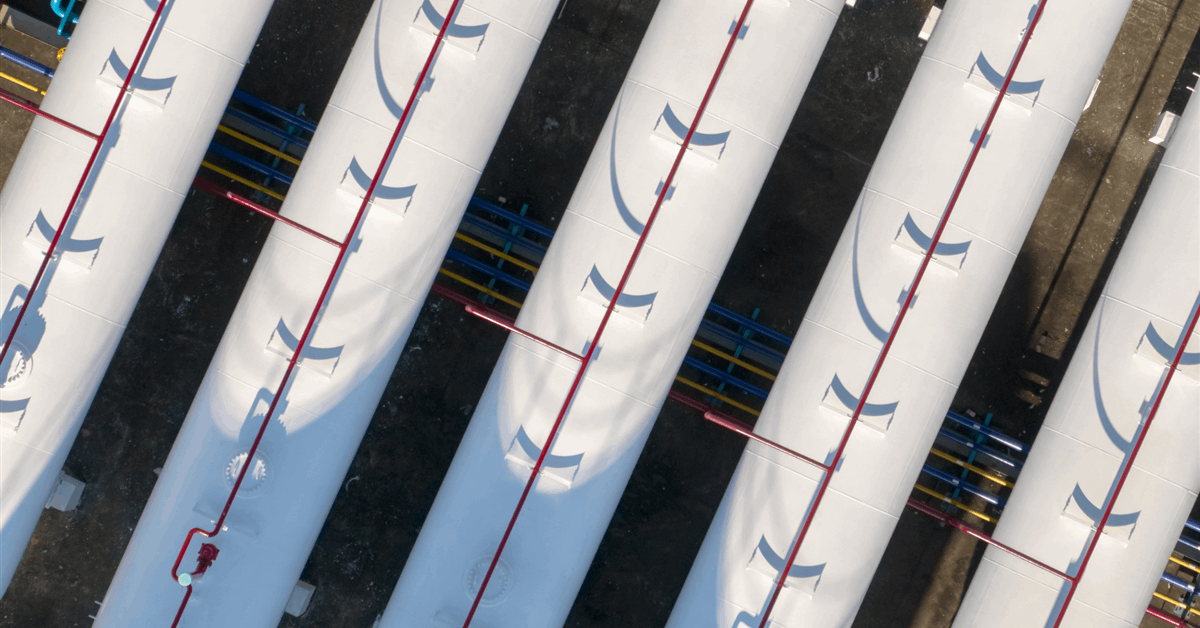

Global investment company XRG has set a goal of building a top-five integrated gas and liquefied natural gas (LNG) business with a capacity of 20-25 million metric tons per annum (MMtpa) by 2035.

Abu Dhabi National Oil Co. (ADNOC) launched the platform late last year to drive the United Arab Emirates’ expansion in the chemical, low-carbon energy and natural gas markets. XRG’s board has now approved a five-year plan (2025-30).

“In its first six months, XRG has established itself as a differentiated global energy investor with an enterprise value exceeding $80 billion”, XRG said in an online statement announcing the plan.

In the gas sector, XRG has already acquired stakes in different countries.

In May XRG said it had obtained a 38 percent stake in the Block I gas and condensate fields on Turkmenistan’s side of the Caspian Sea. Block I produces about 400 million cubic feet a day of natural gas, according to operator Petroliam Nasional Bhd.

“It offers significant long-term potential, with access to over 7 trillion cubic feet of natural gas resources and future opportunities for production capacity expansion”, Malaysia’s state-owned Petronas said then.

In March XRG said it had completed the purchase of Galp Energia SGPS SA’s 10 percent stake in the Area 4 concession in Mozambique’s Rovuma Basin.

“The Rovuma Basin, one of the largest gas discoveries in the past fifteen years, offers XRG access to pioneering LNG projects with a combined potential production capacity of more than 25 million tons per annum”, XRG said at the time. “This acquisition includes stakes in the operational Coral South Floating LNG (FLNG), the planned Coral North FLNG and Rovuma LNG’s onshore development projects”.

In December it said it had formed a joint venture with BP PLC to produce gas for Africa.

“Arcius Energy, initially to operate in Egypt, includes interests assigned by bp across two development concessions, as well as exploration agreements”, XRG said.

XRG said it has also carried over ADNOC’s investments in Rio Grande LNG in the United States and the Absheron gas field in Azerbaijan.

In the chemicals sector, the five-year plan aims to build a top-three player. “Subject to respective regulatory approvals, the proposed formation of Borouge Group International and the proposed acquisition of Covestro anchors an industry-leading portfolio across polyolefins, performance materials, and future specialty segments”, XRG said.

OMV AG and ADNOC signed an agreement in March to consolidate their polyolefin businesses, with ADNOC also agreeing to acquire NOVA Chemicals Corp. to be transferred to the new joint venture (JV). Under the agreement Borealis AG and Borouge PLC will merge to form Borouge Group International.

Austria’s state-backed integrated energy company OMV owns 75 percent of Vienna-based Borealis while ADNOC holds the remaining 25 percent. In Abu Dhabi-based Borouge, ADNOC owns 54 percent and Borealis 36 percent while the remaining 10 percent is on free float.

The new JV will serve as a platform for acquisitions by ADNOC and OMV in the polyolefins sector.

ADNOC and OMV expect to complete the Borealis-Borouge combination and the NOVA Chemicals acquisition in the first quarter of 2026.

ADNOC is also in the process of completing its takeover of German chemicals producer Covestro AG with a share acquisition offer of about EUR 11.7 billion. XRG said December 19, 2024, it had so far bought around 91.32 percent of Covestro’s outstanding shares, exceeding the acceptance threshold for the acquisition. The takeover is expected to conclude in the second half of 2025.

The five-year plan also eyes “select opportunities in carbon capture and storage and low-carbon fuels such as biofuels and low-carbon hydrogen that align with attractive return profiles”, XRG said.

Sultan Al Jaber, XRG executive chair and ADNOC chief executive, said of the plan, “As we enter a new era shaped by artificial intelligence, digital infrastructure, and industrial growth, energy systems must evolve in both scale and sophistication. XRG is investing in the energy systems of the future – more integrated, more resilient, and responsive to global demand”.

“With the Board’s endorsement of our five-year business plan, we are scaling platforms in gas, chemicals, and energy solutions to drive long-term value and ensure energy remains a catalyst for sustainable growth and development”, Al Jaber added.

To contact the author, email [email protected]