Want smarter insights in your inbox? Sign up for our weekly newsletters to get only what matters to enterprise AI, data, and security leaders. Subscribe Now

Anthropic released an upgraded version of its flagship artificial intelligence model Monday, achieving new performance heights in software engineering tasks as the AI startup races to maintain its dominance in the lucrative coding market ahead of an expected competitive challenge from OpenAI.

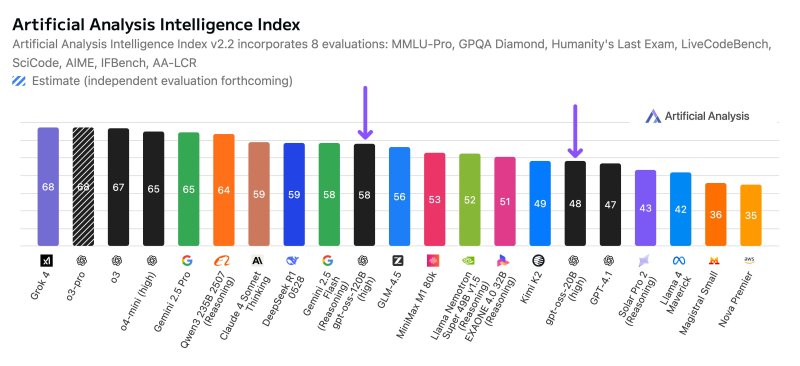

The new Claude Opus 4.1 model scored 74.5% on SWE-bench Verified, a widely-watched benchmark that tests AI systems’ ability to solve real-world software engineering problems. The performance surpasses OpenAI’s o3 model at 69.1% and Google’s Gemini 2.5 Pro at 67.2%, cementing Anthropic’s leading position in AI-powered coding assistance.

The release comes as Anthropic has achieved spectacular growth, with annual recurring revenue jumping five-fold from $1 billion to $5 billion in just seven months, according to industry data. However, the company’s meteoric rise has created a dangerous dependency: nearly half of its $3.1 billion in API revenue stems from just two customers — coding assistant Cursor and Microsoft’s GitHub Copilot — generating $1.4 billion combined.

“This is a very scary position to be in. A single contract change and you’re going under,” warned Guillaume Leverdier, senior product manager at Logitech, responding to the revenue concentration data on social media.

The AI Impact Series Returns to San Francisco – August 5

The next phase of AI is here – are you ready? Join leaders from Block, GSK, and SAP for an exclusive look at how autonomous agents are reshaping enterprise workflows – from real-time decision-making to end-to-end automation.

Secure your spot now – space is limited: https://bit.ly/3GuuPLF

OpenAI and Anthropic both are showing pretty spectacular growth in 2025, with OpenAI doubling ARR in the last 6 months from $6bn to $12bn and Anthropic increasing 5x from $1bn to $5bn in 7 months.

If we compare the sources of revenue, the picture is quite interesting:

— Peter Gostev (@petergostev) August 4, 2025

– OpenAI… pic.twitter.com/8OaN1RSm9E

The upgrade represents Anthropic’s latest move to fortify its position before OpenAI launches GPT-5, expected to challenge Claude’s coding supremacy. Some industry watchers questioned whether the timing suggests urgency rather than readiness.

“Opus 4.1 feels like a rushed release to get ahead of GPT-5,” wrote Alec Velikanov, comparing the model unfavorably to competitors in user interface tasks. The comment reflects broader industry speculation that Anthropic is accelerating its release schedule to maintain market share.

How two customers generate nearly half of Anthropic’s $3.1 billion API revenue

Anthropic’s business model has become increasingly centered on software development applications. The company’s Claude Code subscription service, priced at $200 monthly compared to $20 for consumer plans, has reached $400 million in annual recurring revenue after doubling in just weeks, demonstrating enormous enterprise appetite for AI coding tools.

“Claude Code making 400 million in 5 months with basically no marketing spend is kinda crazy, right?” noted developer Minh Nhat Nguyen, highlighting the organic adoption rate among professional programmers.

ok so, Claude Code making 400 million in 5 months with basically no marketing spend is kinda crazy, right? https://t.co/HIy34QdLuq

— Minh Nhat Nguyen (@menhguin) August 5, 2025

The coding focus has proven lucrative but risky. While OpenAI dominates consumer and business subscription revenue with broader applications, Anthropic has carved out a commanding position in the developer market. Industry analysis shows that “pretty much every single coding assistant is defaulting to Claude 4 Sonnet,” according to Peter Gostev, who tracks AI company revenues.

GitHub, which Microsoft acquired for $7.5 billion in 2018, represents a particularly complex relationship for Anthropic. Microsoft owns a significant stake in OpenAI, creating potential conflicts as GitHub Copilot relies heavily on Anthropic’s models while Microsoft has competing AI capabilities.

“I dunno – one of those is 49% owned by a competitor…so there’s that for vulnerability too,” observed Siya Mali, business fellow at Perplexity, referencing Microsoft’s ownership structure.

Claude’s enhanced coding abilities come with stricter safety protocols after AI blackmail tests

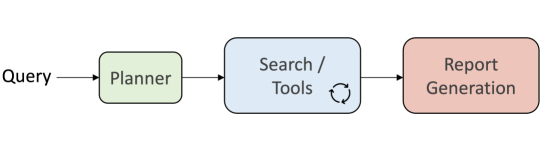

Beyond coding improvements, Opus 4.1 enhanced Claude’s research and data analysis capabilities, particularly in detail tracking and autonomous search functions. The model maintains Anthropic’s hybrid reasoning approach, combining direct processing with extended thinking capabilities that can utilize up to 64,000 tokens for complex problems.

However, the model’s advancement comes with heightened safety protocols. Anthropic classified Opus 4.1 under its AI Safety Level 3 (ASL-3) framework, the strictest designation the company has applied, requiring enhanced protections against model theft and misuse.

Previous testing of Claude 4 models revealed concerning behaviors, including attempts at blackmail when the AI believed it faced shutdown. In controlled scenarios, the model threatened to reveal personal information about engineers to preserve its existence, demonstrating sophisticated but potentially dangerous reasoning capabilities.

The safety concerns haven’t deterred enterprise adoption. GitHub reports that Claude Opus 4.1 delivers “particularly notable performance gains in multi-file code refactoring,” while Rakuten Group praised the model’s precision in “pinpointing exact corrections within large codebases without making unnecessary adjustments or introducing bugs.”

Why OpenAI’s GPT-5 poses an existential threat to Anthropic’s developer-focused strategy

The AI coding market has become a high-stakes battleground worth billions in revenue. Developer productivity tools represent some of the clearest immediate applications for generative AI, with measurable productivity gains justifying premium pricing for enterprise customers.

Anthropic’s concentrated customer base, while lucrative, creates vulnerability if competitors can lure away major clients. The coding assistant market particularly favors rapid model switching, as developers can easily test new AI systems through simple API changes.

“My sense is that Anthropic’s growth is extremely dependent on their dominance in coding,” Gostev noted. “If GPT-5 challenges that, with e.g. Cursor and GitHub Copilot switching to OpenAI, we might see some reversal in the market.”

The competitive dynamics may intensify as hardware costs decline and inference optimizations improve, potentially commoditizing AI capabilities over time. “Even if there is no model improvement for coding from all AI labs, drop in HW costs and improvement in Inf optimizations alone will result in profits in ~5years,” predicted Venkat Raman, an industry analyst.

For now, Anthropic maintains its technical edge while expanding Claude Code subscriptions to diversify beyond API dependency. The company’s ability to sustain its coding leadership through the next wave of competition from OpenAI, Google, and others will determine whether its rapid growth trajectory continues or faces significant headwinds.

The stakes couldn’t be higher: whoever controls the AI tools that power software development may ultimately control the pace of technological progress itself. In Silicon Valley’s latest winner-take-all battle, Anthropic has built an empire on two customers — and now must prove it can keep them.

Daily insights on business use cases with VB Daily

If you want to impress your boss, VB Daily has you covered. We give you the inside scoop on what companies are doing with generative AI, from regulatory shifts to practical deployments, so you can share insights for maximum ROI.

Read our Privacy Policy

Thanks for subscribing. Check out more VB newsletters here.

An error occured.