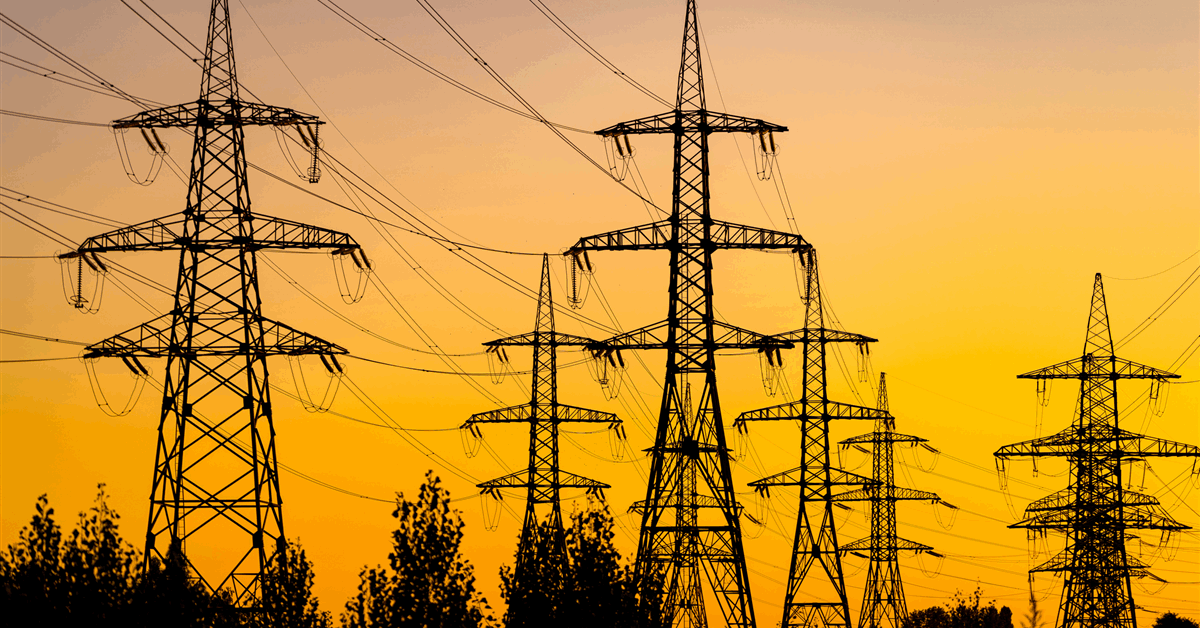

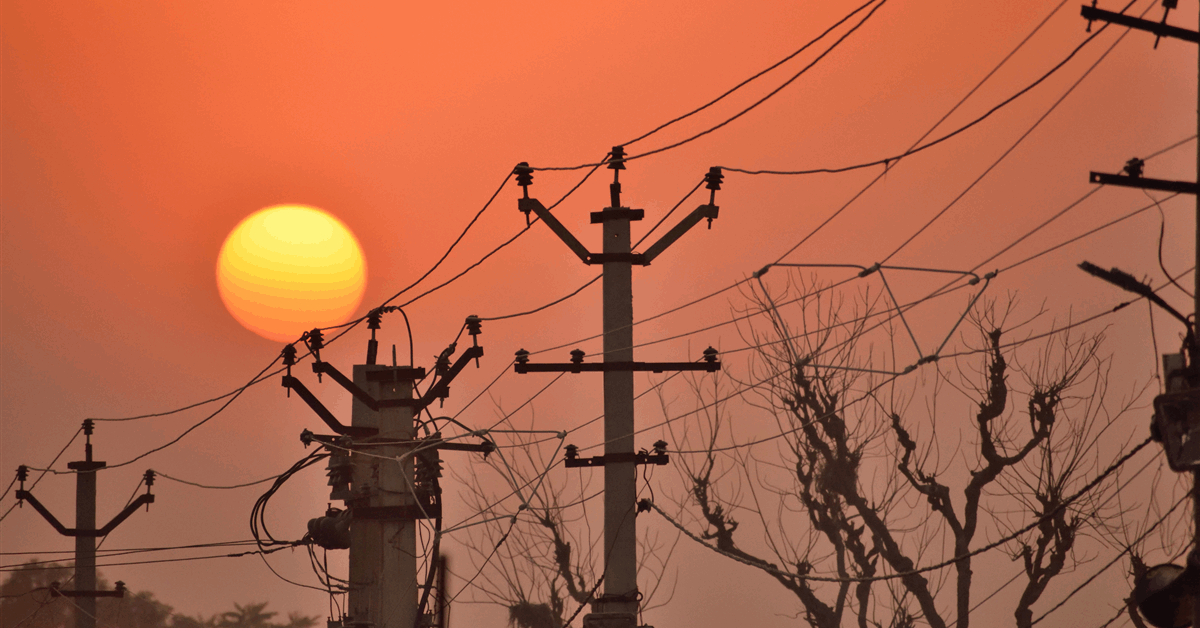

Iberdrola SA’s United States subsidiary said Wednesday it plans to invest $20 billion in the country’s power grid infrastructure until the end of the decade.

That would be spent on grid modernization and expansion. “The investment plan could also include opportunities for new generation”, Avangrid Inc. said in an online statement.

The investment “comes at a time when U.S. energy demand is surging due to manufacturing and data center growth”, it said.

