In a release sent to Rigzone on Thursday, Baker Hughes announced “major gas technology orders for Venture Global LNG”.

Baker Hughes said in the release that it has been awarded a major contract to provide a modularized liquefied natural gas (LNG) system and power island to support Venture Global LNG projects in the United States.

The company added that it has also signed a multi-year services frame agreement, including maintenance, inspection, repairs and engineering services, to support phases one and two of Venture Global’s Plaquemines LNG project in Louisiana.

Baker Hughes noted in the release that the equipment order and services agreement were both secured in the fourth quarter of 2024. The company did not provide the value of the deals in the release.

Rigzone asked Baker Hughes how much the deals are worth and if they will result in more jobs or job retention. A Baker Hughes spokesperson told Rigzone the company was “unable to disclose the value of the deals mentioned, as this information isn’t public”. The spokesperson added that Baker Hughes “can’t provide further details about the project at this time”.

“As power demand surges, LNG has a critical role to play in providing a reliable, flexible fuel source that can be quickly scaled to meet rising demand,” Lorenzo Simonelli, the chairman and CEO of Baker Hughes, said in the release.

“We have been a trusted partner in natural gas operations for more than 30 years, and our collaboration with Venture Global is a key example of what our industry needs more of today: businesses coming together to leverage best-in-class technologies and services that can deliver reliable and efficient natural gas operations to support sustainable energy development,” he added.

Mike Sabel, the CEO of Venture Global, said in the release, “Baker Hughes continues to be a trusted partner for Venture Global in delivering a secure, reliable energy supply to the world and we are thrilled to add another significant milestone on our partnership”.

In the release, Baker Hughes highlighted its role as a “strategic LNG technology supplier to Venture Global for more than 100 million tons per annum of production capacity” and said it has “already provided comprehensive LNG solutions to the Calcasieu Pass and Plaquemines LNG facilities”.

In a release posted on its site back in September 2023, Baker Hughes noted that it and Venture Global had executed an expanded master equipment supply agreement for the delivery of additional liquefaction train systems and power island systems for Venture Global’s future LNG export projects.

Baker Hughes announced in a release posted on its site in March 2022 that it had been awarded a contract and granted notice to proceed by Venture Global LNG to provide a liquefied natural gas system for the first phase of the Plaquemines LNG project in Louisiana.

In a release published on its site in August 2019, Baker Hughes announced that it had been awarded a contract and granted notice to proceed on the construction of its “comprehensive LNG technology solution” for Venture Global LNG’s Calcasieu Pass project.

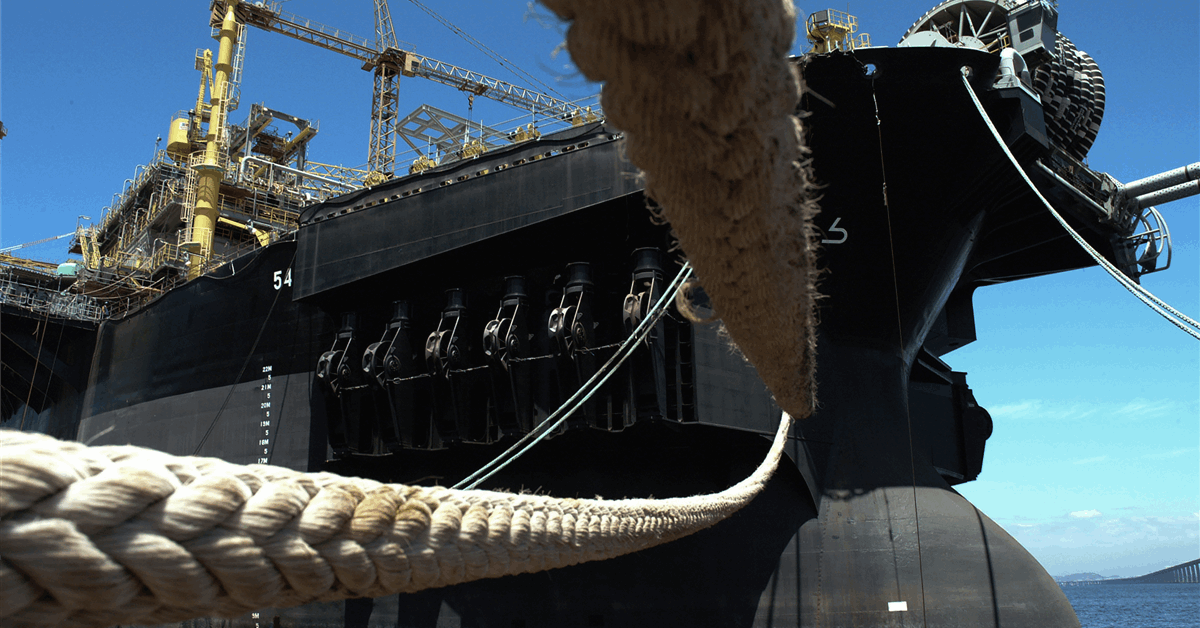

Back in December 2024, in a release posted on its website, Venture Global announced “the successful loading and departure of the first liquefied natural gas cargo produced from the company’s Plaquemines LNG facility”.

“The inaugural commissioning cargo was loaded onto the Venture Global Bayou – one vessel in VG’s fleet of nine new, state-of-the-art LNG ships – and is being shipped to ENBW in Germany, marking over 60 LNG cargos sent from Venture Global into Germany since 2022,” the company noted in the release.

“Plaquemines LNG is one of the two fastest greenfield projects of its size to reach first production and, now, first cargo delivery, along with Venture Global’s first project, Calcasieu Pass,” it added.

In that release, Venture Global described Plaquemines LNG as a 20 million ton per annum nameplate capacity project that reached a final investment decision on phase one in May 2022, and on phase two in March 2023.

To contact the author, email [email protected]