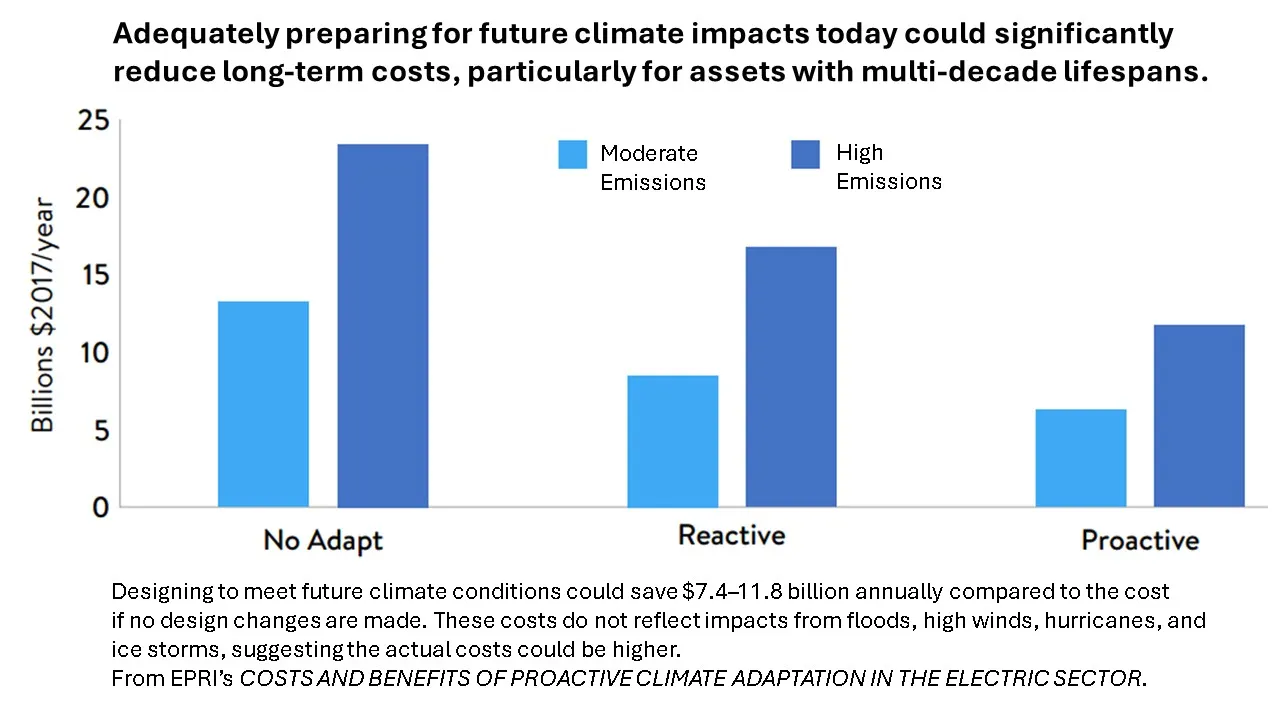

Permission granted by EPRI

Harder balancing decisions

Protecting customers with affordable rates may mean making imperfect choices, regulators and analysts said.

“There are always tradeoffs, and potential investments that are not made, but resources are limited,” RAP’s LeBel said. “The best and most expensive choice, like undergrounding lines, might not be the most judicious for utilities and regulators to make, but the regulator’s job is to take all the lessons learned and do better going forward.”

Worsening extreme weather events driven by the changing climate are making it challenging to do better, especially if a necessary decision is expensive, Electric Power Research Institute, or EPRI, Principal Technical Leader, Energy Systems and Climate Analysis, Andrea Staid acknowledged.

But “research shows how large the cost of inaction will be,” Staid said. Regulators need to remember that “utilities are already planning significant spending to meet customer demand, and investments to reduce climate risk and prepare climate resilience have benefits that massively outweigh the upfront costs,” she added.

Former Arkansas Public Service Commission Chair Ted Thomas, currently founder of Energize Strategies, agreed regulators need to restrain spending “to hold utilities accountable.” But “they must not eliminate innovative investments in technologies like advanced metering infrastructure, or AMI, that can lead to a higher quality system,” he added.

Finally, regulators need to carefully pace investments by understanding “what is necessary to have and what is nice to have,” Oregon Public Utility Commission Chair Letha Tawney said. Current planning allows regulators to “pace and prioritize based on what additional capabilities and what reliability impacts” utility proposals offer, she added.

“There is no perfect answer because stakeholders value different things,” but the planning process allows stakeholders to “fully analyze the proposed investments,” Tawney said. Then regulators “can decide how fast each investment can be made.”

Regulators are bringing new metrics, the potential for innovation and the challenge of pacing expenditures into real world modernization proceedings.

Permission granted by RI PUC

Real world balancing

In the real world, hard cold business facts matter, commissioners said.

A third-party audit of the DTE and Consumers Energy distribution systems by Liberty Consulting was invaluable, said Michigan Chair Scripps. The year-long audit produced multiple “specific recommendations for cost effective improvements,” and “we approved investment recovery mechanisms informed by the audit,” he added.

Another example of the growing emphasis on the business approach was the Massachusetts Department of Public Utilities June order authorizing spending for utility modernization plans. “Grid modernization and resiliency planning must ultimately become a part of each company’s standard business practices,” it said.

A landmark “business case proceeding” led to May’s Rhode Island Public Utility Commission authorization of Rhode Island Energy’s AMI deployment. The commission authorized recovery of utility capital expenditures — but with “conditions.”

The commission’s decision is frequently between “what the utility wants and what Rhode Island needs,” said RI PUC Commissioner Anthony, long an advocate of the business case approach. “The AMI proposal was approved because, despite a limited demonstration of need and value, there was a strong accountability,” she added.

“The first piece of the accountability framework was a hard budget cap on ratepayer costs of $154 million, which the company itself offered,” Anthony said. The company also committed to continue investing its own money, even beyond the cap, “until the advanced metering functions it promised are achieved,” she added.

In addition, the commission imposed penalties if the company does not meet “things core to its value case,” like improved outage notification and “moving customer data faster from the meter to the utility and back to the customer,” Anthony said.

“Modernization could create a more reliable and sustainable power system,” but “there is also the risk that customers are left to pay for a system that doesn’t deliver,” Anthony said. “The stakes are too high for regulators to take bets on the outcome,” but on the AMI deployment a good business case convinced the Rhode Island commission, she added.

“Rates will inevitably be higher because of the need to spend for distribution system modernization,” Newport Consulting’s De Martini said. “The question is how much higher.”

<!– –>