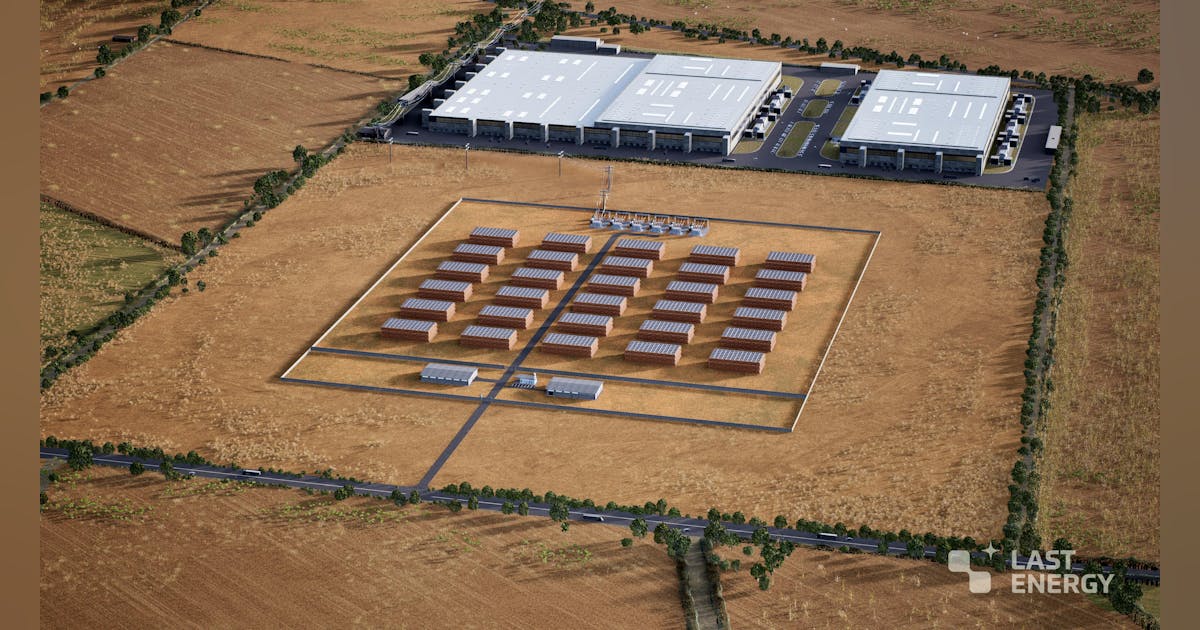

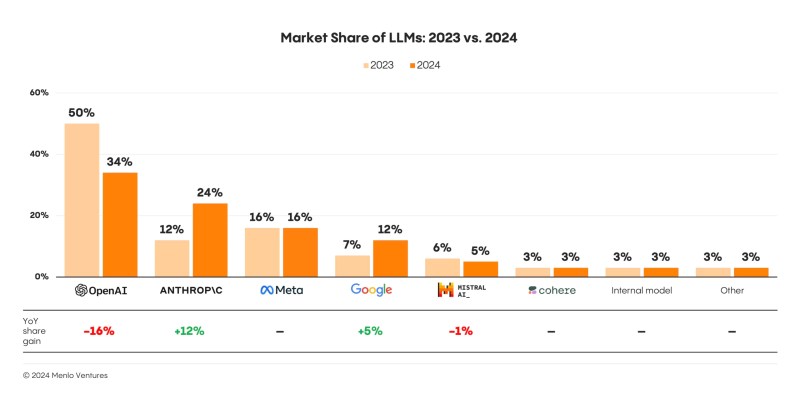

Data center load growth in the U.S. tripled over the past decade and is projected to double or triple by 2028, when data centers would account for about 6.7-12 percent of U.S. power consumption, according to a report by the Energy Department’s Lawrence Berkeley National Laboratory December 20, 2024.

Data center power usage grew from 58 terawatt hours (tWh) in 2014 to 176 tWh in 2023. The sector’s power consumption is projected to surge to between 325 and 580 tWh by 2028, according to the report.

Avangrid announced the investment at CERAWeek in Houston, Texas. At the energy conference Iberdrola executive chair Ignacio Galán and Avangrid chief executive Pedro Azagra met with key U.S. policymakers including Energy Secretary Chris Wright and Interior Secretary Doug Bergum, who is also chair of the White House National Energy Dominance Council.

“They discussed how growing energy demand requires a critical need to invest in energy infrastructure, and that the U.S. is a top investment destination as Avangrid and Iberdrola modernize and expand the country’s electrical grid”, Avangrid said.

It said it has about $50 billion worth of assets across 23 states in the U.S., where it employs over 8,000 people. Avangrid supplies over 3.3 million electricity and gas consumers in the Northeast. It also has about 10.5 gigawatts of generation capacity, enough to power more than three million homes, according to the company.

Avangrid recently won two offshore wind lease areas in the Gulf of Maine. OCS-A 0564 spans 98,565 acres while OCS-A 0568 covers 124,897 acres, Avangrid said in a press release October 29, 2024.

“Avangrid will work to develop the lease areas, with the potential to deliver 3 Gigawatts of clean power, to help meet the energy needs of the New England region and advance the United States 30 GW offshore wind target”, it said.

“Not including the lease area secured today, Avangrid has a projected offshore wind pipeline of over 5 GW on the East Coast of the United States – enough to power more than two million households”, Avangrid said.

However, upon taking office for his second non-consecutive term as U.S. president, Donald Trump ordered a review of wind project approvals and indefinitely paused wind leasing in the U.S. Outer Continental Shelf.

Authorities “shall not issue new or renewed approvals, rights of way, permits, leases, or loans for onshore or offshore wind projects pending the completion of a comprehensive assessment and review of Federal wind leasing and permitting practices”, said a presidential memorandum January 20, 2025.

Late last year Spanish electric utility Iberdrola took full ownership of Avangrid by acquiring the 18.4 percent shareholding it did not already own. Avangrid delisted from the New York Stock Exchange and now operates as a private company, its headquarters still in Connecticut.

“The merger will allow Iberdrola to invest in the United States more efficiently”, Iberdrola said December 23, 2024. “The subsidiary will be able to participate more economically in new energy infrastructure projects in its grid and renewable businesses, representing a significant investment in local communities and generating hundreds of direct and indirect jobs.

“These projects will create a more robust, resilient and reliable power grid, and will help meet the growing demand from utilities and data centers”.

To contact the author, email [email protected]