Abu Dhabi’s main energy company will transfer stakes in some US assets to its new international investment firm, XRG PJSC, part of a push to create a $80 billion global venture.

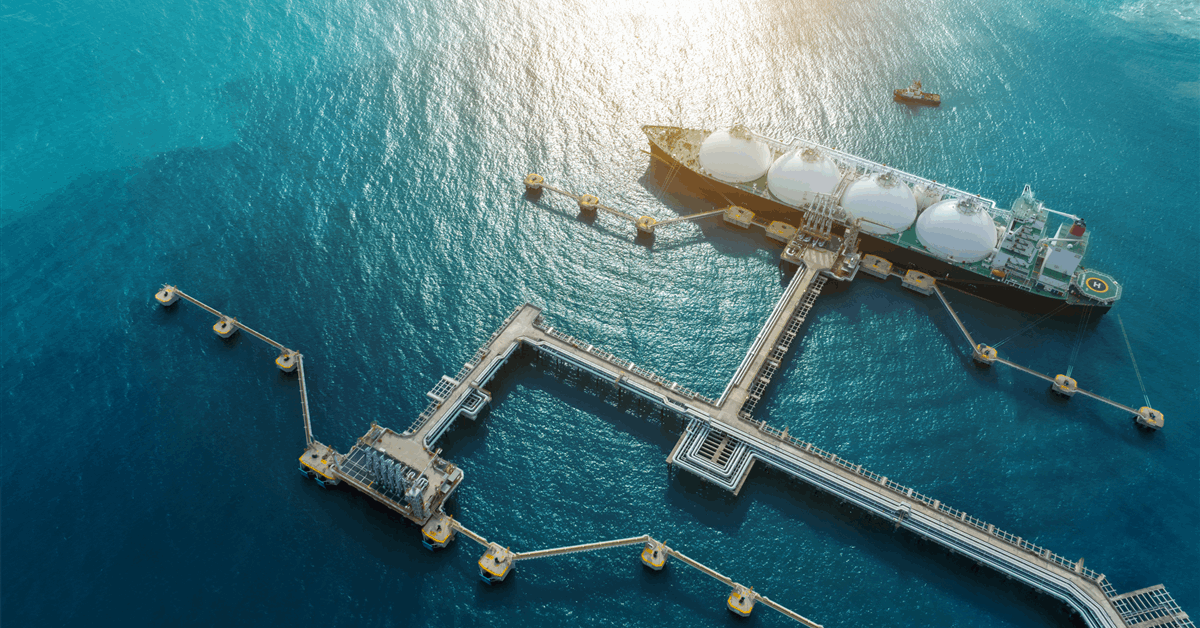

Abu Dhabi National Oil Co.’s holdings in a hydrogen venture with Exxon Mobil Corp. and NextDecade Corp.’s liquefied natural gas export project will move to XRG, according to Chief Executive Officer Sultan Al Jaber. XRG aims to invest in technologies that power the energy transition and the shift to advanced technologies, Al Jaber wrote in a column on the news website Semafor.

Adnoc in September agreed to take a 35% stake in Exxon’s proposed hydrogen project in Baytown, Texas, which is likely to be the world’s biggest once built. That was its second acquisition in the US after Adnoc in May agreed to buy a stake in NextDecade’s LNG project, also in Texas.

Adnoc announced its plan for XRG last year, saying the company will have an enterprise value of over $80 billion and will aim to more than double the value of its assets over the next decade. Adnoc plans to start the unit in the first quarter.

The UAE company has already said XRG will control Covestro AG following a roughly $13 billion deal to buy the German chemical producer. XRG will also hold Abu Dhabi’s share of a joint venture with BP Plc for gas projects in the Mediterranean region, including in Egypt.

The UAE is pursuing expansion in chemicals and gas to feed future energy demand and supply plastics for consumer products amid the energy transition. Through Adnoc, it is expanding its energy business beyond oil to focus on gas trading and chemical derivatives like plastics on expectation demand for these products will benefit from the energy transition.

Over the weekend, Adnoc said it was in talks with Abu Dhabi sovereign fund Mubadala Investment Co. about buying Nova Chemicals, which has two facilities in the US.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg