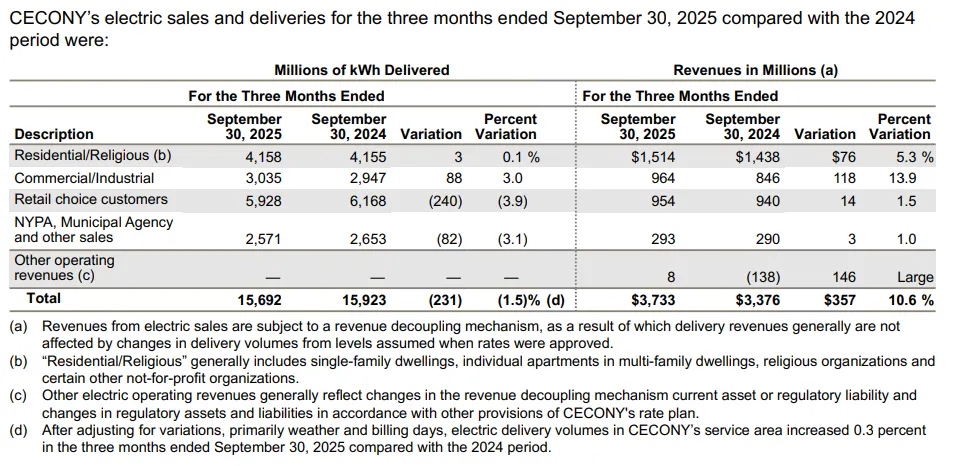

-1.5%

Consolidated Edison Co. of New York sold 15,692 million kWh in the third quarter of 2025, down slightly from 15,923 million kWh in the same period of 2024. After adjusting for weather and other variations, the utility said delivery volumes increased 0.3%.

+10.6%

CECONY’s sales of electricity reached $3.73 billion in the third quarter of 2025, up from $3.38 billion in the same period last year.

$688 million

Utility holding company Consolidated Edison saw its third quarter net income reach $688 million compared with $588 million in the same period of 2024.

Rate case drives revenues

Consolidated Edison Co. of New York, the electric utility serving New York City, warned customers heading into the summer that their bills would be going up. Now those sales are showing up on the utility parent company’s bottom line.

Parent company Consolidated Edison also owns Orange and Rockland Utilities and Rockland Electric Co., as well as transmission and clean energy development businesses.

“Third quarter 2025 results reflect [an] increase in electric rate base at CECONY,” the full name of the New York City distribution utility, the company said in its third quarter earnings presentation. Residential sales were flat but third quarter electric sale revenues at CECONY rose more than 5%, year over year. Commercial sales rose 3% and revenues jumped 13.9%.

And the utility has proposed spending almost $17 billion in New York City and Westchester County to build out its gas and electric systems from 2026 to 2028. Electric system spending is about $12 billion of the total.

If regulators approve, the spending plan “will fund critical infrastructure investments while keeping affordability and reliability front and center,” Chairman and CEO Tim Cawley said in a statement. “At the same time, the settlement advances our long-term operational and financial objectives as we progress New York’s clean energy transition.”

New York state’s climate law requires the state to transition to a zero-emission electric grid by 2040.

“We plan to complete construction of 14 new substations, along with substation upgrades, transmission lines and storm resiliency measures by 2030, continuing to execute our strategy of making robust investments” as demand grows, Consolidated Edison Senior Vice President and Chief Financial Officer Kirk Andrews said in a statement.

Last month, the state’s grid operator warned reliability margins in New York City will be dangerously thin beginning in 2026, making the grid more vulnerable to failures.

Consolidated Edison provided a regulatory update in its earnings presentation, noting that the reliability need is “primarily driven by forecasted increases in peak demand, deactivation notices of existing generation … and uncertainty as to whether or not certain planned projects are completed and energized within the forecasted time period.”

“The NYISO is expected to issue a solicitation for both market-based and regulated solutions. CECONY, as the Responsible Transmission Owner, would propose a regulated backstop solution,” the company said.