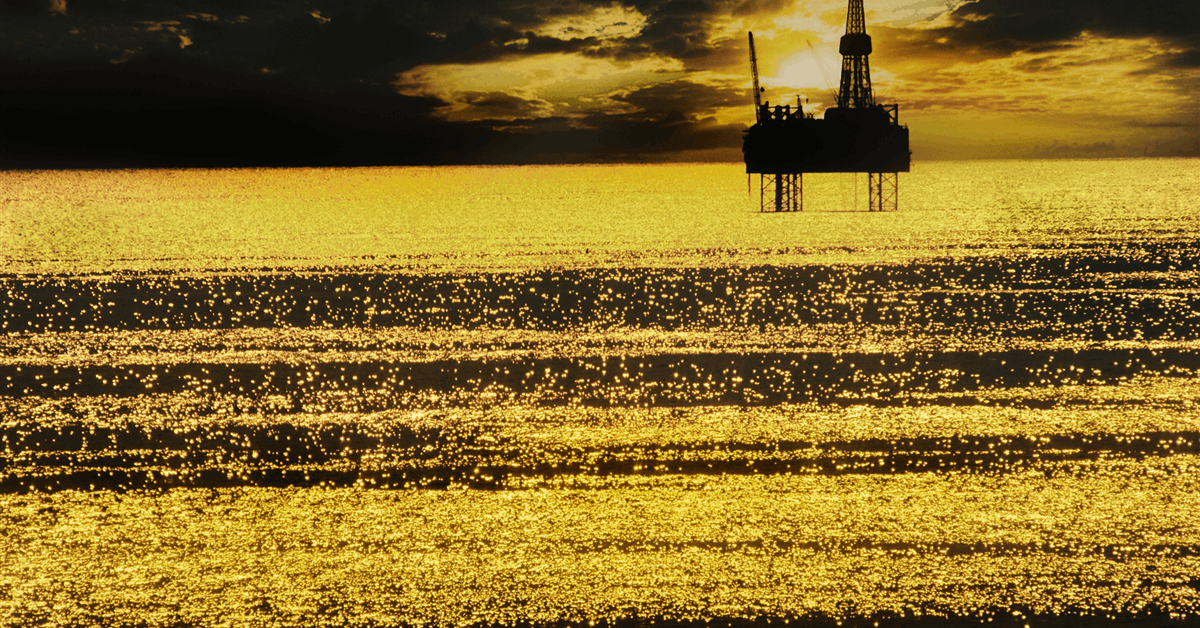

Britain’s BP PLC and the United States’ Chevron Corp and Murphy Oil Corp led the first oil and gas area auction under the Trump administration’s One Big Beautiful Act, winning 51, 24 and 14 blocks respectively in federal waters in the Gulf of America, according to official results published Wednesday.

“Lease Sale Big Beautiful Gulf 1” is the first of at least 30 lease sales required by the 2025 budget “reconciliation bill” for the Gulf of America, which President Donald Trump renamed from Gulf of Mexico after he assumed office for his second non-consecutive term.

Out of nearly 15,200 blocks spanning 81.18 million acres offered, 181 blocks got winning bids. Thirty companies participated, submitting 219 bids, worth a total of $371.88 million. Winning bids totaled $300.43 million, according to the “Sale Day Statistics” released by the Interior Department’s Bureau of Ocean Energy Management (BOEM).

“Lease Sale Big Beautiful Gulf 1 marks a renewed, proactive offshore energy strategy focused on strengthening national security, expanding economic opportunity and responsibly stewarding America’s abundant natural resources”, Interior said in an online statement.

Britain’s Shell PLC and Spain’s Repsol SA completed the top five winners, each of the two landing 12 blocks.

Rounding up the top 10 successful bidders are Houston, Texas-based Talos Energy Inc with 11 blocks, Covington, Louisiana-based LLOG Exploration Offshore LLC (11 blocks), Australia’s Woodside Energy Group Ltd (eight blocks), Houston-based Occidental Petroleum Corp (eight blocks) and Norway’s majority state-owned Equinor ASA (seven blocks).

BP, Chevron and Woodside spent the most for successful bids, totaling $61.88 million, $53.1 million and $38.08 million respectively. Rounding up the top five bidders in terms of the sum of their winning bids are Murphy ($27.39 million) and Houston-based Beacon Offshore Energy LLC ($20.06 million).

Chevron offered the biggest single winning bid at $18.59 million, for Block 25 in the Keathley Canyon area, and the fourth-biggest single winning bid at $12.17 million, for Block 249 of the Green Canyon. Woodside had the second-biggest single winning bid at $15.2 million, for Block 443 in the Walker Ridge, and the third-biggest single winning bid at $12.2 million, for Block 444 of the Walker Ridge. Beacon submitted the fifth-biggest single winning bid at $11.8 million, for the Block 845 of the Green Canyon, and the 10th-biggest single winning bid, for Block 345 of the Green Canyon. Shell had the sixth-biggest single winning bid at $8.67 million, for Block 345 of the Mississippi Canyon. BP had the seventh-biggest single winning bid at $8.51 million, for Block 436 of the Keathley Canyon. A consortium of bidders including LLOG had the eighth-biggest single winning bid at $8 million, for Block 64 of the Atwater Valley. Murphy had the ninth-biggest single winning bid at $7.82 million, for Block 333 of the Walker Ridge.

Leases lasting 10 years comprised the bulk of winning bids, totaling $282.02 million. Winning bids for five-year leases totaled $18.41 million.

Bids concentrated on blocks with water depths of 800-1,600 meters (5,249.34 feet). Winning bids for these blocks totaled $155.49 million, more than half of the total value of winning bids.

“The strong bidding we saw today reflects sustained industry confidence in the long-term potential of the U.S. outer continental shelf and the clear direction of this administration to expand responsible offshore development”, BOEM Acting Director Matt Giacona said in the Interior statement.

Interior Secretary Doug Burgum said, “President Trump made clear from day one that the United States will no longer be held back by bad policy or foreign dependence. Today’s lease sale is another major milestone in rebuilding American energy dominance by unlocking investment, strengthening our energy security, creating jobs and ensuring Americans have access to affordable and reliable energy. The Trump administration is delivering results, and the Gulf of America is once again leading the way”.

Interior noted in the statement that to encourage participation for the auction, which involved the Gulf’s Western and Central Planning Areas and portions of the Eastern Gulf Planning Areas, a 12.5 percent royalty rate had been applied for shallow and deepwater leases, “the lowest deepwater rate since 2007”.

“The Gulf of America’s Outer Continental Shelf spans 160 million acres and holds an estimated 29.59 billion barrels of undiscovered, technically recoverable oil and 54.84 trillion cubic feet of natural gas, supporting long-term U.S. production potential”, the department said.

“Revenues from offshore energy activities continue to provide critical funding for the U.S. Treasury, Gulf Coast states, the Land and Water Conservation Fund and the Historic Preservation Fund. In fiscal year 2024, offshore development generated $6.5 billion in royalties, $372.5 million in bonuses and $122.8 million in rental payments”.

Holly Hopkins, vice president for upstream policy at industry lobby group the American Petroleum Institute, said in a statement, “After two years of unnecessary delay in federal offshore leasing, today’s sale marks the beginning of a new generation of opportunity for safe, responsible development in the Gulf”.

On the other hand, on November 18, environmental watchdogs including Earthjustice, Friends of the Earth and Sierra Club filed a lawsuit to challenge the sale.

According to the One Big Beautiful Act, signed by Trump into Public Law 119-21 on July 4, Interior must hold at least two Gulf lease sales per year from 2026 to 2039 and at least one in 2040.

To contact the author, email [email protected]