BP chairman Helge Lund has announced his plans to step down from his position.

The company’s board of directors has initiated a succession process to select a new chair, with the succession process being led by Amanda Blanc in her capacity as senior independent director.

Although a timeline for Lund’s resignation was not established, BP said it would most likely be during 2026.

Until then, Lund will work with the successful candidate for his replacement to ensure an orderly transition ahead of taking on the role of chair.

Whilst this succession process progresses, the board’s focus will remain on overseeing management’s delivery of the new strategy and this will continue to be their key priority under the new chair.

Lund said: “Having fundamentally reset our strategy, BP’s focus now is on delivering the strategy at pace, improving performance and growing shareholder value.

“Now is the right time to start the process to find my successor and enable an orderly and seamless handover. The board and I are committed to supporting Murray and his team, and to overseeing bp’s delivery of its strategic and financial objectives as we set out in our recent Capital Markets Update.”

Lund has held the position of BP chairman since 2019, having served with three CEOs – Bob Dudley, Bernard Looney, and the current chief executive Murray Auchincloss.

His last few years as chairman have been marked by BP committing, then rowing back on its climate commitments. Amid tighter economic conditions, BP’s investors have been looking for the company to refocus on its core oil and gas operations to boost revenues and share prices.

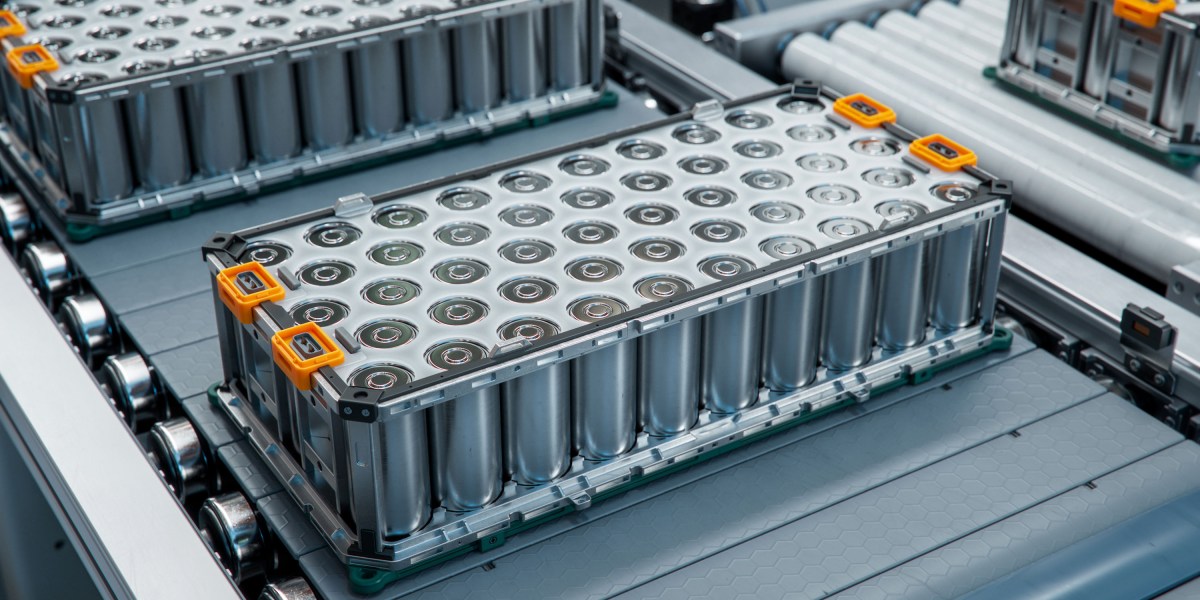

This includes selling its lubricants business Castrol and divesting 50% of its solar business Lightsource BP.

Amanda Blanc added: “We are starting a comprehensive search to identify chair candidates with the credibility and relevant experience to lead the board and continue driving management’s safe execution of the reset strategy.”

Panmure Liberum analyst Ashely Kelty said Lund has likely stepped down to “appease” activist investor Elliott Management which is thought to have built a 5% stake in an effort to demand changes at the oil major that could include cost cuts and a potential leadership reshuffle.

Kelty questioned whether this would be enough.

He added: “The question is now that they have one scalp, will they keep going?

“We think they will, and will now turn attention to CEO Murray Auchinloss –his attempt to pivot BP away from green energy look half hearted and we suppose that Elliott will want a new CEO that can undertake a proper reset on strategy.”