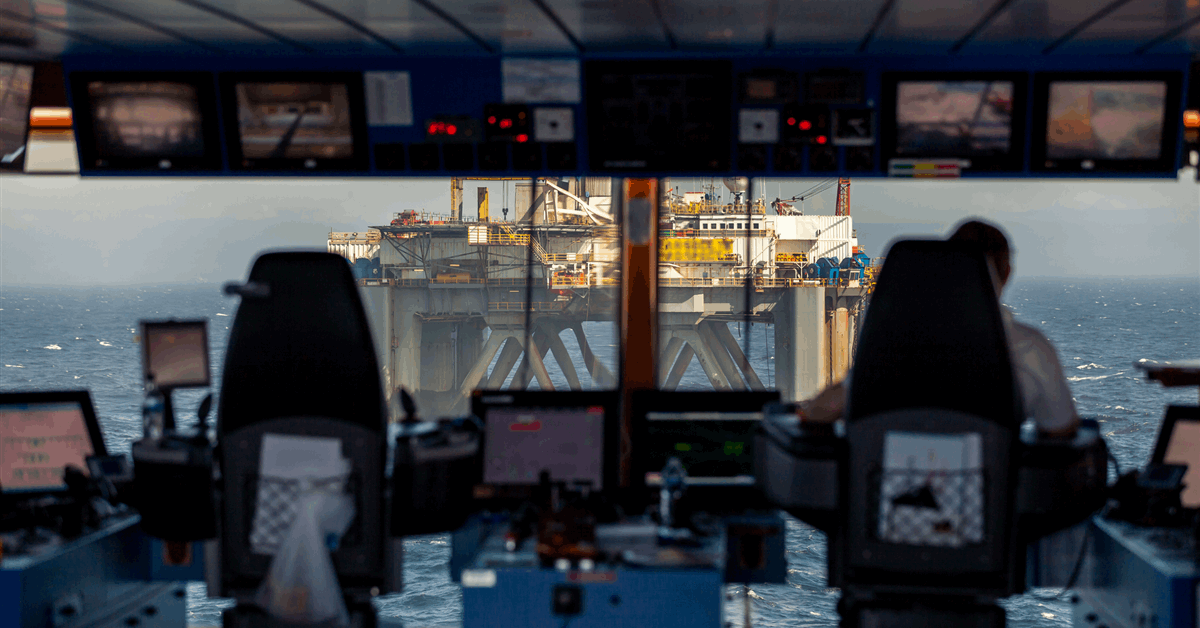

Crude oil’s strong start to the year was reinforced on January 10 with the announcement of the latest, and most extensive yet, round of U.S. sanctions on Russia.

That’s what analysts at Standard Chartered Bank, including the company’s commodities research head Paul Horsnell, said in a report sent to Rigzone by Horsnell this week, adding that the new restrictions “roughly triple the number of directly sanctioned Russian crude oil tankers, enough to affect around 900,000 barrels per day”.

“We do not expect Russia to be able to maintain the full extent of the flow, even with an increase in the use of shadow fleet tankers and ship-to-ship transfers, with perhaps an average 500,000 barrels per day of displacements over the next six months,” the Standard Chartered Bank analysts added in the report.

“The global market had already tightened over the past three months, and the dislocation of Russian exports adds a further layer of prompt demand,” they went on to state.

In a market analysis sent to Rigzone on Tuesday, Maria Agustina Patti, Financial Markets Strategist Consultant to Exness, said the U.S. sanctions “are expected to reduce Russian oil exports, potentially cutting up to 700,000 barrels per day from global supply”.

“However, actual disruptions might be smaller, as Russia and its key buyers explore alternative shipping arrangements,” Patti added in the analysis.

A research note sent to Rigzone late Tuesday by the JPM Commodities Research team said the estimated value of open interest across energy markets “increased by four percent week on week ($29 billion) to $668 billion”.

“The increase was predominantly driven by crude oil and petroleum products which experienced healthy inflows of $12 billion during the week across all trader types,” the note added.

“This was further supported by strong price action across WTI/Brent crude oil markets which rallied by four percent week on week following the announcement that the U.S. will further tighten sanctions on Russian oil industry,” it continued.

The note went on to highlight that J.P. Morgan’s oil strategists “have analyzed the announced sanctions in detail, arguing that it’s the enforcement that matters”.

The note pointed out that the estimated value of open interest across natural gas markets increased by $3 billion week on week.

“Our gas strategists highlight that in the U.S., colder revisions to the January weather forecast … or a cold February could solidify the need for even higher prices for summer 2025 relative to the current forward curve,” the note stated.

In a release posted on the U.S. Department of the Treasury’s website on January 10, the department said it took “sweeping action to fulfill the G7 commitment to reduce Russian revenues from energy”.

In that release, Secretary of the Treasury Janet L. Yellen said, “this action builds on, and strengthens, our focus since the beginning of the war on disrupting the Kremlin’s energy revenues, including through the G7+ price cap launched in 2022”.

“With today’s actions, we are ratcheting up the sanctions risk associated with Russia’s oil trade, including shipping and financial facilitation in support of Russia’s oil exports,” Yellen continued.

Rigzone has contacted the Press Service and Information Department of the Russian Government and the Ministry of Energy of the Russian Federation for comment on the Standard Chartered Bank report, Patti’s market analysis, the Department of the Treasury release, and the U.S. sanctions in general.

Rigzone has also contacted the Press Service and Information Department of the Russian Government, the Ministry of Energy of the Russian Federation, and the White House for comment on the research note sent to Rigzone by the JPM Commodities Research team.

At the time of writing, the Press Service and Information Department of the Russian Government, the Ministry of Energy of the Russian Federation, and the White House have not yet responded to Rigzone.

To contact the author, email [email protected]