BP Plc announced a major pivot back to its core oil and gas business and promised to sell assets and reduce spending, but shares fell as the company sharply cut buybacks.

In a highly anticipated strategy update, BP Chief Executive Officer Murray Auchincloss scrapped a plan to pull back from oil and gas and pledged to grow production slightly instead. He also cut investment in renewable energy and began a strategic review of lubricants business Castrol, which could be worth as much as $10 billion if it was sold.

The changes are intended to appeal to disgruntled shareholders, which include activist Elliott Investment Management, yet the CEO was forced to slow the pace of share buybacks, which are a key part of the industry’s appeal to investors. As BP’s peers maintain payouts in the coming year, the London-based company will reduce its quarterly repurchases to no more than $1 billion, down from $1.75 billion previously.

Shares of the company fell 0.9% to 432.9 pence as of 11:04 a.m. in London trading.

BP has been under intense pressure since Bloomberg reported earlier this month that Elliott had built up a stake worth almost $5 billion. The next move from the activist investor, which is renowned for its aggressive tactics and has been demanding drastic change including a broader exit from low-carbon energy, will be determined by whether Auchincloss’s promises go far enough.

After 13 months as CEO, this is the first big change in direction undertaken by Auchincloss. He rose to the top job promising to continue the rapid transition to low-carbon energy begun by his predecessor, Bernard Looney. But after a 16% drop in shares last year he pledged to “fundamentally reset” the company’s strategy.

“We’ve put together something that’s very compelling, which is a reset strategy focused on growing the upstream” while cutting spending in other areas to help strengthen BP’s balance sheet, Auchincloss said in an interview. “I think in the long run investors will love this.“

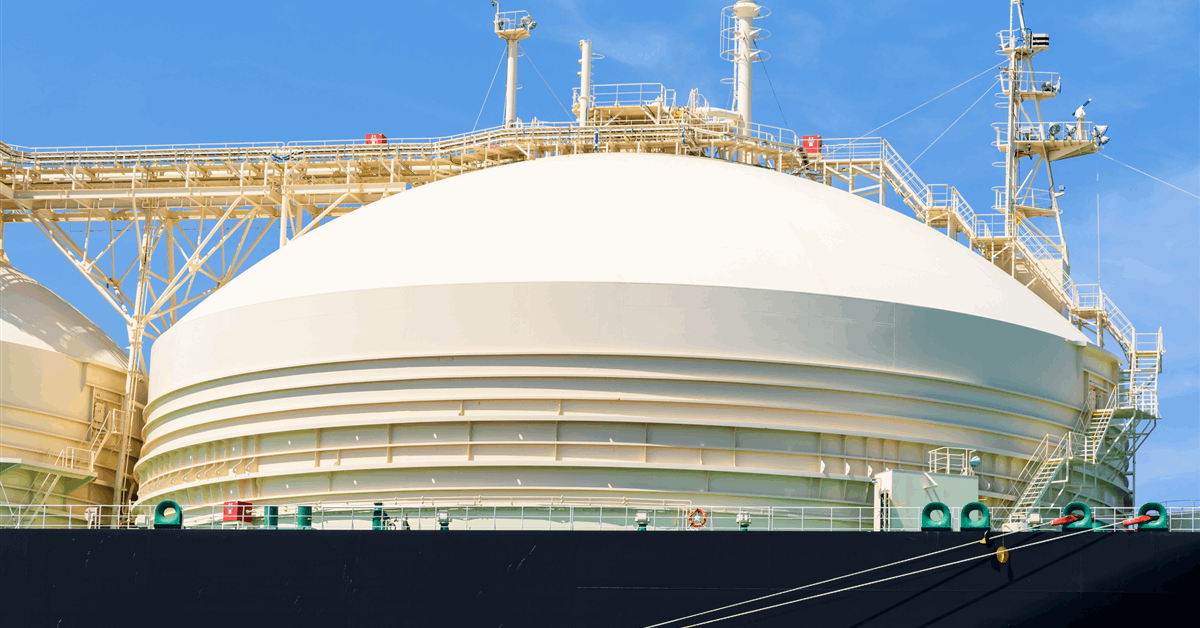

BP will increase investment into oil and gas to about $10 billion a year, with the intention of growing production to 2.3 million to 2.5 million barrels of oil equivalent a day by 2030. Its previous target was for a reduction in output of 25% at the end of the decade, compared with 2019 levels.

The company will reduce annual investment into low-carbon energy to $1.5 billion to $2 billion, about $5 billion lower than its previous guidance. BP will continue to make “selective” investments into biogas, biofuels and electric-vehicle charging.

It intends to sell about $20 billion of assets by the end of 2027, helping to bring net debt down to $14 billion to $18 billion, compared with almost $23 billion at the end of last year.

Two of BP’s key new targets are to increase cash flow by more than 20% a year to 2027, raising returns on average capital employed that year above 16%. That requires a Brent crude price of $70 a barrel and a US natural gas price of $4 per million Btu, not far below current levels.

“The refocus on hydrocarbons is positive for BP, as is the overall lower spending” and asset sales, Morningstar analyst Allen Good said in a note. “However, there still is little, if any, production growth, and BP’s repurchase rate has been reduced materially.”

If Elliott is unsatisfied with BP’s moves, the hedge fund may push for board and management changes, people familiar with the matter told Bloomberg earlier this week. Chairman Helge Lund, who is known as one of the key backers of the company’s now-criticized net zero strategy, could come under particular pressure.

“The board believes that this is an important strategic reset for BP and is confident that it, together with rigorous performance management, will deliver improved performance and sustainable value for BP’s shareholders,” Lund said in the statement.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg