Saudi Arabian Oil Co. (Aramco) on Thursday announced agreements and memorandums of understanding (MOUs) with United States companies spanning its operations from refining and liquefied natural gas (LNG) to artificial intelligence.

The 34 deals have a potential value of about $90 billion, the state-owned oil giant said in an online statement. Earlier the White House announced $600 billion in committed investments from Saudi companies and a $142 billion agreement for U.S. arms sales to the kingdom – signed during President Donald Trump’s visit.

“Our US-related activities have evolved over the decades, and now include multi-disciplinary R&D [research and development], the Motiva refinery in Port Arthur, start-up investments, potential collaborations in LNG, and ongoing procurement”, Aramco president and chief executive Amin H. Nasser said.

“As Aramco pursues an ambitious value-driven growth strategy, we believe that aligning with world-class partners supports further development of our operations, strategic diversification of our portfolio, industrial innovation, and ongoing capability development within the Kingdom”.

During the dealmaking round, Aramco finalized an agreement to buy 1.2 million metric tons per annum (MMtpa) of LNG for 20 years from the fourth train of the under-construction Rio Grande LNG project in Brownsville, Texas. Owner NextDecade Corp. is seeking purchase commitments to be able to make an FID (final investment decision) on trains 4 and 5. NextDecade has so far approved three trains, which comprise phase 1 – out of eight planned for the project.

Aramco also progressed a heads of agreement with Sempra Infrastructure on Port Arthur LNG 2 into an MOU. Aramco plans to purchase 5 MMtpa for 20 years from the expansion project, which has yet to reach an FID. The MOU also provides for Aramco’s potential acquisition of a 25 percent interest.

A non-binding collaboration agreement between Aramco and Australia’s Woodside Energy Group Ltd. that was announced earlier on Wednesday, involving the Louisiana LNG project, was also part of the deals. Aramco plans to place an offtake and acquire a stake in the Gulf Coast project, whose phase 1 recently reached a final investment decision for a capacity of 16.5 MMtpa.

In Saudi Arabia, Exxon Mobil Corp. and Aramco inked an MOU to evaluate a “significant upgrade” of their SAMREF refinery, which processes over 400.000 barrels a day of Arabian light crude, into an integrated petrochemical complex.

Aramco also signed an MOU with its U.S.-based subsidiary Motiva Enterprises LLC for an aromatics project in Port Arthur, and another MOU with Honeywell International Inc. “related to technology licensing for an aromatics project”, Aramco said.

With Afton Chemical, Aramco signed MOUs “related to development and supply of chemical fuel additives in pipelines and retail fuel offerings”, it said.

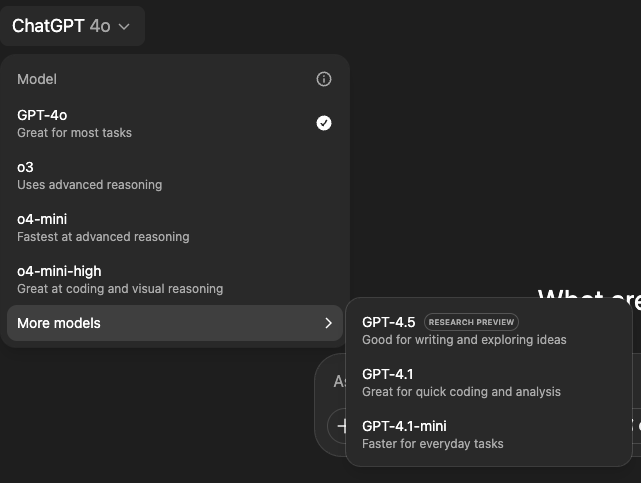

On technology and innovation, Aramco signed an MOU with NVIDIA Corp. on “developing advanced Industrial AI computing infrastructure, establishing an AI Hub and AI Enterprise platforms, an Engineering and Robotics Center of Excellence, training and upskilling, and collaborating with NVIDIA’s startup ecosystem”.

A non-binding framework agreement has been signed with Amazon.com Inc. on digital transformation and lower-carbon initiatives.

Another MOU with Qualcomm “aims to explore entry into a strategic collaboration that will focus on key digital transformation use cases, leveraging Aramco Digital’s 450 MHz 5G industrial network to connect intelligent edge devices with on-device AI capabilities, including smartphones, rugged industrial devices, robots, drones, cameras, sensors, and other IoT [Internet of Things] devices”.

Aramco also signed MOUs to extend existing relationships with suppliers Air Products, Baker Hughes, Emerson, Flowserve, GE Vernova, Halliburton, Helmerich & Payne, Honeywell, KBR, McDermott, Nabors, NESR, NOV, SLB, Weatherford and Valaris. “These suppliers provide high-standard materials and professional services that help support Aramco’s projects and operations”, Aramco said.

On finance, Aramco signed agreements “for short-term cash investments through a unified investment fund, the ‘Fund of One,’ with BlackRock, Goldman Sachs, Morgan Stanley, and PIMCO”.

Aramco also signed wisayah asset management agreements with PIMCO, State Steel Corp. and Wellington.

Additionally Aramco signed an MOU with Guardian Glass to establish specialty glass manufacturing for architectural applications in Saudi Arabia.

To contact the author, email [email protected]