Nuclear + Data Centers: A Convergence Trend

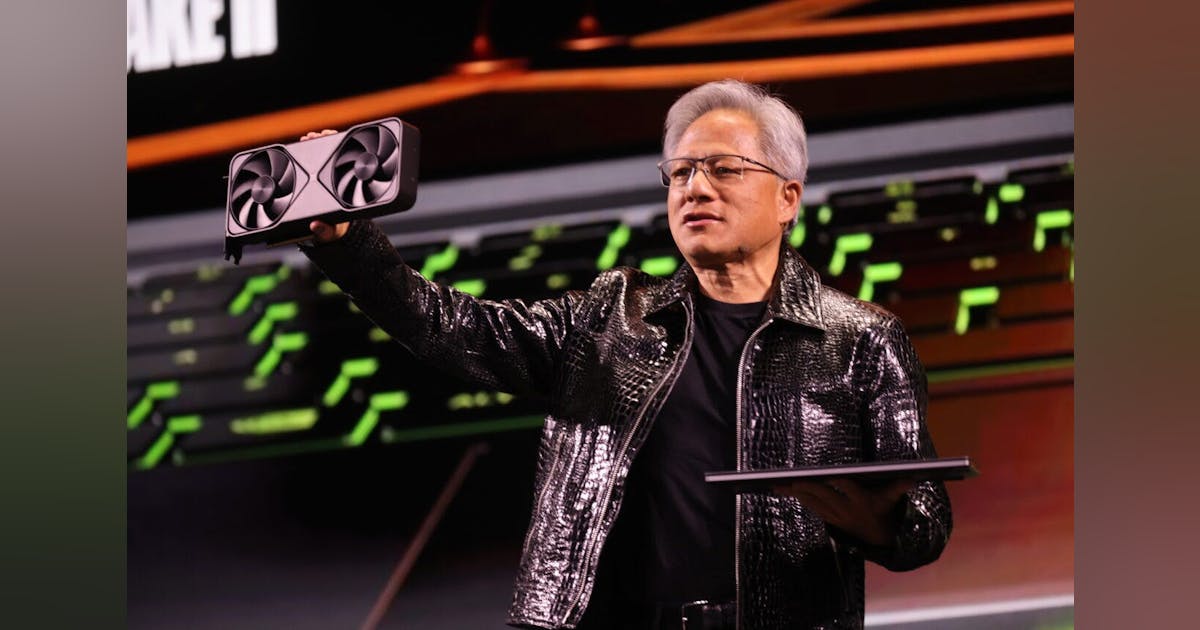

Aalo’s announcement adds to a growing list of nuclear startups that explicitly reference data centers as their first commercial market. Oklo has positioned its Aurora powerhouse as a plug-in solution for AI campuses, Kairos is developing fluoride salt-cooled reactors with potential colocation applications, and Last Energy is pitching its compact 20 MW units for industrial and IT workloads.

Hyperscalers are also signaling interest in firm, carbon-free nuclear. Google has backed advanced nuclear at TVA’s Clinch River, Microsoft signed a 20-year offtake deal with Helion for fusion, and Amazon has explored options for long-duration nuclear and hydrogen power. Each of these moves reflects the same reality: AI-scale power demand is colliding with clean energy commitments, and nuclear is increasingly viewed as a credible path forward.

Against this backdrop, Aalo’s XMR strategy — factory-built modules, simplified siting, and direct adjacency to compute campuses — positions it as part of a portfolio of experimental approaches. The next three years will be pivotal in showing whether these concepts can advance beyond demonstration to commercial deployment.

Regulatory Pathways and Challenges

The U.S. Department of Energy has accelerated advanced reactor testing at Idaho National Lab through its Reactor Pilot Program and NRIC initiatives. These test beds allow projects like Aalo-X, Oklo Aurora, and MARVEL to move quickly from design to hardware, bypassing some of the lengthy steps of traditional NRC licensing.

However, there remains a sharp distinction between DOE demonstration projects and true commercial operation. While the DOE can authorize on-site testing, selling power into the grid — or even into an adjacent commercial data center — still requires NRC approval. Industry observers note the tension between data center timetables, which measure deployments in months, and nuclear licensing cycles, which span years.

Aalo is betting that its modular design, coupled with DOE partnerships, can shrink the licensing gap. But for now, the central question remains: can nuclear speed up enough to match the urgency of AI power demand?

Economics of Modular Nuclear for AI Power

At the heart of Aalo’s pitch is the idea that modular manufacturing can bring nuclear closer to the cost, speed, and scalability that data center operators expect. Factory-built components, shipped in containerized form and assembled on-site, promise reduced construction risk, faster timelines, and a 90% reduction in building materials compared to traditional reactor containment.

The 50 MW Aalo Pod is designed as a “sweet spot” between microreactors (

The open question is price. Nuclear traditionally carries high upfront capital costs even when fuel costs are low. For hyperscalers, the benchmark is whether modular reactors can deliver electricity at or below the cost of firmed renewables or natural gas turbines. Until demonstration plants move into regular operation, economics will remain a critical uncertainty.

Data Center Implications of Behind-the-Meter Nuclear

If successful, Aalo’s model could reshape how data centers evaluate new sites. Historically, hyperscalers and colocation providers have clustered around strong transmission capacity, cheap land, and access to renewables. Aalo’s vision of colocating 50 MW pods next to compute campuses suggests a new blueprint: build where you can host a reactor.

Behind-the-meter nuclear would give operators control over carbon-free, always-available power while reducing dependence on congested regional grids. It would also insulate campuses from rising interconnection delays, which can stretch to five years or more in some U.S. regions.

If Aalo’s July 2027 target for its experimental data center proves viable, it could serve as a template for an “AI campus + reactor pod” model. Such designs could become attractive for remote or power-constrained geographies — provided regulators, communities, and investors are willing to buy in.

Industry Voices: Support and Skepticism

Reactions to nuclear colocation range from enthusiastic to cautious. Data center real estate experts at firms like JLL and CBRE note the appeal of unlocking stranded land with no grid connection but warn of the long timelines and public scrutiny that accompany any nuclear project.

Nuclear engineers highlight sodium-cooled fast reactors’ proven history in experimental settings but caution that scaling them for commercial use is uncharted territory. Advocates point to Aalo’s simplified design and modular construction as ways to overcome historical barriers, while skeptics stress that fuel supply, waste management, and emergency planning remain unresolved.

For policymakers and communities, nuclear power still carries cultural and political baggage. While hyperscalers are often eager to sign clean energy deals, convincing local communities to host reactors next to AI campuses may be the harder test.

The Big Picture: Toward 2030 AI Infrastructure

The timeline is tight. Aalo’s target of July 2026 for reactor criticality and July 2027 for a colocated data center aligns with a wave of other demonstrations — Oklo’s Aurora, the DoD’s Project Pele, and DOE’s MARVEL reactor among them. By 2028–2030, many forecasts suggest AI demand will exceed the availability of carbon-free power in multiple U.S. regions.

This creates a convergence: advanced nuclear startups will be moving from demonstration to commercialization at the same moment hyperscalers are scrambling for new sources of firm, clean electricity. Whether Aalo’s XMR pods and similar projects can scale fast enough will determine if nuclear becomes a mainstream option for AI campuses or remains a boutique solution.

The stakes are clear. It seems that the next five years will reveal whether nuclear’s long-promised renaissance finally intersects with the data center industry’s most urgent challenge.