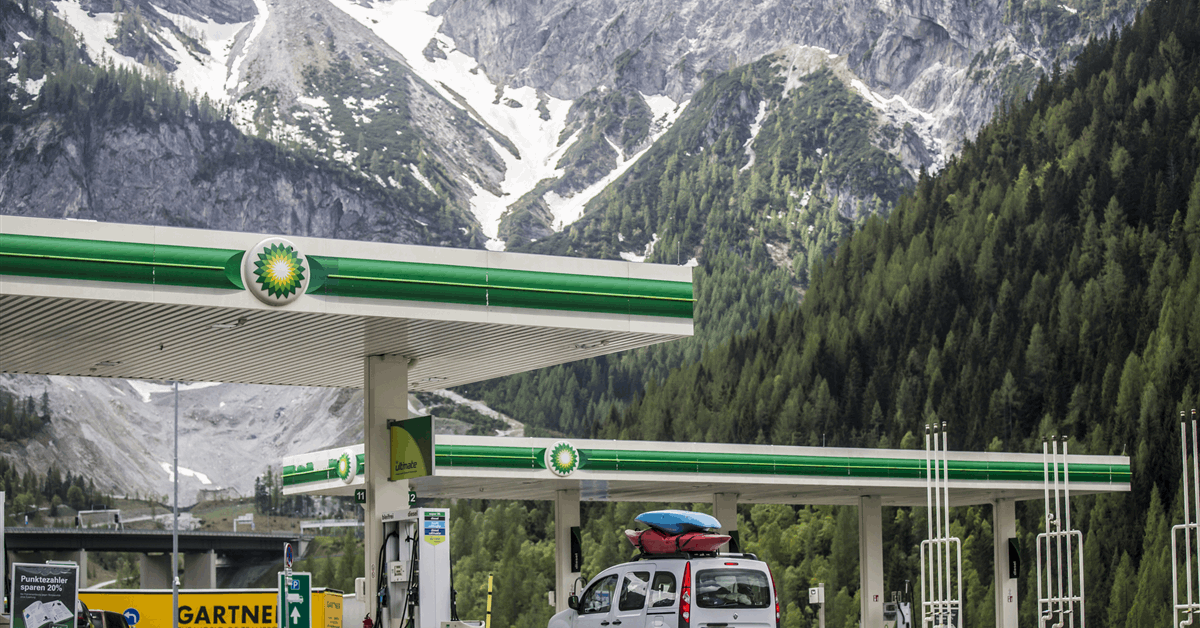

BP PLC is initiating a marketing process to divest its retail sites, associated fleet and electric vehicle (EV) charging infrastructure in Austria, as well as its stake in the Linz fuel terminal.

“This decision is the latest example of bp’s strategy to reshape and focus its downstream businesses”, the British energy major said in an online statement. BP previously exited the retail sector in Switzerland and Turkey and recently initiated retail and downstream divestments in Germany and the Netherlands.

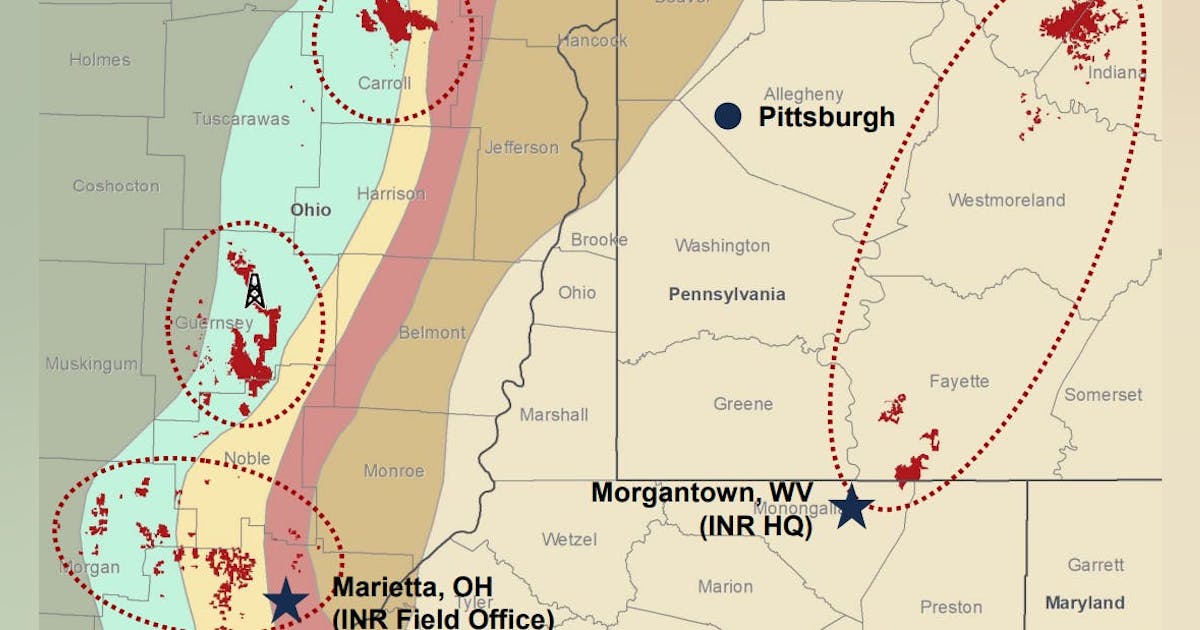

The Austria sale includes over 260 retail sites, of which about 120 are owned by BP, and the associated fleet; EV charging assets including those under development; and BP’s interest in the company operating the Linz fuel terminal non-operated joint venture. BP plans to complete the sale this year, subject to regulatory approvals.

“Over recent years we have grown the business to become number two major branded retailer in the market”, said Emma Delaney, executive vice president for customers and products at BP. “As bp now looks to focus downstream and reshape our portfolio, we believe that a new owner will be best placed to unlock the business’s full potential”.

On February 6, 2025, BP announced a marketing process for the potential sale of Ruhr Oel GmbH-BP Gelsenkirchen (ROG), which operates in Germany and the Netherlands. Sale completion is targeted 2025.

“bp needs to continually manage its global portfolio as we position to grow as a simpler, more focused, higher-value company”, Delaney said then.

With a workforce of about 2,000 employees, ROG’s German operations include 2 plants in Horst and Scholven in Gelsenkirchen that form a refining and petrochemical site. The refinery can process up to approximately 12 million metric tons of petroleum a year.

ROG also owns the Bottrop tank farm, DHC Solvent Chemie GmbH and Nord-West Oelleitung GmbH, which operates pipelines, crude tanks, tank farms and unloading points.

In the Netherlands ROG owns stakes in the Maatschap Europort Terminal and the NV Rotterdam-Rijn-Pijplining crude and refined products pipeline.

In its latest quarterly report BP also said it plans to sell its mobility and convenience business in the Netherlands.

Last year BP completed a 2023 agreement selling its fuel operations in Turkey, consisting of BP Petroleum Inc. and BP Turkey Refining Ltd., to Petrol Ofisi Group, owned by Vitol. The sale included stakes in three terminals, BP said in the quarterly report February 11, 2025.

In 2022 BP sold its retail assets in Switzerland to Oel Pool AG under terms that allow the sites to continue marketing the BP brand, BP said in a quarterly report May 3 that year.

BP did not disclose the financial details of the planned and completed sales.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR