Join our daily and weekly newsletters for the latest updates and exclusive content on industry-leading AI coverage. Learn More

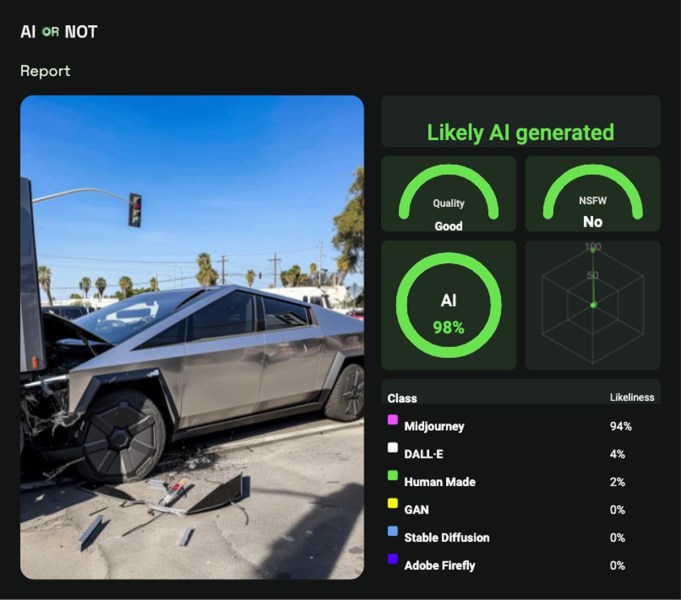

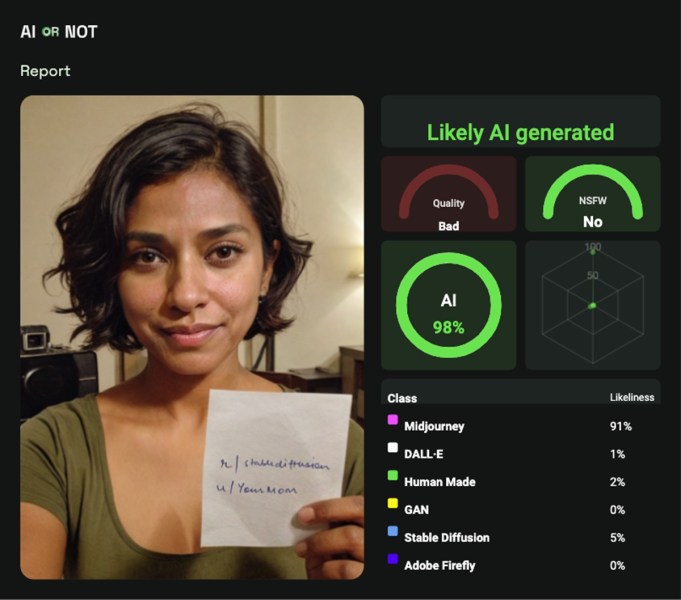

AI or Not, a widely covered AI fraud detection platform, has raised $5 million in a seed funding round to accelerate its use of “AI to detect AI” in images, audio video and deepfakes to prevent fraud and misinformation.

Foundation Capital led the round, with participation from GTMFund, Plug and Play, and strategic angel investors.

The company noted 85% of corporate finance professionals now view AI scams as an “existential” threat and more than half of them have already become a target of deepfake technology.

In the next two years, generative AI scams could be responsible for over $40 billion of losses in U.S. alone. It is this growing threat that fueled AI or Not’s growth over the past year, serving over 250,000 users to date, with the new injection of funding used to create more sophisticated ways of detecting misinformation online and ensure their tools remain ahead of evolving threats.

“In countless ways, we rely on our ability to see and hear to verify authenticity. With the advent of generative AI models, now we can no longer be so sure,” said Zach Noorani, partner at Foundation Capital, in a statement. “AI or Not’s unique approach to AI detection solves this emerging problem. We’re excited to support their mission of protecting people, companies, governments, and assets broadly from the risks posed by generative AI.”

AI or Not’s platform uses proprietary algorithms to identify and verify authenticity in content, ranging from AI-generated deepfakes impersonating female politicians, deepfake voices used to impersonate seniors to AI-generated music already present on major streaming platforms.

As the recent backlash against companies like Meta highlights, public demand for authenticity and transparency in digital content is surging. With its innovative tools, AI or Not is uniquely positioned to address these challenges, helping users and enterprises navigate the complexities of the AI era while safeguarding trust in the digital world.

“Generative AI has unlocked incredible potential, but it has also opened the door to harmful misuse that affects everyone from vulnerable individuals to global enterprises,” said Anatoly Kvitnisky, CEO of AI or Not, in a statement. “This funding allows us to continue our mission of creating a safer digital world by giving users the ability to detect and stop AI-driven fraud and misinformation before it causes harm.”

AI or Not is on a mission to protect individuals and organizations from the risks of generative AI misuse. The platform provides advanced AI-powered tools to detect deepfakes, fraud, and misinformation in real-time, ensuring authenticity in an increasingly AI-driven world. The company has seven people.

Daily insights on business use cases with VB Daily

If you want to impress your boss, VB Daily has you covered. We give you the inside scoop on what companies are doing with generative AI, from regulatory shifts to practical deployments, so you can share insights for maximum ROI.

Read our Privacy Policy

Thanks for subscribing. Check out more VB newsletters here.

An error occured.