A 5.2 percent decline in coal-fired power generation in the Philippines in the first half of 2025 has put the Southeast Asian country on course for its first annual decline in coal power production in decades.

This would be due to the growth of renewable energy rather than an increase in liquefied natural gas (LNG) imports, the Institute for Energy Economics and Financial Analysis (IEEFA) said.

“Recent media coverage has asserted that growing LNG imports are responsible for coal’s decline, reciting oil and gas industry logic that Asia’s energy transition hinges on replacing one fossil fuel (coal) with another (LNG)”, the United States-based IEEFA said.

“However, these conclusions overlook basic trends in the Philippines’ energy market. Renewables have rapidly outpaced the growth of LNG, while gas-fired power generation remains below historical levels.

“Outages at existing coal facilities provide a better explanation for declining coal generation than the growth of LNG, which is significantly more expensive than renewables and other energy resources”.

Based on an analysis of government data, the IEEFA said the country did not add any new greenfield gas or LNG-fired generation capacity between 2017 and 2024.

“The most recent increase in the country’s gas capacity was in 2022, when several existing facilities were uprated”, the IEEFA said, citing data from the nation’s Department of Energy (DOE).

On the other hand the Philippines installed over one gigawatt (GW) of solar capacity in 2024 alone. “This growth outpaced all other asset classes last year and previous projections for solar deployment. Centralized government auctions, among other government policies, are driving project developments”, the IEEFA said.

Last month the DOE said it had awarded geothermal, hydropower and pumped storage capacities totaling about 6.68 GW. It also launched an auction offering over 10 GW of solar and wind, targeted for commercial operations 2026-29, and a separate auction for fixed-bottom offshore wind installations totaling 3.3 GW, targeted for start-up 2028-30.

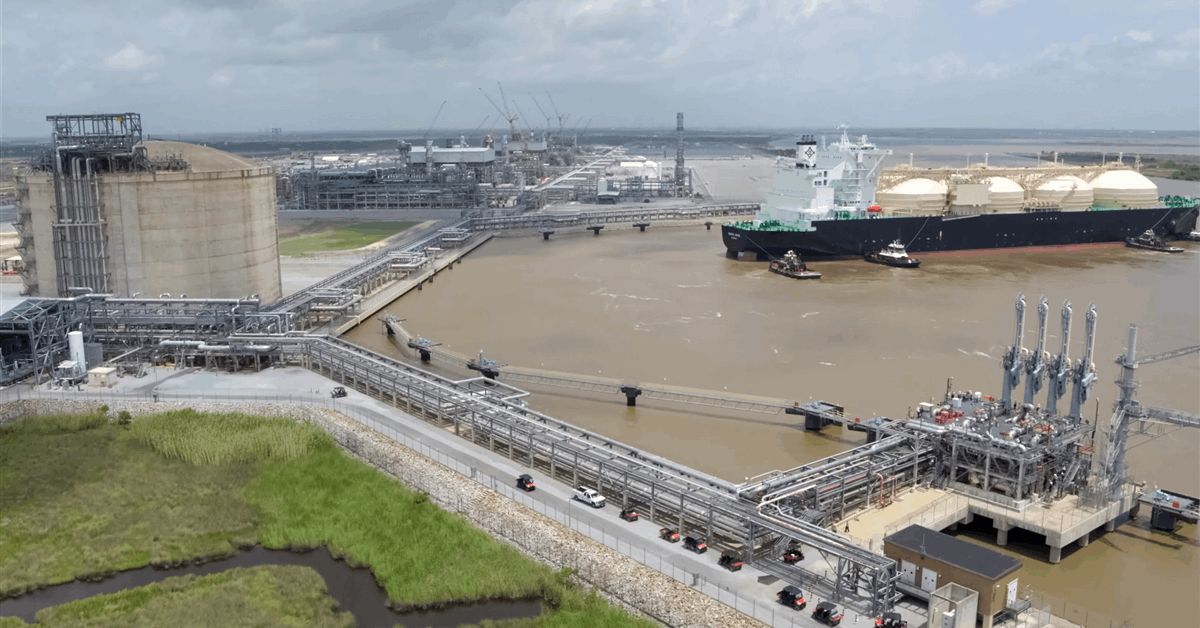

“In the Philippines’ liberalized electricity market, power projects win supply contracts with distribution utilities through auctions, called competitive selection processes (CSP). Utilities are legally required to supply power in the ‘least cost manner’, meaning power generators must compete on price”, the IEEFA said. “To date, only one greenfield LNG-fired power project has managed to win a CSP. Although that project is beginning operations this year, auctions present a key challenge for the rapid growth of future LNG projects.

