BP’s confirmation that it will be cutting 7,700 jobs has served as a “hammer blow to the north-east” of Scotland, one politician said in response to the news.

The London-listed supermajor told staff on Thursday that it would be cutting 4,700 internal jobs and 3,000 contractor positions as it looked to cut costs and drive profitability.

In 2024 BP (LON:BP) announced plans to cut costs by $2 billion (£1.64bn) by the end of next year and this move is set to play a part in the supermajor’s penny-pinching drive.

Ashley Kelty, director and oil and gas research analyst at Panmure Liberum, told Energy Voice: “I don’t think it would have been a surprise that there would be job cuts.

“However, the issue is that this is their opening move in their cost reduction programme when they’re already under pressure to change strategy.

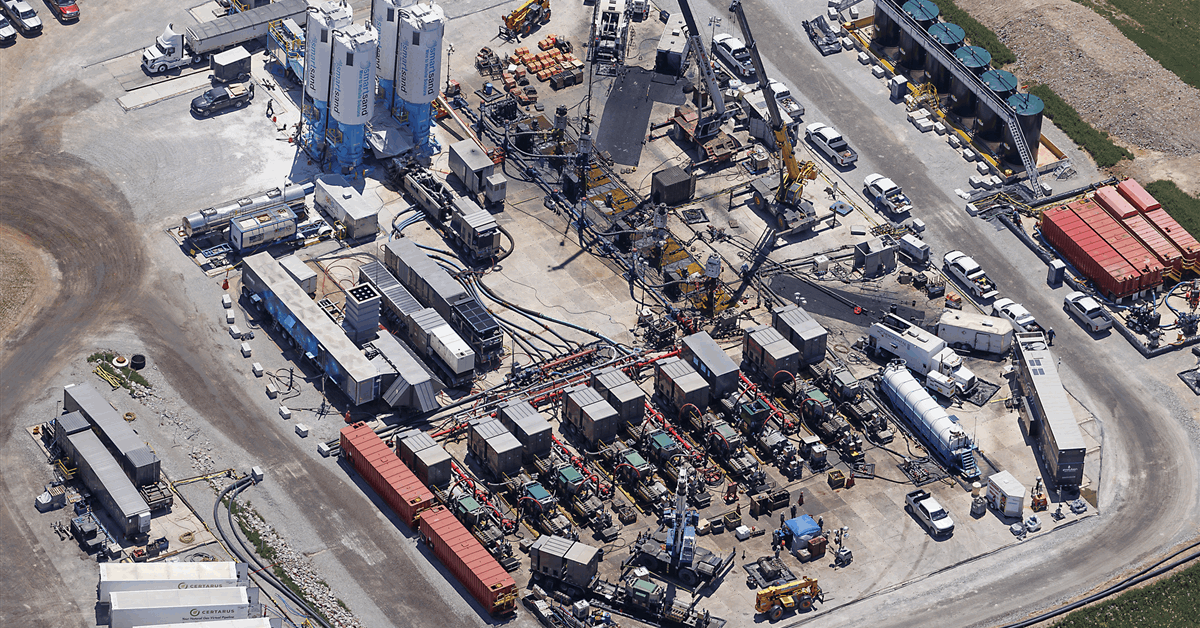

© Supplied by BP

© Supplied by BP“Rather than change the strategy which persists with low margin renewables, they’ve decided to just slash headcount, now that’s not going to give them returns. They could have maintained the headcount and pivoted back to traditional energy projects, like their peers have done, and they would have improved performance.

“They seem to think ‘oh well, cut the bottom line costs, that’s going to make a difference,’ whereas if you’d actually improve the top line margin, that would have given them a lot more leeway.”

The analyst argued that the firm is “not happy to change direction” as its fellow UK supermajors have done.

‘There’ll be lots of people going in Aberdeen’

This lack of change in company strategy and recent market trends has led to speculation that Aberdeen is set to be hit hard by looming redundancies.

“There’ll be lots of people going in Aberdeen, I think that’s pretty clear,” Kelty added. He added many offered voluntary redundance may just “take the package and go”.

He added: “That will be a shame because they’ll be losing a lot of very good people.”

Another analyst commented that, based on previous BP job cut processes, restructuring and voluntary redundancies are likely to play a part.

However, Kelty added, “It is too early to make any assumptions” about where job cuts will come from and how many will be made in specific regions.

© Supplied by BP

© Supplied by BPEarlier this week Hunting, a supply chain firm with a base in the north-east of Scotland, announced plans to restructure its business following North Sea operators slashing spending.

The firm has 200 employees across its three UK bases, however, it said it would be unable to confirm how these positions will be affected until it releases its full year results in March.

“You’ll see lots of people talking about it,” Kelty added.

“I think they’ll point to the changes in the UK as a justification for it, whereas it’s an easy excuse.”

‘Devastating announcement from BP’

Scottish Conservative shadow secretary for net zero and energy, Douglas Lumsden, said: “This devastating announcement from BP is a hammer blow to the north-east and illustrates the economic damage which is being caused by both Labour and the SNP’s opposition to oil and gas.”

The UK’s energy industry has pushed back against domestic policy and the county’s taxation regime as it warned business will go overseas.

