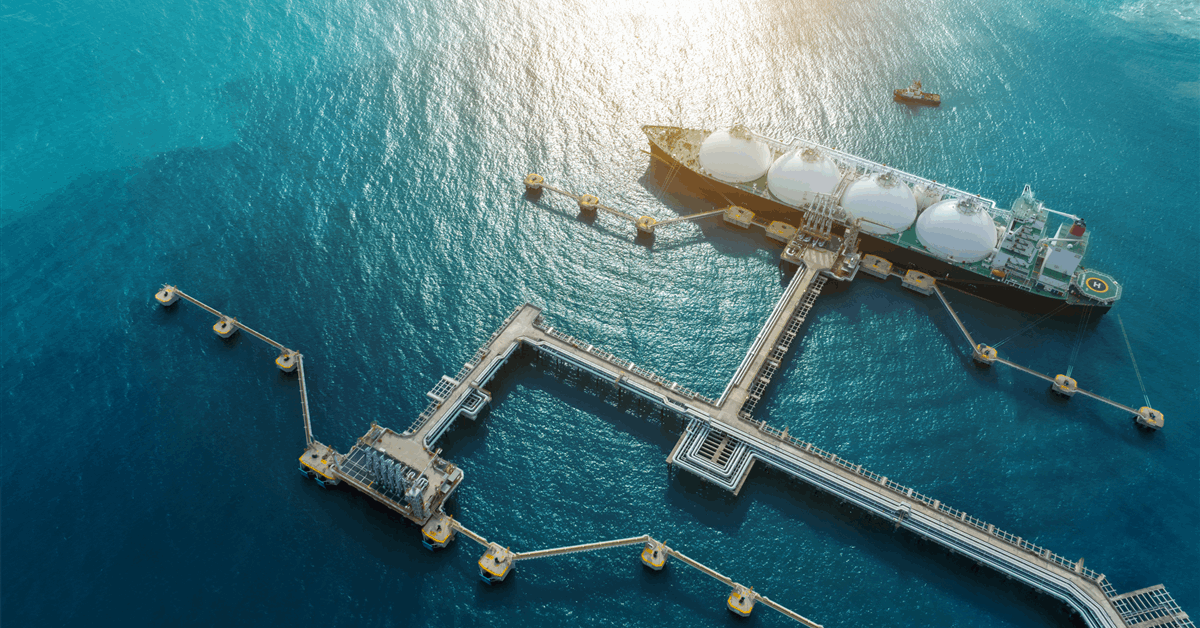

ADNOC Gas PLC has awarded three contracts totaling $2.1 billion for the feedstock infrastructure of the Ruwais LNG project in the United Arab Emirates.

The bulk of the awards at $1.24 billion, for an LNG pre-conditioning plant (LPP), went to a consortium between Engineering for the Petroleum and Process Industries (ENPPI) and Petroleum Projects and Technical Consultations Co., both Egyptian state-owned companies.

State-owned China Petroleum Pipeline Engineering Co. bagged a $514 million contract for transmission pipelines.

The remaining $335 million went to Petrofac Emirates LLC to develop compression facilities, ADNOC Gas said in a press release Thursday.

The facilities outlined in the three contracts cover the conditioning and delivery of natural gas to the liquefaction plant in Al Ruwais Industrial City on the Persian Gulf coast.

Expected to start operation 2028, Ruwais LNG is planned to have two trains with a combined capacity of 9.6 million metric tons per annum (MMtpa). It would more than double ADNOC Gas’ current LNG production capacity to over 15 MMtpa.

On June 12, 2024, Abu Dhabi National Oil Co. (ADNOC), the biggest shareholder in integrated gas processing company ADNOC Gas, announced a positive final investment decision and the award of a $5.5 billion engineering, procurement and construction contract for Ruwais LNG. The contract went to a joint venture by Dutch firm Technip Energies NV, Japan’s JGC Holdings Corp. and the UAE’s NMDC Energy.

In 2023 ADNOC awarded a contract for all-electric compression systems for Ruwais LNG to Baker Hughes Co. Ruwais LNG’s two trains will use the United States firm’s 75-megawatt BRUSH electric motor technology, Baker Hughes said in a press statement October 4, 2023. Ruwais LNG will be the first gas export facility in the Middle East and Africa to run on clean power, according to ADNOC.

On Wednesday, The Woodlands, Texas-based CB&I said it had won a “substantial” contract from the Technip Energies-led consortium to deliver two cryogenic tanks for Ruwais LNG.

CB&I will deliver two 180,000-cubic meter (6.36 million cubic feet) full containment concrete LNG tanks and carry out the associated civil, structural, mechanical and piping works. CB&I expects to start construction November 2025.

CB&I, a designer and builder of storage facilities, tanks and terminals, did not specify the contract value, but it defines a “substantial” contract as ranging from $250 million to $500 million.

Ruwais LNG counts towards a planned 2025–29 capex of $15 billion that ADNOC Gas announced November 11, 2024.

However, it said, “The capital expenditure for the LPP, compression facilities and transmission pipelines, does not form part of the costs previously outlined by ADNOC Gas for its intended acquisition of ADNOC’s majority stake in the Ruwais LNG project once the plant becomes operational in 2028”.

ADNOC Gas chief executive Fatema Al Nuaimi said about the feedstock infrastructure contracts, “We are investing in world-class infrastructure and innovative technologies as we expand our capacity in LNG liquefaction and strengthen our position as a global player”.

“The awards also underline our commitment to making strategic and targeted investments that enable the delivery of our most significant projects, allowing us to continue meeting our customers’ demands internationally”, Al Nuaimi added.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR