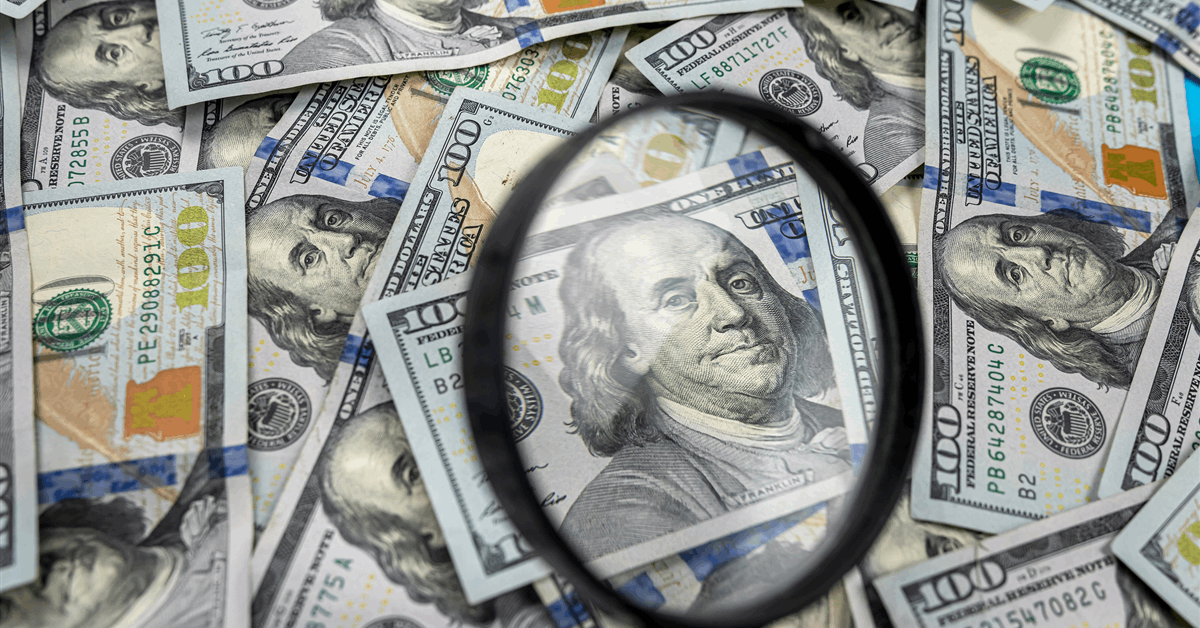

In a report sent to Rigzone by Standard Chartered Bank Commodities Research Head Paul Horsnell late Tuesday, analysts at the bank, including Horsnell, noted that, in their view, the key price determinant for crude oil over the past week was the U.S. tariff announcement.

“The downwards vortex set in play by the announcement took Brent prices lower by more than $12 per barrel over just four trading days from the 2 April intra-day high ($74.95 per barrel) to the 7 April intra-day low of $62.51 per barrel,” the analysts said in the report.

“Brent 30-trading day realized annualized volatility rose by 15.2 percentage points week on week to 35.7 percent at settlement on 7 April, with 10-trading day volatility rising 34 percentage points to 47.3 percent over the same period,” they added.

“In all, we saw a sharp fall at the front of the curve accompanied by large trading ranges on the way down,” they continued.

The Standard Chartered Bank analysts highlighted in the report that they have been asked by clients whether the scale of the fall was justified. They noted in the report that, in their view, “given market positioning and normal market dynamics, the fall was fully justified and could have gone significantly further.”

“The U.S. tariff announcement was a severe shock to a market that was predominantly of the view that tariff rates would be limited, well-thought out, likely delayed and rapidly negotiated away, and would still lie within the ambit of the normal staid range of international trade diplomacy,” they added.

“What was announced did not conform with the dominant oil market consensus view. Instead, the market immediately started to price in a significant reduction in expectations of global GDP, with U.S. recessionary risk in particular marked sharply higher,” they continued.

The analysts stated in the report that oil markets are particularly sensitive to sudden discounting of global GDP expectations. They pointed out that this is “a theme that showed itself strongly from the oil price watersheds in 2008 and 2020 and which has now re-emerged”.

“After the initial push lower due to the sudden shift in GDP growth expectations, a series of other factors accelerated the decline,” the Standard Chartered Bank analysts said in the report.

“A general risk-off environment led to positions being reduced by money-managers in particular, who had added 172 million barrels to their crude oil longs in the three weeks before the tariff announcement, including 66 million barrels in the week prior to the announcement,” they added.

The analysts noted in the report that they think almost all of the new long positions were closed out very rapidly.

“A further acceleration in the decline came when prices fell into the zone where potential gamma effects are at their greatest,” they said.

“We showed this zone in an earlier report … noting that the market had survived some gamma effects in early March when the 2025 WTI futures strip fell below $65 per barrel and started biting into the distribution of producer put options,” they added.

“This time there was to be no reprieve, with the 2025 WTI strip falling below $60 per barrel; the sudden price fall, together with the sharp increase in volatility, meant that banks had to sell large volumes of crude futures in order to manage the positions they held as a result of providing hedges to producers,” they continued.

“The gamma effects become a positive when prices rise and volatility subsides, but they proved a highly significant depressive factor in a short time frame during the move following the U.S. tariff announcement,” they went on to state.

The Standard Chartered Bank analysts also noted in the report that the latest positioning data shows a further drift towards long crude oil positions but added that the next data is likely to be very different.

“The latest positioning data relates to 1 April, the day before the announcement of new U.S. tariffs; next week’s data is likely to look radically different after the heavy net selling of recent days,” the analysts said.

“The 1 April data is the last snapshot of a set of relatively positive oil market dynamics that would soon be swept away, but it is notable that they showed a shift to greater positivity from money managers on crude oil,” the analysts added.

“This was particularly evident in Brent, with our ICE Brent money-manager positioning index advancing 29.3 week on week to +71.1, which is the most positive reading since May 2018,” they continued.

The analysts went on to state in the report that the overall crude oil index moved into positive territory, “gaining 20.0 week on week to +12.2”, and pointed out that “for the first time since April 2024, crude oil moved to the top of the ranking of money-manager preferences across energy contracts”.

“This general move to a more balanced fund view of crude oil was described in an earlier report … however, the basis for that reappraisal has since been removed by changes in U.S. tariff policy and in OPEC+ policy,” the analysts added in the report.

In a research note sent to Rigzone by the JPM Commodities Research team late Monday, J.P. Morgan said the estimated value of open interest across energy markets “declined by -$43.5 billion week on week (seven percent week on week), despite contract-based inflows, as crude oil prices declined by over -12 percent week on week”.

“Contract-based inflows reached~$11.6 billion week on week, largely into crude markets ($13 billion week on week) while outflows departed natural gas markets (-$2.3 billion week on week),” it added.

“Our oil strategists flag that a potential trade war could reduce 2025 U.S. and global GDP by 0.5 percent-pt, lowering global oil demand by 250,000 barrels per day,” it continued.

Rigzone has contacted the White House for comment on Standard Chartered Bank’s report and the JPM Commodities Research team note. Rigzone has also contacted OPEC for comment on the Standard Chartered Bank report. At the time of writing, the White House and OPEC have not responded to Rigzone.

Standard Chartered Bank’s report showed that the company is forecasting that the ICE Brent nearby future crude oil price will average $77 per barrel in 2025 and $85 per barrel in 2026. The company is projecting that the NYMEX WTI basis nearby future crude oil price will average $75 per barrel this year and $82 per barrel next year, the report outlined.

A research note sent to Rigzone by the JPM Commodities Research team on Friday showed that J.P. Morgan expected the Brent crude price to average $73 per barrel in 2025 and $61 per barrel in 2026 and the WTI crude price to average $69 per barrel in 2025 and $57 per barrel in 2026.

To contact the author, email [email protected]