Other reactions following unpopular fiscal changes in the UK have seen Shell (LON:SHEL) and Norway’s Equinor (OSL:EQNR) merge their North Sea assets into a separate company.

Last year, Doris Reiter, senior vice president of BP North Sea, spoke to Energy Voice about the issues of fighting for capital with other regions.

© Supplied by Kath Flannery/DC Tho

© Supplied by Kath Flannery/DC Tho“We need to have certainty,” she said in September.

“We need to have long-term fiscal stability and the conditions need to be right to continue investing.”

Following the Labour Party’s first budget of its premiership, the headline rate of tax for North Sea oil firms jumped to 78%.

At the same time the government removed investment allowances that were afforded to operators under the Energy Profits Levy (EPL).

However, the Labour government retained the capital allowances outlined under the EPL, or windfall tax, something that is seen as key to getting new projects up and running.

Lumsden hit out at Labour’s fiscal plans: “The consequences of Labour’s shortsighted sanctions of increasing the windfall tax, ending the investment allowance and opposing all new oil and gas licences are now being felt, resulting in the loss of thousands of jobs.”

‘Tough news for all of those jobs are under threat’

The Labour Party has previously discussed a ban on future North Sea oil and gas licences.

However, this week saw a committee hearing in which UK energy secretary Ed Miliband laid out plans to consult with North Sea stakeholders regarding the future of oil and gas licensing policy.

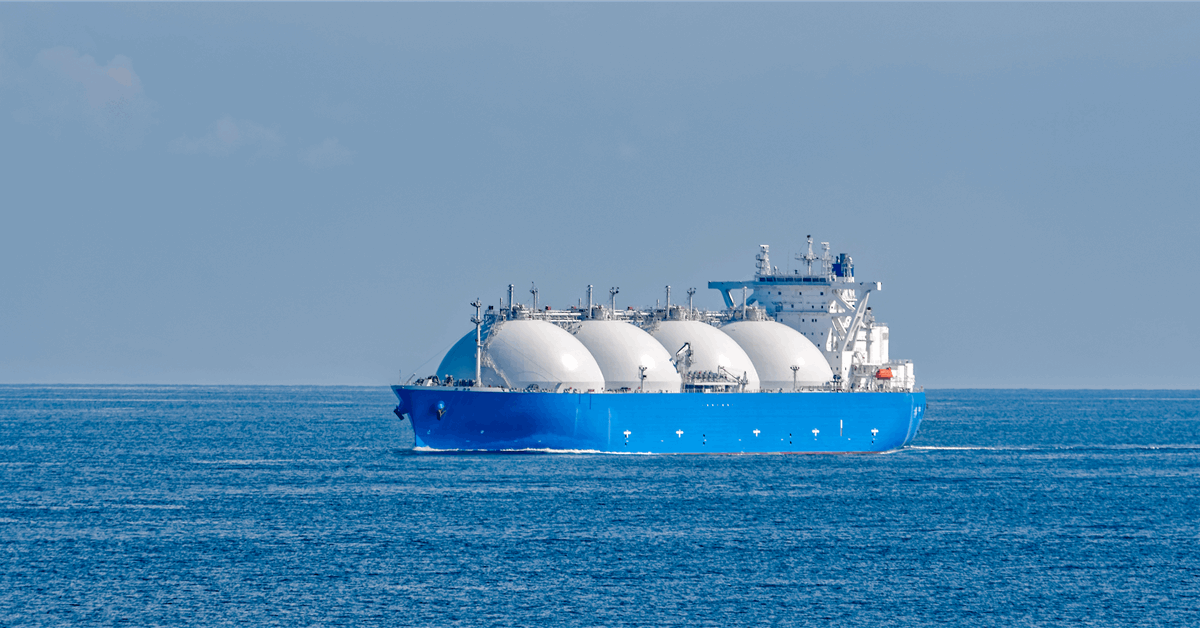

“Keir Starmer’s desire to kill off the industry will force us to import expensive fossil fuels from overseas with a far higher carbon footprint,” the Tory politician added.

“BP’s decision is disastrous for Scotland and must act as a catalyst for both Labour and the SNP to show some common sense for a change by supporting the sector, instead of turning their backs on it.”

Lumsden wasn’t the only politician to give his two cents on the matter as Liberal Democrat MSP Liam McArthur said the Scottish Government should step in if domestic jobs are impacted.

© Supplied by BP

© Supplied by BPMcArthur commented: “This will be very tough news for all of those jobs are under threat. We need urgent clarity about how many of the affected jobs will be in Scotland.

“If jobs in Scotland are at risk then Scottish Government will need to work with BP, trade unions and workers to preserve expertise and skills and help people transition to new roles.

“There are major questions over Scotland’s energy security. We must ensure that talented people are not thrown onto the scrap heap as a result of poorly thought-out government policies or changing market conditions.”

Unions have refused to comment until it is made clear how their members will be impacted by the job cuts.

BP employs 15,000 people in the UK with the majority based in the firm’s London headquarters and North Sea oil and gas production division.

A further 6,000 work in the BP petrol and service stations, however, these roles will not be affected by the cuts.

Recommended for you

BP to slash nearly 8,000 jobs as it looks to cut costs