“At the same time, coal capacity has continued to grow despite a moratorium on greenfield plants issued in 2020, due to exclusions for brownfield expansions and projects already underway.

“Moreover, claims that LNG was responsible for the drop in coal overlook that hydropower and solar generation increased more than gas generation in 1H2025 compared to the same period last year.

“While several technologies have helped compensate for the decline in coal generation, it is misleading to position LNG as the main driver”.

Gas Power Decline

Additionally gas generation remains below historical levels in the Philippines, the IEEFA said. “Despite an 8.3 percent rebound in 2024, natural gas generation remained less than in every year between 2007 and 2021”, it said. “Although natural gas rallied in 2024, coal also increased by nearly eight percent”.

“Natural gas for power declined rapidly in the Philippines between 2019 and 2023, due primarily to falling output from Malampaya, the country’s only gas-producing field”, the IEEFA added. “This drop occurred before LNG import terminals were online to augment supplies.

“Since two terminals started operating and LNG imports began in 2023, gas generation has started to recover, but not in a way that would effectively explain coal’s decline”.

Increased Coal Outages

“Along with the rise of hydropower and solar, coal plant outages provide another explanation” for the decline of coal generation in the Philippines in the January-June period, the IEEFA said.

In the first quarter, eight coal plants with a total capacity of 1.4 GW were offline for over 30 days, it said, citing data from the Philippine Electricity Market Corp.

“Outages at fossil fuel generators in the Philippines occur every year – mainly during hot, dry months – but the average coal plant capacity on outage in 1Q2025 was markedly higher than the same period last year.

“By contrast, natural gas capacity on outage was slightly lower in the first quarter”.

High Prices from LNG Power

The IEEFA also countered claims that LNG has become a more cost-competitive alternative to coal.

“LNG prices in Asia remain above historical averages”, it said. “Recent coal prices are nearly four times cheaper than LNG on an energy equivalent basis.

In the Philippines, “LNG imports have put upward pressure on generation prices from gas-fired power plants, which have recently risen to between PHP8-11 per kilowatt-hour”, the IEEFA said, using data from the country’s biggest power utility, Meralco.

“These prices are significantly higher than solar and coal generation rates, as well as purchases from the Wholesale Electricity Spot Market. They are also above Meralco’s overall average purchase price, meaning that LNG is keeping electricity prices high for Filipino consumers”.

Government Push for LNG

In January President Ferdinand Marcos Jr. signed legislation to establish a downstream gas industry in the Philippines by increasing the share of gas in the domestic energy mix and positioning the country as an LNG transshipment hub in the Asia-Pacific.

The new law insists it only promotes gas as a transition fuel and that it does not contradict existing policy for the shift to a lower-carbon future.

The Philippine Natural Gas Industry Development Act seeks to “develop natural gas as a reliable fuel for power plants capable of addressing the peaking, mid-merit, and baseload demand of the country to help achieve energy security, while progressively transitioning to renewable energy sources”, according to the official text.

The government shall also facilitate the development of “non-power end-uses of natural gas which include commercial, industrial, residential, and transport applications that promote fuel diversity”, states the law, codified as Republic Act 12120.

“In all cases, the State shall ensure the safe, secure, reliable, transparent, competitive, and environmentally responsible operation of the PDNGI [Philippine downstream natural gas industry] value chain, and ensure alignment with the State’s policy on transitioning to a low-carbon future, consistent with the sustainable development goals on increasing the share of renewable energy in the country’s energy mix”, the law says.

To contact the author, email [email protected]